Nancy Pelosi's call options on Tempus AI, valued at fifty or even one hundred thousand dollars, have truly shone a spotlight on a company previously only whispered about among industry insiders. What does she know that we don't? What exactly lies behind Tempus AI, seemingly emerging from nowhere, shrouded in an aura of secrecy and promises of a medical revolution? Perhaps Pelosi sensed that this isn't just another tech startup, but an entity literally rewriting the rules of medicine, one algorithm at a time, with the potential to transform the future of patient care and, perhaps, even our investments.

In this article, we'll unveil the secrets of Tempus AI to understand why, right now, all eyes are on them.

The Story Behind Tempus AI

The spark that ignited the Tempus AI (TEM) revolution was deeply personal. Eric P. Lefkofsky's wife's battle with breast cancer brutally exposed the glaring lack of technological integration in shaping treatment decisions.

Driven by an unwavering determination, Lefkofsky embarked on a mission to merge cutting-edge technologies with healthcare, aiming to bridge that critical gap in the precision medicine sector.

Headquartered in the vibrant heart of Chicago, Illinois, Tempus AI generates the majority of its revenue through a holistic approach to healthcare, extending far beyond just comprehensive genetic testing.

Business Profile

Its primary revenue streams are derived from:

Data Licensing: The commercialization of invaluable, anonymized datasets.

Clinical Trial Matching: Facilitating connections between patients and groundbreaking therapeutic trials.

Comprehensive Genetic Testing: In-depth DNA analysis for a molecular understanding of diseases.

Related Services: An entire ecosystem of solutions supporting the complete care journey.

Today, Tempus AI stands at the forefront of leveraging AI to redefine precision medicine, developing next-generation intelligent diagnostics. By harnessing the power of AI, including generative AI, Tempus is transforming laboratory tests, making them more accurate, personalized, and individualized. It achieves this by integrating an unprecedented wealth of patient information – clinical data, molecular profiles, and imaging analyses – to elevate the intelligence of testing and the perspicacity of the results.

Tempus's objective is twofold: to empower physicians to deliver better care and to accelerate researchers' discovery of more precise therapies, with the potential to save millions of lives. To achieve this, Tempus has built a robust technological platform and an innovative operating system to foster seamless data sharing across the healthcare ecosystem, enabling data-driven decisions in clinical care and therapeutic development.

Initially Focused On Oncology

Tempus AI has demonstrated how its "intelligent diagnostics" model can revolutionize the delivery of personalized treatments for cancer patients. The success of this approach has propelled the company to expand its horizons into other crucial medical areas, including neuropsychology, radiology, cardiology, and many more specialties.

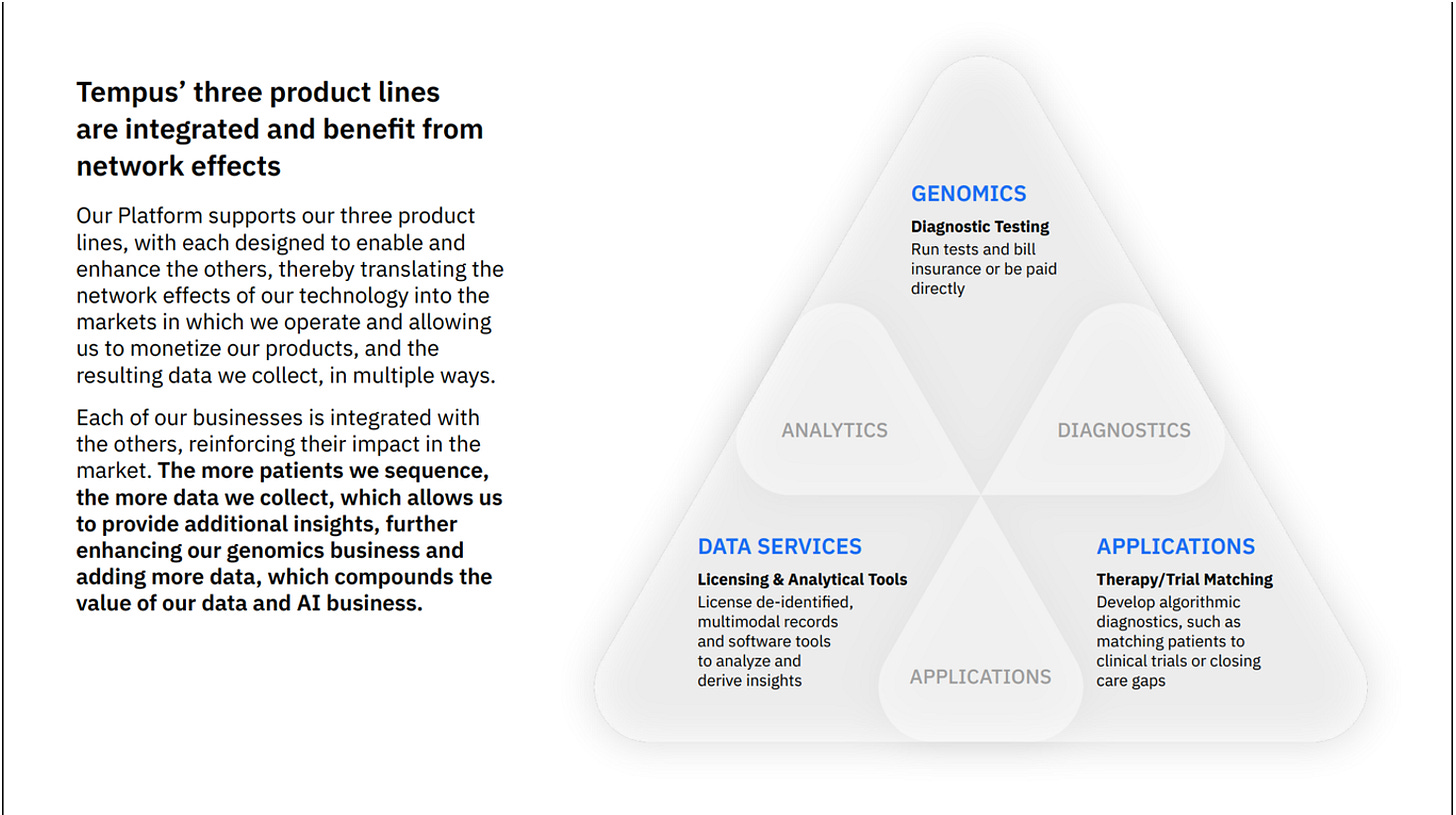

Tempus's product suite, which includes Genomics, Data, and AI Applications, is strategically designed to enable and enhance healthcare across a broad spectrum of diseases.

But why is it so crucial for Tempus AI to integrate the study of Genomics into its approach?

The integration of Genomics is crucial for Tempus AI because it enables a holistic understanding of the patient. By combining genomic data with other information (longitudinal clinical data, imaging analysis), Tempus builds a radically more complete and detailed biological picture of the patient and their disease. This goes beyond the superficial analysis of symptoms or isolated clinical data, truly enabling personalized medicine.

An interesting way to get information about Tempus AI is to query their AI directly on their website (see photo above).

Market Profile

Industry Growth

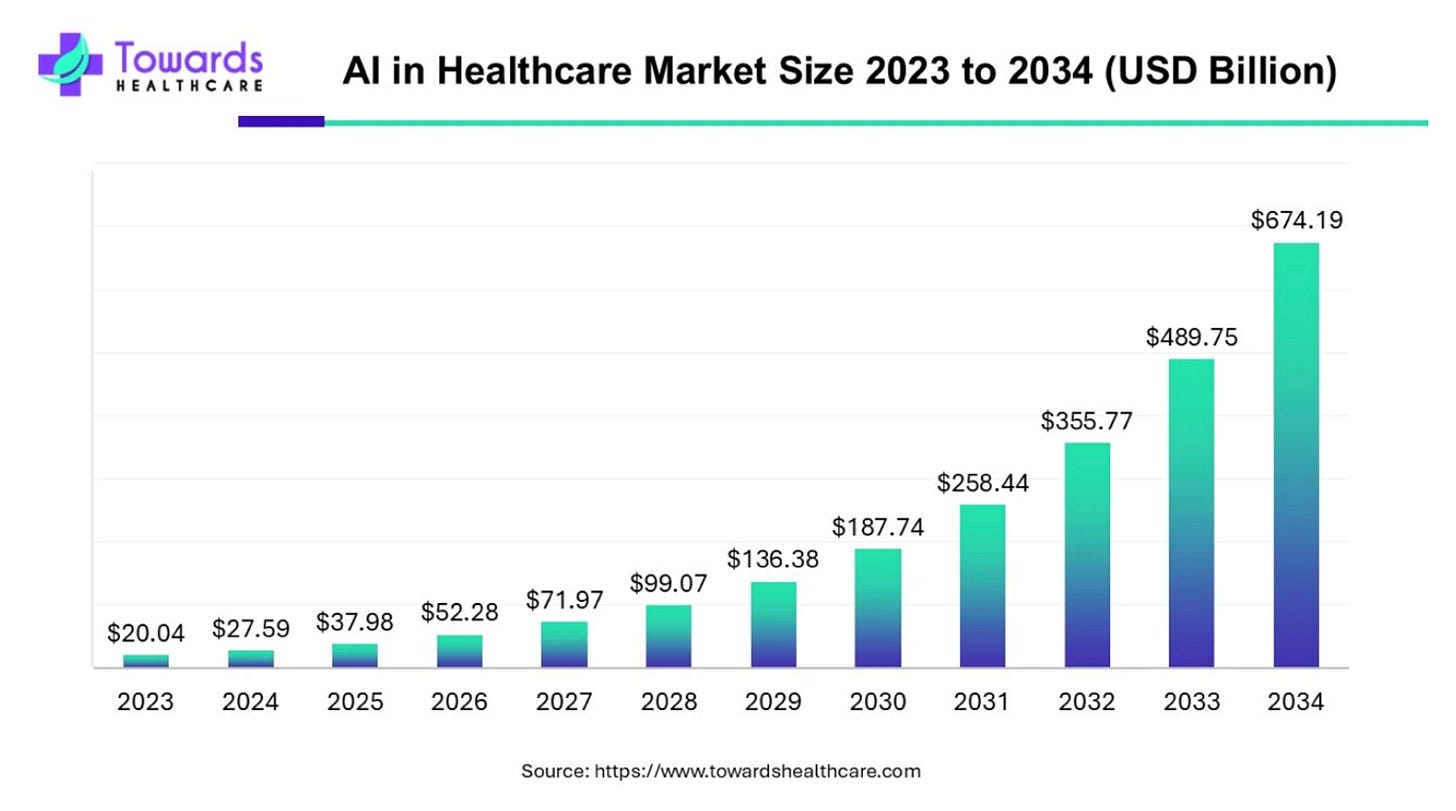

The global artificial intelligence market in healthcare is experiencing unprecedented growth: it is projected to skyrocket from $20 billion in 2024 to an incredible $674 billion by 2034, boasting a CAGR of 37.66%.

The World Economic Forum's predictions from May 2023 paint an alarming picture: by 2030, the world will face a severe shortage of healthcare workers, estimated at 10 million professionals. In this critical scenario, Artificial Intelligence (AI) emerges as a beacon of hope. Sophisticated algorithms, trained on vast datasets of health information, can empower healthcare providers, assisting them in formulating rapid and accurate diagnoses and planning personalized, effective treatments.

This exponential growth of AI in healthcare isn't an isolated event; it's the convergent result of several powerful driving forces:

Rapid Proliferation of Artificial Intelligence: The pervasive integration of AI into healthcare systems is igniting a radical transformation, reshaping medical diagnosis, treatment planning, and, most importantly, patient outcomes.

Focus on Human-Aware Artificial Intelligence Systems: Continuous advancements in AI technology are paving the way for more personalized and profoundly human-centered healthcare solutions—an imperative in the delicate context of healthcare.

Relentless Pressure to Reduce Healthcare Costs: Healthcare systems globally are under increasing pressure to contain costs. AI presents itself as a potent tool for improving operational efficiency, automating repetitive tasks, optimizing clinical workflows, and potentially reducing medical errors, translating into significant savings. A Deloitte survey reveals that over 70% of top healthcare executives identify operational efficiency and increased productivity as absolute priorities for their organizations in 2025. Healthcare systems must navigate complex scenarios characterized by budget constraints, a shortage of qualified personnel, physician burnout, and the pressing need to integrate new, cutting-edge technologies.

Soaring Increase in Investments: A significant influx of funding, from both public and private sectors, is accelerating the large-scale adoption of AI technologies within the healthcare industry.

In this scenario of epochal transformation, Tempus AI is uniquely positioned to fully capitalize on these emerging trends. With its AI-powered precision medicine platform, TEM is a leader in integrating AI into healthcare workflows, generating a positive impact on patients' lives.

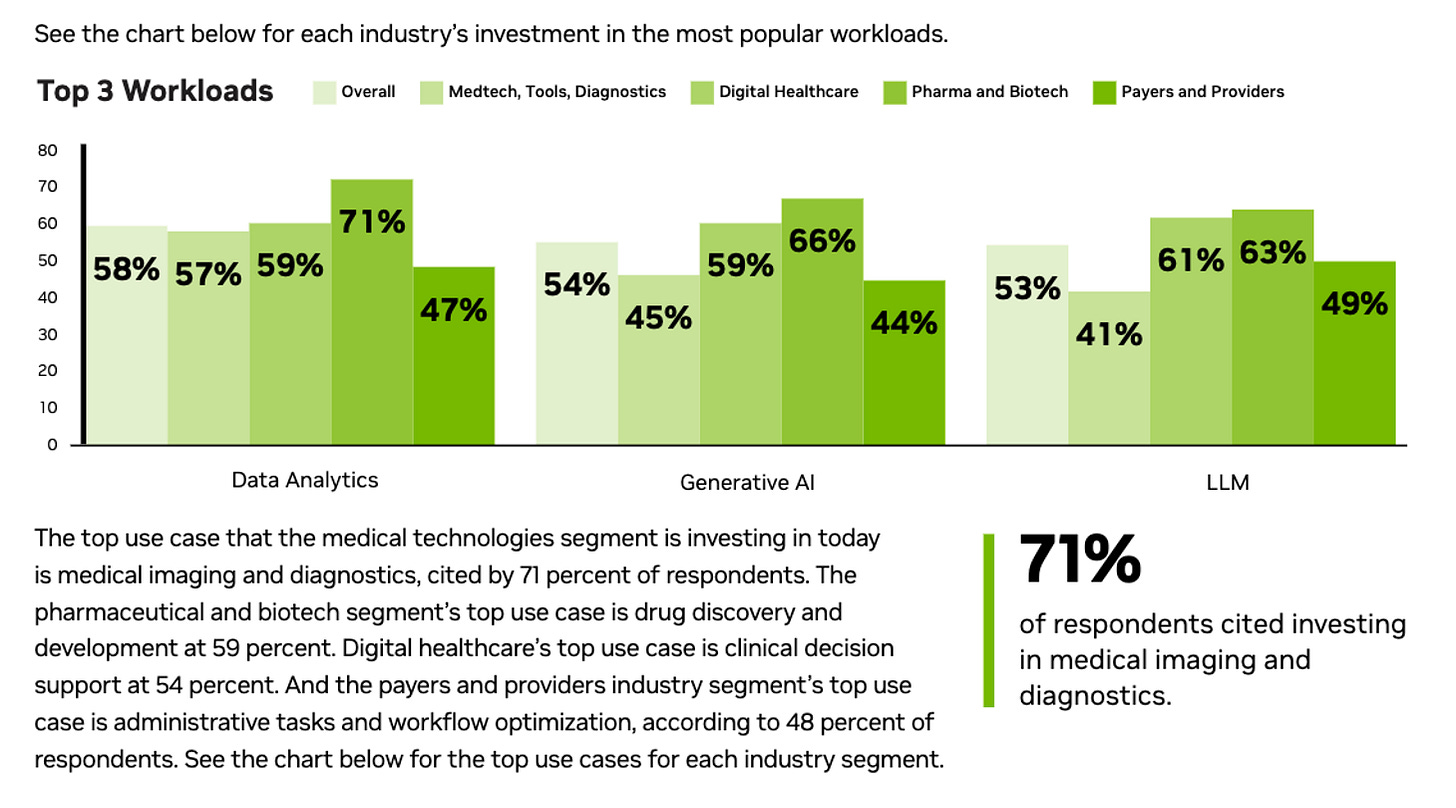

Indeed, as we can see from the image above: The primary use case where the medical technology segment is investing today is medical imaging and diagnostics, cited by 71% of respondents. Both these areas fall squarely within the activities carried out by Tempus AI.

So, how does Tempus AI generate value and revenue in this dynamic healthcare landscape?

Tempus AI generates value and revenue through an integrated and scalable business model, built upon three core pillars: Genomics, Data, and AI Applications. These segments are interconnected, creating a powerful closed-loop system that mutually reinforces each component, fueling robust network effects and long-term sustainability.

The Genomics segment focuses on providing advanced laboratory services to a broad spectrum of healthcare stakeholders, including physicians, genetic counselors, prestigious academic research institutions, and other key entities. This translates into diversified revenue streams, encompassing both clinical orders reimbursed by Medicare, Medicaid, and commercial insurance, as well as direct-billed orders from research institutions and pharmaceutical giants.

In parallel, the Data and Services segment capitalizes on the intrinsic value of the data generated and aggregated by Tempus. This primarily involves licensing de-identified healthcare data and providing specialized clinical trial services directly to pharmaceutical and biotech companies. The data licensing business allows Tempus to commercialize its rich anonymized datasets, while clinical trial services include comprehensive support for study execution and the offering of sophisticated analytical services. High-value strategic agreements, such as the significant $200 million partnership with AstraZeneca and Pathos for data licensing and modeling, underscore this segment's potential to contribute substantially to Tempus's overall revenue streams.

Analyzing Tempus AI's product lines in more detail reveals an even clearer picture of its monetization strategy:

Genomics: This division leverages state-of-the-art laboratories to offer a comprehensive range of genetic diagnostic tests, including next-generation sequencing (NGS), PCR profiling, molecular genotyping, and other sophisticated anatomical and molecular pathology tests. These services are offered to a vast audience, including healthcare providers, pharmaceutical companies, biotech firms, researchers, and other interested third parties. Revenue is derived from both insurance and government reimbursements for clinical orders and direct payments for direct-billed orders.

Data and Services: This segment primarily focuses on licensing Tempus's proprietary data and offering specialized clinical trial services to pharmaceutical and biotech companies. The data, meticulously structured and de-identified after laboratory generation or ingestion into the platform, becomes a valuable asset for accelerating drug discovery and development through two key products: Insights and Trials. Essentially, Tempus licenses its vast database, enabling partners to advance research and develop new therapies. Transactions in this segment include data licensing agreements, AI-powered patient matching for clinical trials, and advanced analytical services. It's important to note that revenue from this segment tends to be concentrated in the second half of the year, aligning with pharmaceutical clients' budget cycles.

AI Applications: This product line is dedicated to the development and provision of algorithm-driven diagnostics, the implementation of novel software as medical devices, and the creation and deployment of intelligent clinical decision support tools. Each product line is strategically designed to integrate and empower one another, triggering powerful network effects within the markets where Tempus operates. Despite their potential, revenues from AI Applications are currently included under the Data and Services line due to their present immateriality.

The Competitive Advantage of Tempus AI's Closed Loop

Tempus AI's business model thrives on robust network effects intrinsic to its closed-loop system:

Growing Data Accumulation: The more patients undergo genomic sequencing through Tempus, the greater the quantity of multimodal data the company collects and integrates into its platform.

Continuous Knowledge Enhancement: This additional data feeds increasingly sophisticated AI algorithms, enhancing the insights derived and increasing the intrinsic value of the Data and AI Applications segments.

Attraction of New Partners: In turn, these continuous technological and data quality improvements attract a growing number of healthcare and pharmaceutical partners and providers, fostering further adoption of Tempus's genomics services.

This closed-loop system not only consistently increases the overall value of Tempus AI's offering but also enables sustainable investments in its technological platform, creating a defensible and lasting competitive advantage in precision medicine. Each business segment seamlessly integrates with the others, forming a cohesive and scalable strategy to bring AI into healthcare on an unprecedented scale.

Let's now delve deeper into each of these crucial revenue sources.

Genomics: AI at the Heart of Personalized Diagnosis

The Genomics segment at Tempus AI is the pulsating core of its platform, delivering AI-powered diagnostic tests that go far beyond mere genetic analysis. These tests surpass simple genetic analysis by providing contextualized results through the integration of clinical, molecular, and imaging data, offering an unprecedented understanding of a patient's biology.

What makes Tempus AI's diagnostics so distinctive?

Contextualized Results: Tempus AI fuses advanced molecular profiling with comprehensive patient clinical data, providing results specifically tailored to their unique circumstances.

Patient Comparisons: Tempus AI's proprietary platform can analyze how patients with similar profiles have responded to different treatment strategies, paving the way for highly personalized care.

Optimized Clinical Trial Matching: Sophisticated AI algorithms match patients to relevant clinical trials based on meticulous inclusion and exclusion criteria, ensuring precision and efficiency in the process.

Actionable Algorithmic Insights: Tempus AI refines therapy selection by integrating insights based exclusively on AI, transforming raw diagnostic data into clinically actionable information.

Growth of the Genomics Segment

Tempus AI's Genomics segment showcases robust financial growth. In 2024, it generated $451.7 million, constituting over 65% of the company's total revenue and marking a 24.4% year-over-year increase (compared to an overall revenue growth of +30% YoY).

The strategic acquisition of Ambry Genetics in 2025 is set to further solidify this segment's position.

Growth of the Data and Services Segment

In parallel with Genomics, the Data and Services segment has shown even more dynamic growth, with a +43% increase in 2024 compared to 2023. It's important to note that this segment also includes revenues from the promising AI Applications segment, though the latter are currently considered immaterial.

Financial Strength and Future Growth Potential

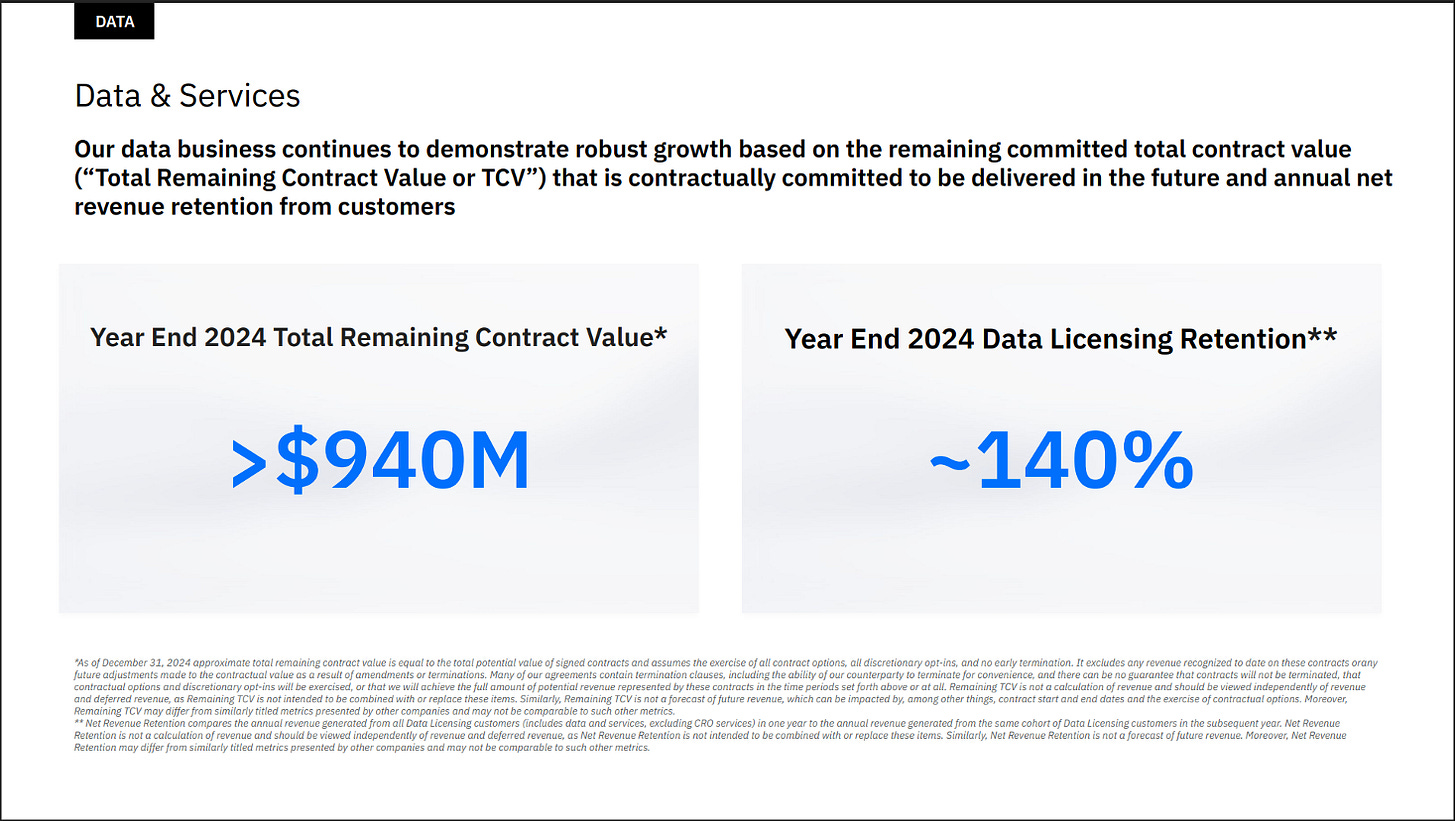

An analysis of the Full Year 2024 financial data reveals further signs of health and growth potential for Tempus AI. The company reported a Total Contract Value (TCV) of $940 million and a significantly improved Net Revenue Retention (NRR) of 140%. Simply put, management indicated that, at the end of 2024, the value of contracts remaining to be executed amounted to $940 million, a result directly correlated with the improved Net Revenue Retention.

This latter key indicator measures a company's ability to increase spending from its existing customers over time, either by raising service prices or by selling additional services. A Net Revenue Retention above 100%, like the remarkable 140% achieved by Tempus AI, signals that the company is not only retaining its customer base but is also capable of generating increasing revenue from it. This highlights strong customer loyalty and significant opportunities for upselling and cross-selling, crucial factors for sustainable long-term growth.

The Strategic Acquisition of Ambry Genetics: A Turning Point for Tempus AI's Growth in the Genomics Market

In a strategic move aimed at consolidating its genomics segment and significantly expanding its diagnostic capabilities, Tempus AI recently finalized the acquisition of Ambry Genetics for a considerable sum, totaling $375 million in cash and $225 million in stock.

The acquisition of Ambry Genetics was driven by its direct integration with Tempus's core strategy: "This acquisition completes our strategy of leveraging diagnostics and data to drive innovation," stated CEO Lefkofsky. Ambry, a leader in hereditary screening and cancer risk assessment, allowed Tempus to complete its platform, covering the entire spectrum of patient care, from early risk assessment to therapy selection and monitoring. The synergistic combination of Ambry's expertise in genetic testing with Tempus's AI-powered precision medicine solutions is set to enable Tempus to capture a larger market share and drive future growth.

The integration of Ambry Genetics within the Tempus AI ecosystem brings with it strategic synergies of remarkable scope, manifesting on multiple fronts:

Consolidation of Hereditary Cancer Screening: Tempus AI already utilized Ambry Genetics for germline sequencing (xG) for hereditary cancer risk. With the acquisition, TEM internally integrates and expands hereditary risk screening for oncology patients, enhancing its diagnostic capabilities.

Exponential Enhancement of Data and Analytics: Ambry Genetics performs sequencing for an impressive volume of approximately 400,000 patients annually, generating an invaluable amount of genetic data. The synergistic combination of this data with TEM's existing multimodal datasets will enable the company to gain deeper insights and further strengthen its offering of data-driven and AI-powered solutions.

Strategic Expansion into New Disease Areas: Ambry Genetics' diversified product line offers Tempus AI the immediate opportunity to enter additional, highly relevant therapeutic categories, including pediatrics, rare diseases, cardiology, reproductive health, immunology, and many other medical areas with high growth potential.

Expansion of Geographic Presence and Infrastructure: Thanks to its significant laboratory facilities strategically located on the West Coast of the United States, Ambry Genetics adds valuable infrastructure to TEM's operational network, expanding its national geographic footprint and significantly improving overall service efficiency.

Before the acquisition, Ambry Genetics demonstrated robust financial health. It was projected to exceed $300 million in revenue and reach $40 million in EBITDA for the 2024 calendar year. Furthermore, its revenue was experiencing significant growth, increasing by over 25% annually. Ambry's strong pre-acquisition financial performance, particularly its positive and substantial EBITDA, made it an exceptionally attractive acquisition target for Tempus. This indicates that Ambry is not just a strategic asset providing complementary capabilities, but also a profitable entity that can immediately contribute positively to Tempus's consolidated financial results.

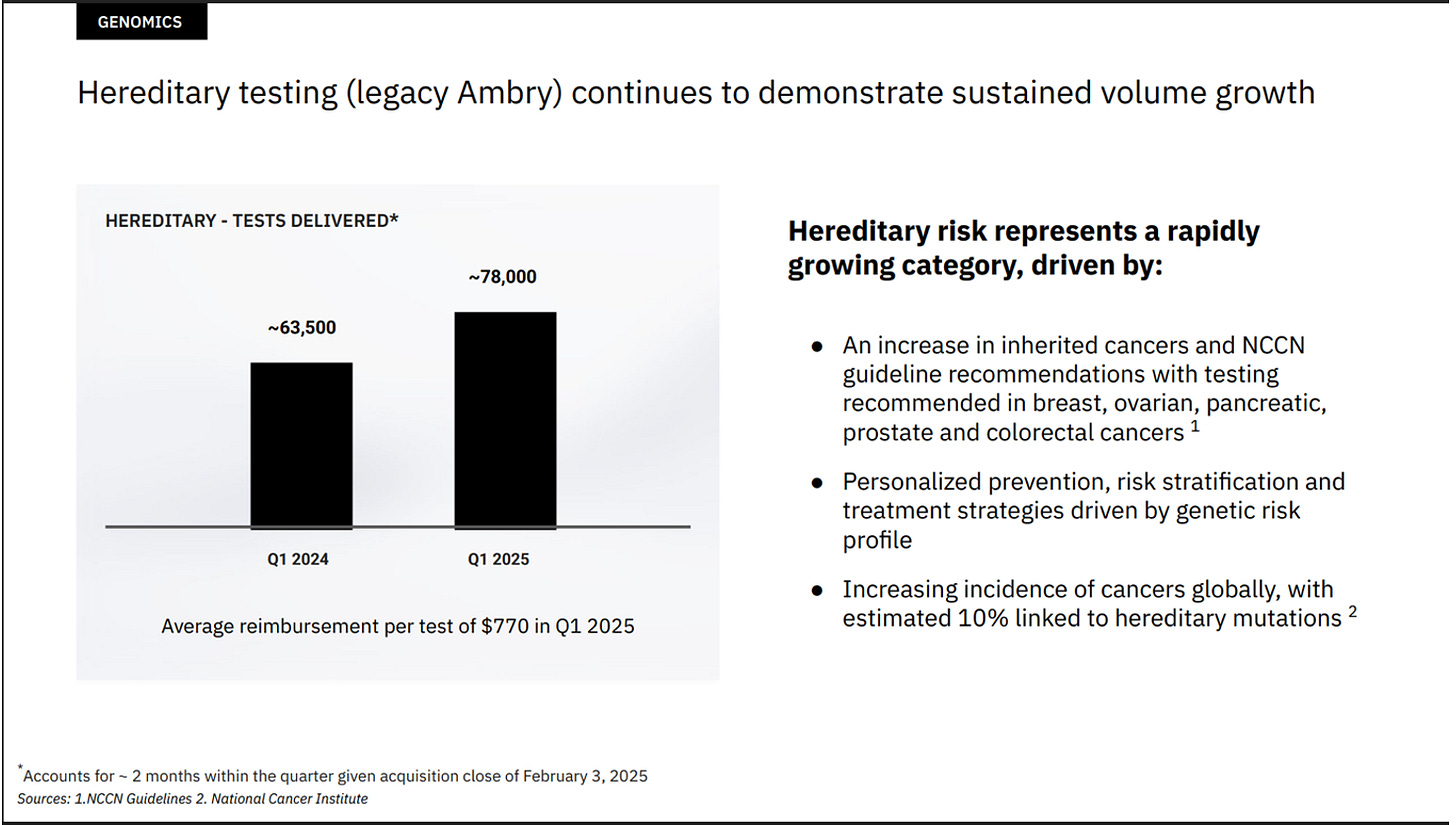

Moreover, throughout the last quarter of 2025, Tempus AI reported strong and promising financial results. Alongside these positive figures, the company highlighted the significant ongoing growth in its crucial oncology department and substantial expansion opportunities within the hereditary testing sector, fully capitalizing on the synergies stemming from the recent and strategic acquisition of Ambry Genetics.

Tempus AI's pricing power is evident in this chart, where the price per test gradually increases, demonstrating TEM's ability to offer value and command higher fees over time.

Tempus AI's latest slides reveal strong growth in the Genomics sector, encompassing both "Legacy Tempus" oncology tests and "Legacy Ambry" hereditary tests. The volume of NGS oncology tests has increased significantly since 2019, with projections for continued growth into 2025, paralleled by an increase in average revenue per test.

For hereditary tests, volume growth was observed between Q1 2024 and Q1 2025, despite the latter reflecting only about two months post-Ambry acquisition. The average reimbursement for hereditary tests in Q1 2025 was $770. The growth in both segments is attributed to increased genetic awareness, medical guidelines recommending tests, and their vital role in cancer prevention and personalized treatment.

Towards Profitability…

This acquisition isn't just about expanding capabilities; it represents a pivotal step toward financial sustainability. According to TEM's founder and CEO, the new combined entity is projected to achieve both EBITDA and Free Cash Flow (FCF) positivity by 2025.

This milestone will mark a significant shift for Tempus AI, validating its business model and long-term strategy. The acquisition of Ambry integrates TEM's closed-loop system, adding new dimensions to its genomic and data analysis capabilities. It positions the company as a leader not only in oncology but also across a wide range of other diseases, enabling it to serve a broader spectrum of patients and healthcare providers.

Tempus AI's Data and Services: The High-Margin Growth Engine for the Future of Precision Medicine

Tempus AI's Data and Services segment is emerging as a rapidly expanding, high-margin revenue source, poised to play an increasingly crucial role in the company's future trajectory. This core business strategically focuses on licensing its vast and valuable libraries of de-identified clinical, molecular, and imaging data, while also providing advanced analytics and powerful AI tools to dynamic pharmaceutical and biotech companies.

What makes Tempus AI's data offering unique in the healthcare landscape?

The World's Largest Multimodal Data Library: Tempus AI boasts the most comprehensive collection of clinical, imaging, and molecular data globally. In the United States, out of approximately 19 million cancer patients, TEM manages a remarkable 8.5 million fully processed cases and an additional 11 million with meticulously collected data ready for in-depth analysis.

Strategic Partnerships with Industry Leaders: Tempus AI's collaboration with 19 out of the 20 largest public pharmaceutical companies worldwide underscores its strategic importance and deep integration within the pharmaceutical industry's fabric.

Powerful Integrated Platform Tools: The company doesn't just license data; it provides its partners with an advanced technological platform for autonomous analysis. Its comprehensive suite of analytical tools, scalable cloud resources, and powerful data processing capabilities empower pharmaceutical companies to extract actionable information and valuable insights from raw data.

TEM's cutting-edge platform exponentially amplifies the intrinsic value of its data through deep integration with the healthcare ecosystem:

Continuous, Bidirectional Data Flow: Tempus AI's sophisticated "data pipes" efficiently connect to over 2,500 healthcare institutions, allowing a continuous flow of information from hospitals to the TEM platform and vice versa, with actionable insights delivered in surprisingly short timeframes, often within a few days.

Growing Powerful Network Effects: With over 65% of leading academic medical centers and 50% of oncologists in the United States actively utilizing the TEM platform, its ecosystem continues to expand rapidly, constantly enhancing the quality, depth, and breadth of its valuable multimodal datasets.

The synergistic combination of unparalleled data assets, cutting-edge AI tools, and robust strategic partnerships positions Tempus AI as an undisputed leader in this high-margin growth sector. With the continued expansion of the Data and Services segment, the company is expected to gain significant operating leverage and achieve robust profitability, solidifying its crucial importance in the future of precision medicine and innovative drug discovery.

AI Applications: An Emerging Product Line with Transformative Potential

While Tempus AI is widely recognized as a pioneer in integrating artificial intelligence into the healthcare landscape, its dedicated product line for AI applications is still in its early stages of development and commercialization. This promising segment, focused on developing advanced algorithmic diagnostics and intelligent clinical decision support tools, is currently included within the broader Data and Services category due to its relatively modest contribution to the company's overall revenue.

Financial Profile

Profitability

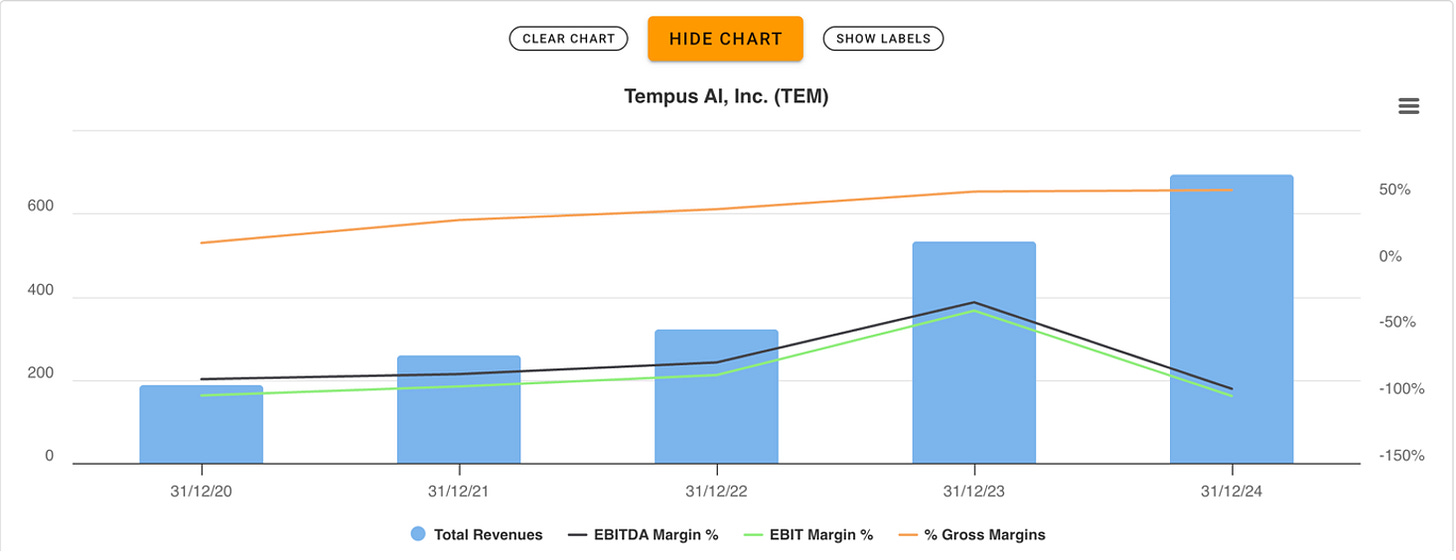

Tempus AI's gross margin trend shows robust growth, an encouraging sign that suggests the company's ability to increase the pricing of its products and services. This reflects the unique value and growing demand for its innovative AI-powered precision medicine solutions.

Regarding the evolution of EBITDA margin and EBIT margin, a decline is evident, which can be directly attributed to the substantial strategic investments the company is currently undertaking to fuel its future growth and solidify its market leadership. These significant investments inevitably reflect in the amount of depreciation and amortization, temporarily impacting short-term profitability.

However, it's reasonable to assume that with the considerable increase in revenue, estimated by management at approximately $1.23 billion for 2025, Tempus AI will be able to focus more on optimizing profit margins. The operating leverage, intrinsic to a scalable business model like Tempus AI's, should fully manifest with revenue growth, leading to a progressive improvement in profitability in the medium to long term. The expansion of the high-margin Data and Services segment and the full integration of synergies from the Ambry Genetics acquisition represent additional factors that could significantly contribute to Tempus AI's margin improvement in the coming years.

Financial Analysis

From a financial perspective, it's clear that Tempus AI still carries a high level of debt when compared to its current cash generation and the EBITDA it produces. This situation is relatively common for a rapidly growing company, even one already boasting a market capitalization of over $10 billion. This "embryonic" phase, despite the significant capitalization, implies that investments in expansion and innovation might temporarily limit profitability and increase debt.

It will be crucial to closely monitor the increase in margins, which management anticipates for 2025, and the achievement of positive Free Cash Flow (FCF). These developments would represent tangible signs of an improvement in the company's financial solidity. Positive FCF would indicate that Tempus AI is beginning to generate excess cash after covering its operating expenses and capital investments—a fundamental step toward greater financial stability and a potential reduction in debt over time. Successfully reaching these goals could significantly transform Tempus AI's financial profile, making it an even more compelling investment option in the rapidly growing field of AI applied to healthcare.

Adjusting for Non-Cash Items

To truly assess Tempus AI's financial health beyond the accounting profit figures, we calculated Warren Buffett's "Owner's Earnings," which aims to isolate the cash generated from the company's core operations. Starting with net income and adjusting for non-cash items (like depreciation, amortization, and Stock-Based Compensation) and changes in working capital, and then subtracting necessary capital expenditures, we found that in 2024, Tempus AI reported negative Owner's Earnings of over $130 million. This indicates that the company is still heavily investing to fuel its rapid expansion, outspending the cash internally generated by its operating activities.

This figure is particularly significant when compared to the much more negative net income of -$705 million. The substantial difference between these two figures highlights a crucial aspect: the majority of Tempus AI's accounting "loss" is not due to an actual, proportional outflow of cash.

Specifically, the item most impacting this discrepancy is Stock-Based Compensation, which amounted to over $534 million in 2024. While this is an expense that reduces net income, it does not represent a cash outlay for the company. Rather, it's a form of remuneration granted as shares, which, while diluting the ownership of existing shareholders, does not directly impact the company's liquidity during that period.

In summary, while net income paints a picture of deep accounting losses, the analysis of Owner's Earnings reveals that the company's actual cash burn from its core operations, while still negative, is significantly lower. This suggests that Tempus AI, although not yet profitable in accounting terms and still in an investment phase, is managing its cash resources more efficiently than net income alone might suggest, especially due to the use of Stock-Based Compensation as a remuneration tool that preserves liquidity for other purposes, such as research and development and operational expansion.

Growth Outlook for 2025

Tempus AI's recent participation in JP Morgan's influential annual healthcare conference provided optimistic financial guidance for the current year:

Projected revenue of approximately $1.23 billion, representing an impressive over 75% year-over-year growth (including acquisitions).

Positive adjusted EBITDA and Free Cash Flow (FCF), signaling a significant improvement in profitability and cash generation.

Potential Catalysts for Future Growth

Several factors could act as powerful catalysts for further growth and valuation of Tempus AI:

Growing Institutional Ownership: Institutional investors currently hold approximately 33% of TEM shares, a relatively low percentage for a company of its size and high growth potential. As an increasing number of financial institutions recognize the intrinsic value of the TEM platform and its central role in the healthcare ecosystem, this share is expected to increase, which could trigger a significant appreciation in stock price.

Significant Margin Improvement: Tempus AI is approaching a crucial turning point where its profit margins are set to improve substantially. Thanks to the growth of its high-margin segments like Data and Services and AI Applications, and the integration of synergies from the Ambry Genetics acquisition, the company should see a notable increase in its overall profitability.

Strategic Expansion Beyond Oncology: Tempus AI has already made great strides in expanding its reach beyond oncology, successfully penetrating promising medical areas such as neuropsychology, cardiology, and rare diseases, opening new and significant revenue streams. Bolstered by its robust technology platform, Tempus is well-positioned to make further advancements in a growing number of healthcare specialties.

Potential Reimbursement for AI Applications: One of the most exciting catalysts for TEM's long-term growth lies in the future reimbursement of its innovative AI applications. As regulatory authorities begin to recognize the enormous potential of AI in improving patient clinical outcomes, AI-powered diagnostic and decision-support tools developed by TEM could benefit from dedicated reimbursement mechanisms, resulting in a significant increase in revenue. The CEO expresses strong optimism regarding this potential, which, if materialized, could become a major growth driver in the coming years.

A detail of considerable importance concerns the significant shareholding of founder and CEO Eric Lefkofsky, who owns over 20% of the company, demonstrating a strong personal interest in its future success. Overall, insiders (executives and key shareholders) hold approximately 35% of the company, further aligning their interests with those of external shareholders.

It is also noteworthy that TEM boasts two globally prominent investors: Google and Novo Nordisk. Google holds approximately 1% of the company, while Novo Nordisk has a 2.5% stake. These high-profile investors lend further credibility to Tempus AI, strengthening its leadership position in the dynamic sector of digital health and AI applied to medicine.

Final Assessments

Valuing Tempus AI presents an inherent challenge, as it's a company with exponential growth potential that could redefine the landscape of AI applied to healthcare.

We believe that Tempus AI's organic revenue growth, excluding the transformative impact of the Ambry Genetics acquisition, is set to accelerate significantly in the coming years. In particular, the dynamic Data and Services segment should emerge as a significant driver of operating leverage, contributing substantially to the company's overall margin expansion as it captures a larger share of the business.

If Tempus AI can achieve terminal Free Cash Flow (FCF) margins of at least 20%, the company could prove to be an extremely attractive long-term investment, especially considering its growing competitive advantage in a rapidly expanding sector. Reaching this level of sustainable profitability does not seem unrealistic at all and could offer investors substantial growth potential in the coming years.

In summary, while acknowledging that, based on current numbers, Tempus AI might not appear to be a "bargain" at these valuation levels, we firmly believe that, should the company concretely demonstrate its ability to fulfill its ambitious mission, a market capitalization of $10.8 billion will ultimately be considered a paltry sum for such a valuable and potentially life-saving ecosystem.

Final Thoughts: Tempus AI as a Protagonist in the AI Healthcare Revolution

Overall, our analysis leads us to the conclusion that Tempus AI will position itself as one of the companies that will benefit most from the growing and unstoppable trend of integrating artificial intelligence within the healthcare sector, with the primary objective of significantly improving patient outcomes. The company is uniquely positioned to fully capitalize on this epochal transformation, and its cutting-edge platform is paving the way for personalized, deeply data-driven healthcare solutions, promising a smarter and more efficient future for medicine.

Technical Analysis

Graphically, there isn't a long history for Tempus AI to analyze, so technical analysis can offer us very little help in this case.

However, we can note that the POC (Point of Control) level, around $62.67, could be considered an interesting support level.

Should the POC level be breached, we believe the stock could fall to $53.54, potentially using the 200-period moving average as support.

Conversely, if the POC acts as a strong support, then Tempus AI would be poised for a rebound, aiming to return to its all-time highs, around $91.00 per share.

Our views expressed here are current as of this report's date and may change without notice. This information isn't meant to be your primary guide for investment choices, nor should it be taken as personalized financial advice. Remember, all investments carry risk, including the potential loss of your principal, and past performance doesn't guarantee future returns. Equity Analysis, along with its team members, leaders, and staff, explicitly disclaims responsibility for any actions you take based on this content.