The Prysmian Secret

How the Electricity Revolution is Inflating Its Value (Full Analysis: USA, Future Plans, and a Rating to Rediscover)

In this article, we're embarking on an exhilarating journey into the very heart of Prysmian, an industrial titan that has masterfully reinvented itself over time, solidifying its position as an undisputed leader in the cable and energy and telecommunications systems sector. We'll unearth its deep roots (its history), delve into its current business architecture (its company profile), uncover the revelations from the recent "Capital Markets Day 2025," and finally, immerse ourselves in a thorough market analysis to fully grasp its strategic standing in the global market.

Our path will wind through:

Prysmian's History: Historic Roots and Corporate Evolution

Prysmian's Business Profile: Business Lines, Sectors, and Diversification

Prysmian's Capital Markets Day 2025: News, Future Strategies, and Key Announcements

Prysmian Market Analysis: Competitive Positioning, Growth Prospects, and Industry Dynamics

Prysmian Financial Analysis and Valuations: Economic Performance, Rating, Undervaluation

Prepare to discover a story of ingenuity, challenges overcome, and a bold vision that continues to shape the future of energy and telecommunications.

1.Prysmian’s History

Imagine an era of monumental industrial transformation, an Italy teeming with ambitious ideas and projects. It was in this fervent atmosphere, way back in 1872, that Prysmian's historical roots took hold. It began as a specialized division within the prestigious Pirelli group, focused on creating high-voltage cables. From Milan, a pulsating heart of innovation, the company started its journey – an adventure that would ultimately lead it to conquer the global markets for cables and systems.

With nearly 150 years of corporate history behind it, Prysmian now stands as a beacon in the global landscape of energy and telecommunications cables and systems. It's a legacy of excellence that has evolved through time, overcoming challenges and seizing opportunities, transforming into the leading company we know today. It boasts over 33,000 employees operating in 109 plants and 27 research and development centers spread across more than 50 countries. This expansive global presence truly underscores its strategic importance in the cable sector.

Prysmian's ability to diversify its product portfolio, offering cabling solutions for over 100 industrial sectors, has always been its defining characteristic. And before we delve into its current business lines, it's crucial to emphasize a fundamental aspect: Prysmian operates in an oligopolistic market, where its market leadership in high-voltage cables and transmission systems is undisputed. This sector, marked by its high capital intensity, presents significant barriers to entry, both in terms of necessary investments and specialized cable know-how.

As mentioned, the original connection with Pirelli was the initial spark for Prysmian's birth. Subsequently, a corporate restructuring orchestrated by Goldman Sachs marked a new phase in its evolution.

2005 proved to be a pivotal year in Prysmian's history, with its official establishment as an independent entity, sharply focused on developing its core business of high-voltage cables and energy systems.

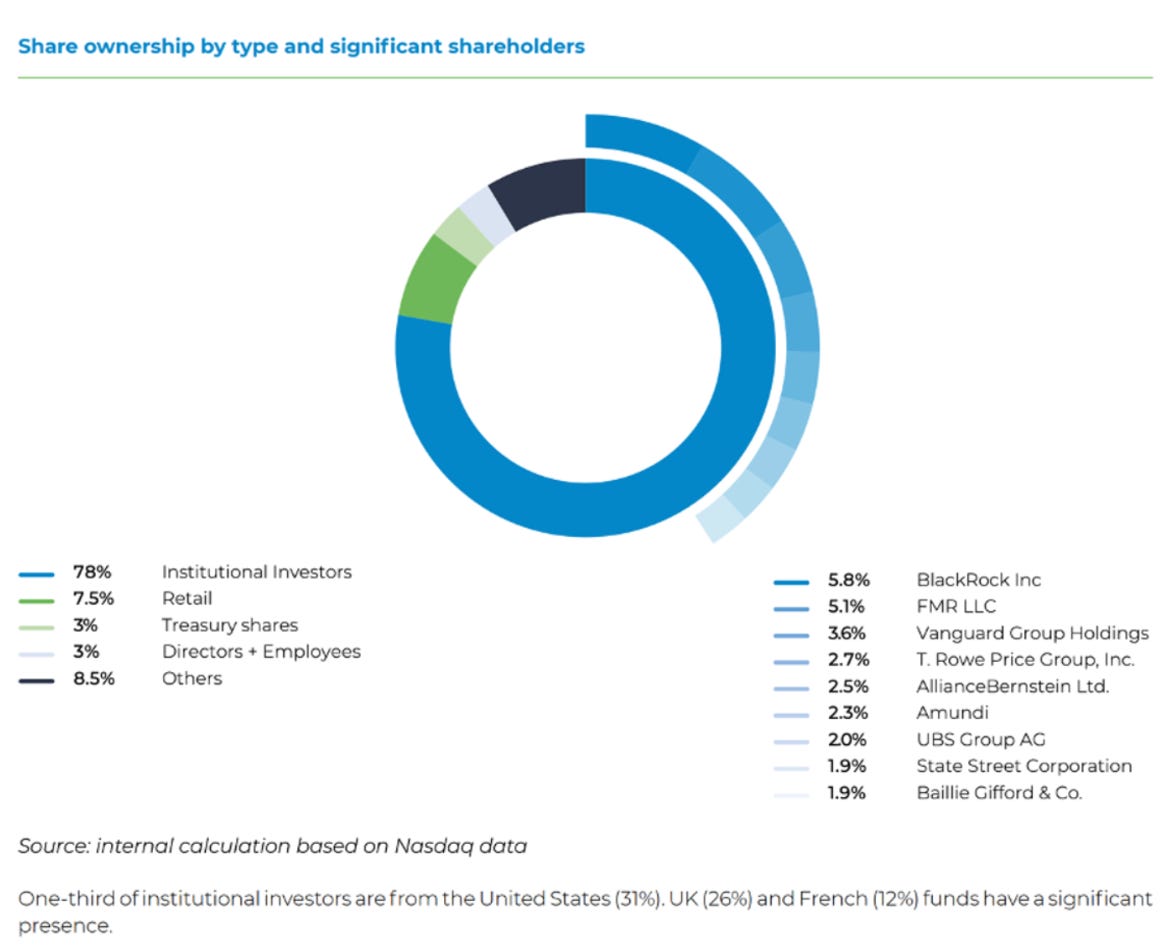

Today, with a market capitalization of approximately 16 billion euros, Prysmian is a public company boasting a solid institutional shareholder base, clearly evidenced by the chart that highlights the prevalence of institutional investors in its ownership.

2.The Current Business Profile

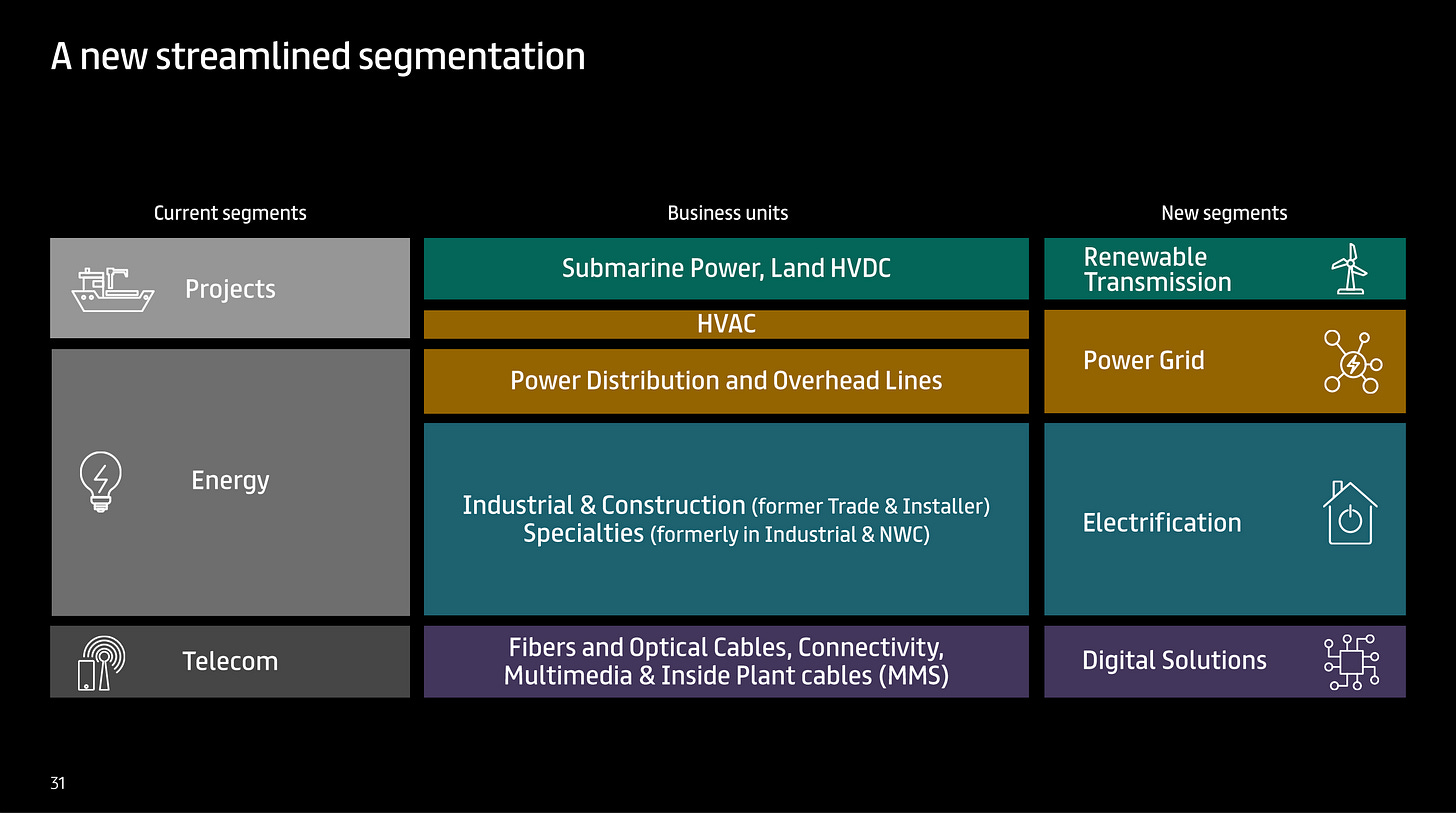

Over the years, Prysmian's business structure has dynamically evolved to meet shifting market demands and embrace new opportunities within the energy and telecommunications cable and systems sector. Until the third quarter of 2023, the company primarily operated through three pivotal segments:

Energy

Projects

Telecom

1)Energy

This is a vast, strategic, and utterly fundamental sector for Prysmian's growth, further broken down into:

Industrial & Construction & Specialties: Dedicated to cables for electrifying residential buildings, industrial plants, and infrastructure, as well as specialized cables for crucial sectors like automotive, renewable energy (wind, solar), and oil & gas.

Power Distribution: Focused on producing essential copper cables for utility investments in the electrical distribution sector.

2)Projects

This is Prysmian's operational arm for cable laying, both submarine (where Prysmian already held a significant competitive edge thanks to its specialized fleet of vessels for installing subsea energy and telecom cables) and terrestrial. It covers both HVAC (High Voltage Alternating Current) and HVDC (High Voltage Direct Current) solutions for power transmission. The 2018 acquisition of General Cable further enriched its expertise in submarine telecom and terrestrial cables.

3)Telecom

This business division is devoted to producing fiber optic and copper cables for the telecommunications sector, with a particular focus on advanced technologies like FTTA (Fiber to the Antenna) and 5G.

However, to respond even more effectively to the ongoing evolution of the global cable market and the powerful synergies between its various business areas, Prysmian has embarked on a strategic reorganization. This has given rise to a bold new business architecture built upon four fundamental pillars:

1)Transmission

This strategic division is the powerful result of merging the Submarine Power and Land HVDC operational units. The focus is unmistakably geared towards the transmission of renewable energy through cutting-edge cable solutions. This encompasses high-tech, high-value-added technologies like HVDC, high-voltage grid components, subsea energy and telecom cables, offshore specialties (for offshore wind farms, oil platforms), and high-voltage EOSS (Electrical Oilfield Subsea Solutions). An emblematic example is the Viking Link project, a record-breaking subsea interconnector linking the UK and Denmark, a testament to Prysmian's unrivalled expertise in HVDC submarine cables.

2)Power Grid

This business area encompasses the HVAC (Land HVAC Cables), Power Distribution, and Overhead Lines operational units. The primary objective is to support the modernization of existing electrical grids through innovative technologies for electricity transport and distribution. The segment branches into various business lines, including HVAC, power distribution, overhead lines, and medium and low voltage grid components.

3)Electrification

This segment represents a broad spectrum of activities within the energy sector, featuring a comprehensive and innovative product portfolio designed to meet the surging demand for electricity across diverse industrial and civil sectors. It includes the Industrial & Construction, Specialties divisions (which in turn encompass OEM - Original Equipment Manufacturers - renewable energy, automotive, oil & gas, etc.) and other occasional sales. It's fascinating to note that the Electrification sector alone accounts for approximately 57% of Prysmian's total revenue, underscoring its paramount strategic importance for corporate growth.

4)Digital Solutions

This division brings together activities related to optical fibers and cables, connectivity, multimedia, and indoor cables (MMS), concentrating on the production of cabling systems and connectivity products for telecommunication networks. The segment includes optical fiber, optical cables, connectivity components and accessories, OPGW (Optical Ground Wire) cables, and copper cables. The recent acquisition of Channel Commercial Group represents a significant strengthening of Prysmian's presence in North America within this strategic telecommunications and connectivity sector.

This dynamic new organizational structure powerfully reflects Prysmian's vision: to increasingly integrate itself into its customers' value chain, offering not just high-quality products, but true, complete solutions to face the future challenges of the energy and telecommunications sectors.

3.The Voice of the Future: Key Insights from Capital Markets Day 2025

And here we are, at the very heart of our story: Prysmian's Capital Markets Day 2025. This was a truly pivotal event where Massimo Battaini and the Prysmian leadership team shared with the world the challenges they've faced, the triumphs they've achieved, and most importantly, the company's strategic vision for the future and its ambitious growth targets.

The Capital Markets Day 2025 was a key moment for Prysmian, an opportunity to take stock of the journey undertaken in the company's evolution and to unveil its aspirations for the coming years in the global cable market. Massimo Battaini, a central figure in this narrative of transformation, led the presentation, recounting the challenges met within the sector and celebrating the milestones achieved in the group's growth.

The Tale of a Transformation: The Integration of General Cable

Battaini, who played a pivotal role as CEO of the North American group following the significant acquisition of General Cable, shared his initial reflections on that crucial moment for Prysmian's expansion into the USA.

"When we began the integration of General Cable," he confessed, "I genuinely worried about how we would unite people from two such distinct corporate cultures."

His answer was an act of visionary leadership: to bring all employees together and share a bold outlook for the American market. The goal was crystal clear: to make the USA market the largest and most profitable region for the Prysmian Group. "It won't be easy," he admitted transparently, "but with a joint commitment, we will turn this vision into a reality."

And the reality has surpassed expectations. Today, North America represents an impressive 40% of revenue and a considerable 50% of the EBITDA (earnings before interest, taxes, depreciation, and amortization) for the Prysmian Group. Battaini's vision has materialized, propelling Prysmian to new heights of success in the US market.

Goals Surpassed and a New Era of Dynamism

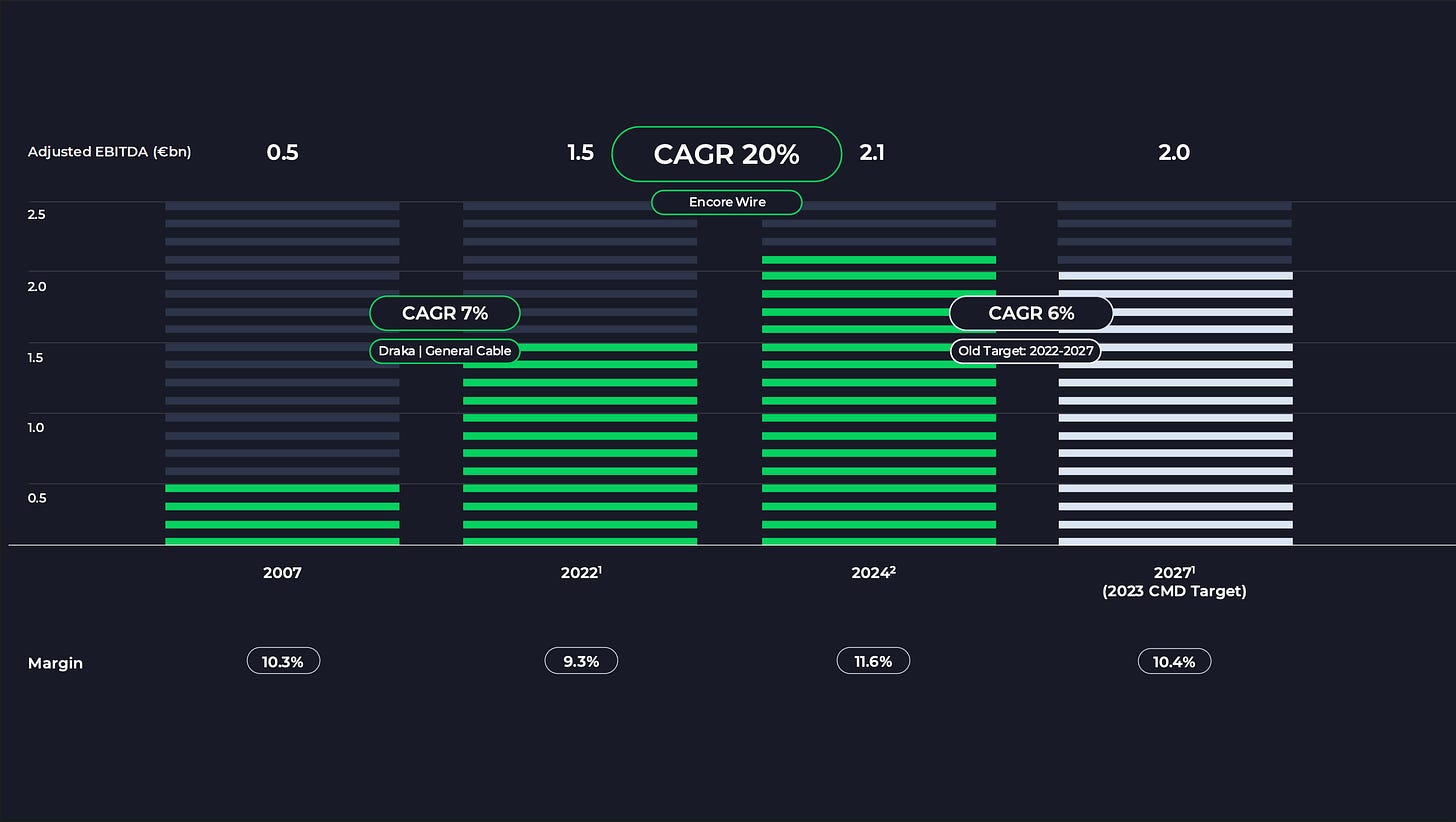

2024 was a breakthrough year, with Prysmian exceeding its ambitious EBITDA targets of 2 billion euros, set for 2027, a remarkable three years ahead of schedule. This achievement is even more significant when considering that just two years prior, in 2022, the EBITDA stood at 1.5 billion euros.

The final result for 2024 marked a new peak, with an EBITDA of 2.1 billion euros.

"All of this was possible because we are a new Prysmian," Battaini declared emphatically, "more dynamic, more agile, capable of navigating the market with unprecedented flexibility. We've entered a new mode, an acceleration that propels us toward even more ambitious goals in the growth of our business."

The Pillars of Acceleration: Demand, Profitability, and M&A

So, what are the driving forces behind this remarkable acceleration in Prysmian's EBITDA? Battaini identified three key factors for future growth:

Strong market demand, with particular momentum in the strategic sectors of renewable energy Transmission and Power Grids for infrastructure modernization.

Continuous improvement in our profitability (margins), a result of efficient operational cost management and constant optimization of production processes.

Strategic agility in M&A (Mergers and Acquisitions) operations, allowing us to seize inorganic growth opportunities swiftly and intelligently, expanding our global presence and acquiring new technologies.

The objective is clear: to continue on this accelerated growth trajectory, combining organic expansion with strategic acquisitions. Today, Prysmian stands as an undisputed leader in the cable sector, roughly three times the size of its closest competitor. Our growth strategy has included acquiring numerous competitors, and we don't rule out future operations, should strategic opportunities arise.

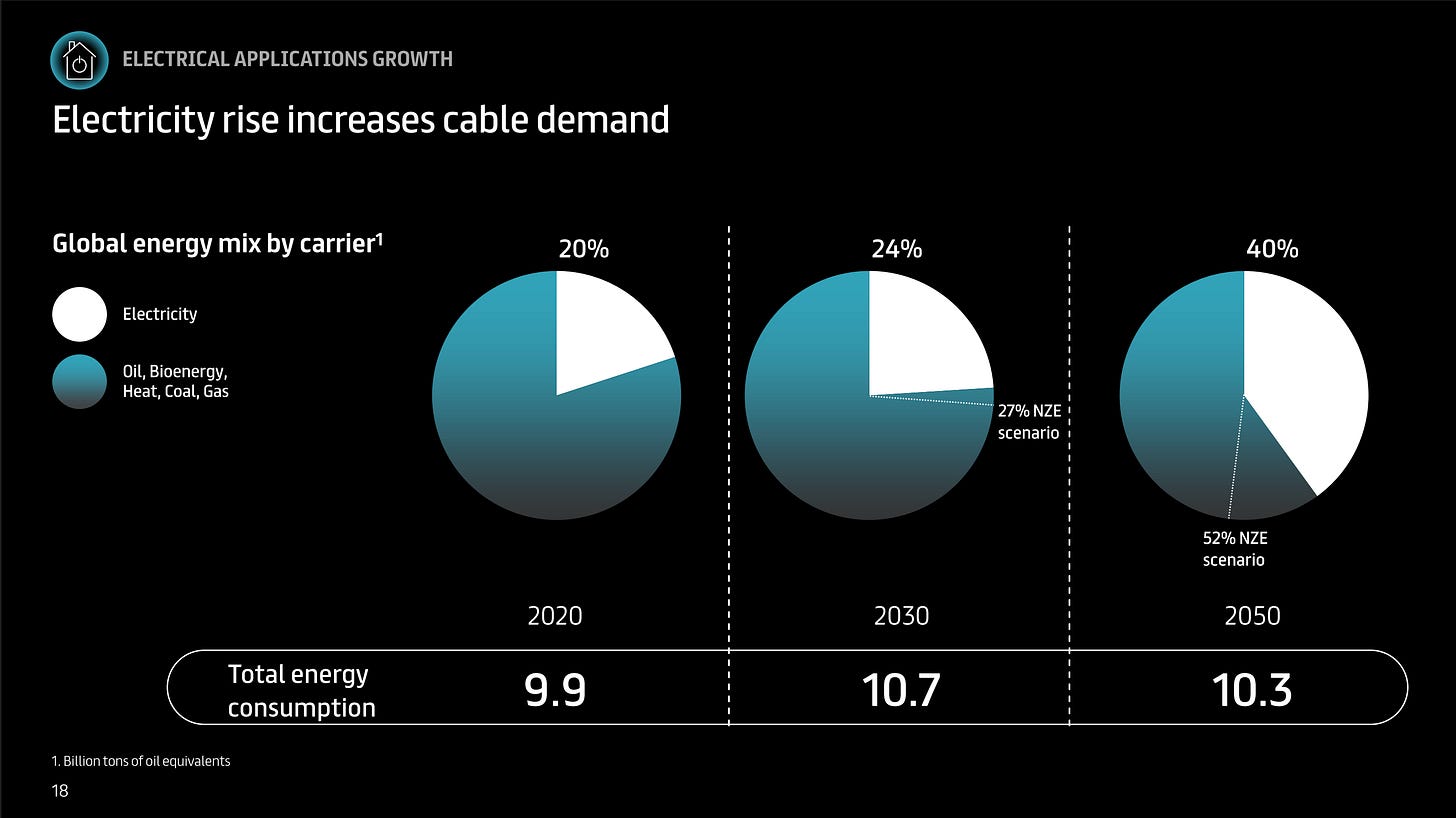

The increasing demand for electricity will inevitably lead to a greater demand for cables! It's a certainty!

A fundamental consideration is that Prysmian operates in a solid leadership position within an oligopoly. Its main competitors are France's Nexans and Denmark's NKT. Despite the presence of these rivals, Prysmian firmly maintains its dominant stance.

As of today, it's estimated there are roughly 80 million km of cables installed worldwide. Of these, a striking 50% are over 20 years old (with an estimated useful life of 40-60 years). This implies that, beyond the goal of doubling the global cable network to reach 160 million km, there is an urgent need for massive modernization of the existing infrastructure.

This combination of fresh demand and urgent replacement needs powerfully reinforces our argument for an exponential increase in global cable demand. Such a scenario will undoubtedly benefit Prysmian, as well as its competitors. However, the presence of these rivals raises no concerns: Prysmian not only excels in the sector, but the demand is so incredibly high that the current supply simply cannot meet it. Consequently, there's a large slice of the market for all major players.

A Profound Transformation: From Manufacturer to Global Solutions Provider

Over a span of 17-18 years, Prysmian has undergone a radical metamorphosis, evolving from an expert cable manufacturer to the undisputed global leader in its sector, offering integrated solutions for energy and telecommunications.

"We can combine growth and resilience," Battaini affirmed, introducing a key concept. The diversification of business lines (Transmission, Power Grid, Electrification, Digital Solutions) and its presence across diverse geographical areas allow Prysmian to balance performance, with some growing areas compensating for any downturns in others, thereby ensuring greater financial stability.

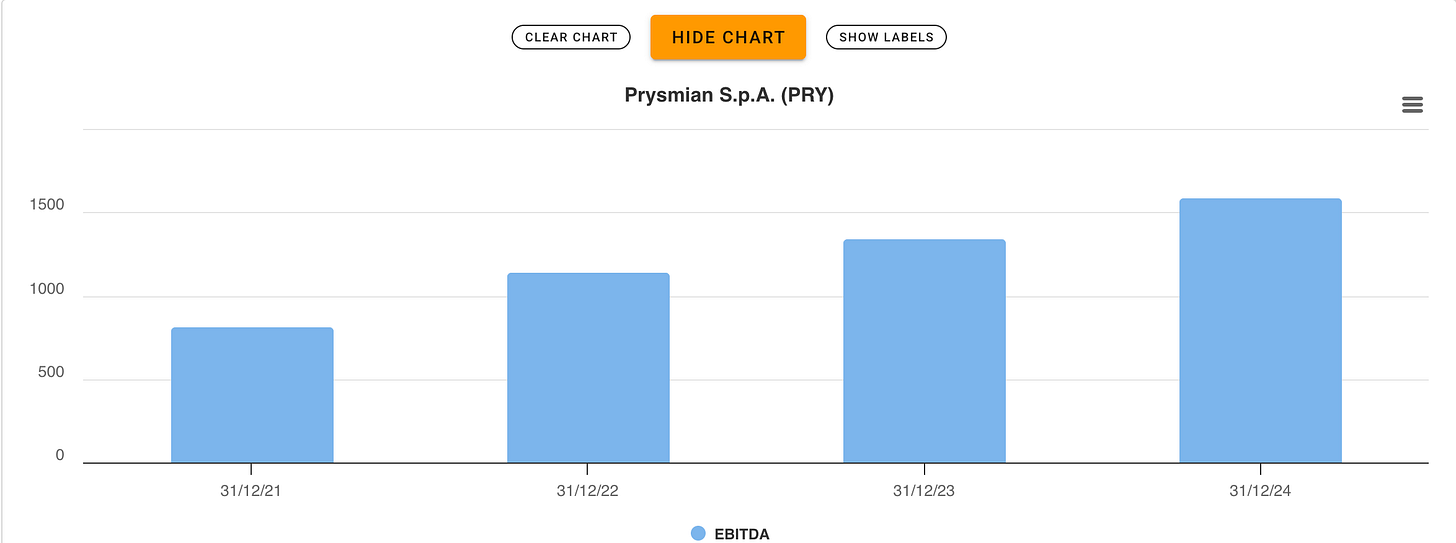

This resilience has been rigorously tested over the past four years, a period marked by global challenges such as supply chain issues, high inflation, and surging energy costs. Despite these adversities, Prysmian's EBITDA has continued to grow, climbing from approximately 1 billion euros in 2021 to 1.7 billion in 2024, excluding the impact of the Encore Wire acquisition. "Resilience isn't just a slogan; it's a reality that our results clearly demonstrate," Battaini emphasized.

This remarkable resilience has empowered Prysmian to complete an epoch-making transformation, evolving from a mere "Cable Manufacturer Player" to a "World Class Solutions Provider."

Business Areas

Four Pillars to Conquer the Market

Prysmian's new organizational structure is built upon four strategic areas, each perfectly aligned with the market's primary demand drivers:

Transmission: Accelerating the transition to renewable energy.

Electrification: Supporting the increasing demand for electricity consumption.

Power Grid: Strengthening and modernizing electrical networks.

Digital Solutions: Leading the digital transformation.

"We are the only ones to boast such a broad portfolio of services," Battaini stated with conviction, "capable of covering the entire spectrum of market needs."

Ambitious Targets for 2028

Prysmian's gaze is already firmly set on 2028, with ambitious targets that underscore its confidence in the future:

EBITDA: A projected range between 2.95 and 3.15 billion euros.

FCF (Free Cash Flow): Between 1.5 and 1.7 billion euros.

Superior Shareholders Return: A compound annual growth rate (CAGR) for EPS (earnings per share) of 15-19% over the 2024-2028 period.

Solution Provider: The goal is for 55% of revenue to come from integrated solutions.

If we consider the period from 2007 to 2024, even including Encore Wire, EBITDA has grown fourfold (X4), as we can observe in the image below.

And in that same period (2021-2024), Free Cash Flow (FCF), specifically Levered Free Cash Flow, grew even faster, by an astounding five times, clearly highlighting Prysmian's robust cash generation. Crucially, in 2023 and 2024, this FCF surge experienced a powerful acceleration, signaling a significant improvement in Prysmian's financial performance.

If we look more closely at the image (referencing an unseen visual element), we can see how EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) grew in 2023 and 2024 with a Compound Annual Growth Rate (CAGR) of +20%, demonstrating robust organic growth for Prysmian. Meanwhile, in the same period (2023-2024), FCF grew at a CAGR of +35%, outperforming EBITDA growth and indicating greater efficiency in working capital management and investments.

At the previous "Capital Markets Day," Prysmian introduced a new financial ratio for its targets: EPS (Earnings Per Share), a key indicator of profitability for shareholders. The target for the 2022-2027 period projected a 10% EPS CAGR, but in the first two years of this period, 2023 and 2024, EPS grew with a CAGR of +15%, surpassing initial expectations and signaling strong potential for earnings growth at Prysmian.

By 2028, Prysmian expects to organically achieve an EBITDA of 2.9 billion euros, with an additional 150 million euros anticipated from the integration of Channell Commercial Corporation, highlighting the expected synergies from this strategic acquisition.

The Strategic Acquisition of Channell Commercial Corporation

Battaini then dedicated time to the acquisition of Channell Commercial Corporation, emphasizing its strategic importance for strengthening Prysmian's Digital Solutions business. The primary objective is to transform Prysmian from a cable manufacturer into a comprehensive solutions provider in the "digital solution" sector for telecommunication networks.

Channell Commercial Corporation, with over a century of experience in the United States, is a leading provider of connectivity solutions, offering:

Plastic and metal enclosures (vaults) for underground telecommunications infrastructure.

Copper cable connectors for telecommunication networks.

Fiber optic cable management systems for network infrastructure.

Thermal management products for telecommunication infrastructure.

The acquisition has a total value of 950 million dollars, with a potential earn-out of up to 200 million dollars linked to Channell's future performance, underscoring Prysmian's confidence in the acquired company's growth potential within the digital solutions sector.

Focus on Key Segments: Transmission

Moving on to the individual business segments, Battaini highlighted Prysmian's complete vertical integration in the energy Transmission sector. The company is the only player capable of directly installing all the cables it produces, thanks to a fleet of eight specialized cable-laying vessels for high-voltage submarine cables and terrestrial HVDC cables. This direct control over the value chain ensures optimal management of profit margins, operational costs, project execution times, and work quality.

Furthermore, Prysmian offers a "Unique Inspection of Maintenance and Repair Solution" for repairing damage to submarine energy and telecommunications cable networks. The true uniqueness lies in the immediate availability of dedicated resources: a standby vessel, a specialized crew, and expert engineers ready to intervene rapidly, minimizing downtime for clients in the offshore and submarine sectors.

Prysmian's technological leadership across three dimensions (innovative cables, advanced installation, and integrated sensing) represents another distinguishing element. The company continues to innovate, creating cables capable of transmitting ever-increasing amounts of energy, making the energy transition more efficient and sustainable. Within submarine cable installation, the ability to operate in deep waters up to 3000 meters positions Prysmian as the only company in the world with this expertise, opening new frontiers for the submarine interconnection of electrical grids and telecommunications.

Finally, integrated sensing cable technology allows for maximizing energy flow and rapidly detecting faults, improving network efficiency and reducing downtime. Prysmian anticipates further improvement in profit margins within the backlog of this Transmission segment, with a CAGR of 25-28%, underscoring its potential for profitable growth.

4.Beyond the Numbers: Market Analysis and Outlook

After charting Prysmian's brilliant past trajectory, the "Capital Markets Day" truly shone a spotlight on its future ambitions, with a particular focus on strategic investments planned for the four-year period of 2025-2028.

The total Capex (Capital Expenditures) investment plan for the next four years stands at a significant figure: 2.6 billion euros. This allocation of financial resources isn't just a number; it's a clear signal of Prysmian's unwavering commitment to continuous growth, innovation, and the solidification of its market leadership.

A substantial portion of this investment, amounting to 0.5 billion euros, will be specifically directed towards the integration and development of Encore Wire's operations – the strategic acquisition in the North American electrical cable sector. These funds will be crucial for harmonizing operations, expanding Encore Wire's distinctive production capacity within the Prysmian Group, and realizing the anticipated operational synergies, thereby boosting efficiency and profitability.

But it doesn't stop there. The overall figure also includes the necessary investments for the seamless integration of Channell Commercial Corporation, the recent acquisition in connectivity solutions for telecommunications networks. These investments will target several key aspects: aligning business operations, increasing Channell's production capacity, fostering synergy between Channell's product offerings and Prysmian's existing digital solutions, and potential joint investments in research and development to fuel future innovation in the telecommunications and connectivity sector.

A stable Capex level bodes well for achieving our financial targets.

Analyzing the various financial objectives, a clear outlook of continuous EBITDA growth emerges, further supported by an initial contribution from the Channell Commercial Corporation acquisition.

A significant portion of this growth is attributable to the Transmission business line. Here, Prysmian can provide clients with both manufacturing and installation capabilities, and this is poised to drive high double-digit growth.

The CFO outlined a robust growth outlook for the group in the coming years, with the Transmission sector playing a leading role. Thanks to a significant expansion of both manufacturing and installation capacity, this segment is projected for high double-digit growth, aiming to achieve revenues nearing 5 billion euros and an EBITDA margin close to 20% by 2028.

Digital Solutions will also contribute substantially to margin growth, benefiting from both the recent strategic acquisition of Channell Commercial Corporation in the United States and targeted organic growth in the North American market.

For the Power Grid and Electrification segments, the strategy anticipates solid mid-single-digit organic growth, leveraging past and future capacity expansions, with a particular focus on the US and European markets for Power Grid. In the North American industrial and construction sectors, attention will be centered on optimizing synergies from acquisitions, targeting an increase of approximately 75-80 million euros compared to 2025 forecasts, with a long-term goal of 140 million euros in overall synergies.

Now, let's move on to analyzing the FCF guidance for the 2028 target:

Regarding cash generation, the CFO expressed a clear ambition for Free Cash Flow (FCF) growth, projecting an increase from the midpoint of 1 billion euros indicated in the 2025 guidance to 1.6 billion euros as the midpoint of the 2028 financial target. This growth will be underpinned by maintaining a high FCF conversion rate from EBITDA, exceeding 50%.

It's crucial to highlight that the 2028 target assumes a normalization of working capital dynamics in the pivotal transmission business. This implies that cash inflows from customer advances should largely offset the increased working capital needed for accelerating project execution and the significant revenue growth anticipated.

This dynamic differs from 2024's performance, where the 1 billion euro FCF had significantly benefited from a working capital reduction thanks to substantial customer advances. The CFO concluded that this normalization makes the 2028 FCF target not only achievable but also sustainable in the long term.

5.Financial Analysis and Valuations

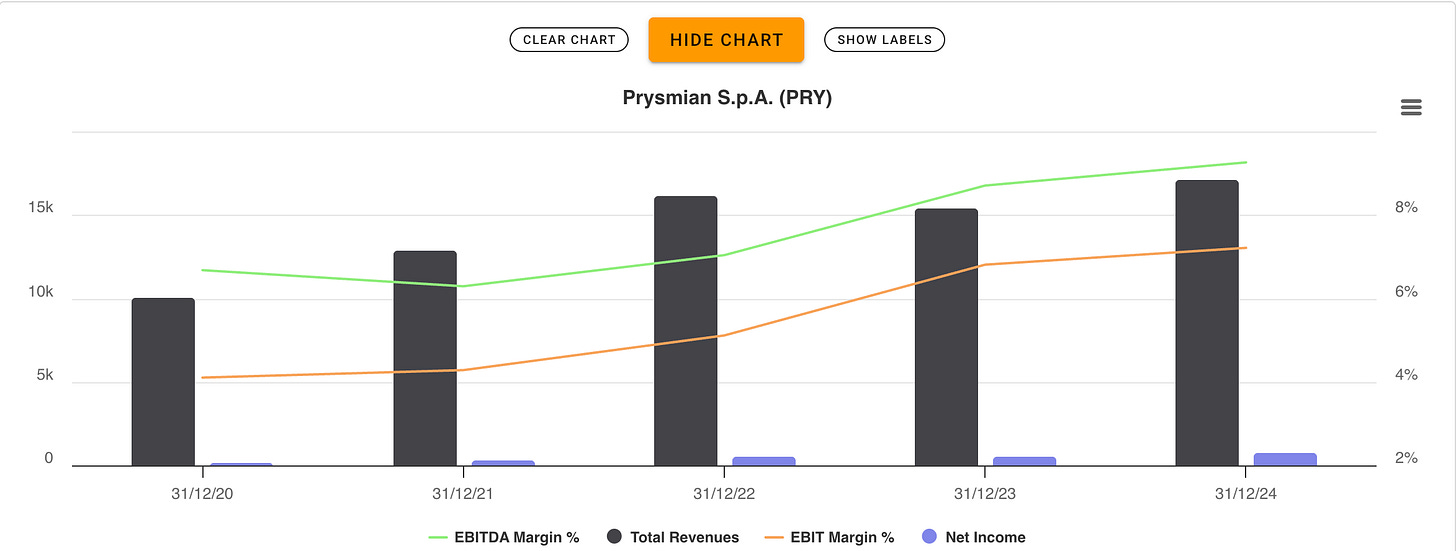

As the graph below clearly shows, the company has made significant improvements over the last four fiscal years, successfully overcoming major macroeconomic challenges.

In 2020, Prysmian closed the fiscal year with revenues of approximately 10 billion euros, generating a net profit of 178 million euros, and recording an EBITDA margin of 6.68% and an EBIT margin of 4%.

Observing the progression of both margins and revenues, significant growth is evident. In 2024, Prysmian achieved revenues of 17 billion euros, with a net profit of 729 million euros. The margins improved significantly, reaching 9.26% for EBITDA and 7.21% for EBIT.

In summary, while revenues increased by 70%, Prysmian managed to boost profits by an impressive 309%. This highlights how, with the growth in order volume, Prysmian is able to leverage its leadership position to significantly expand revenues.

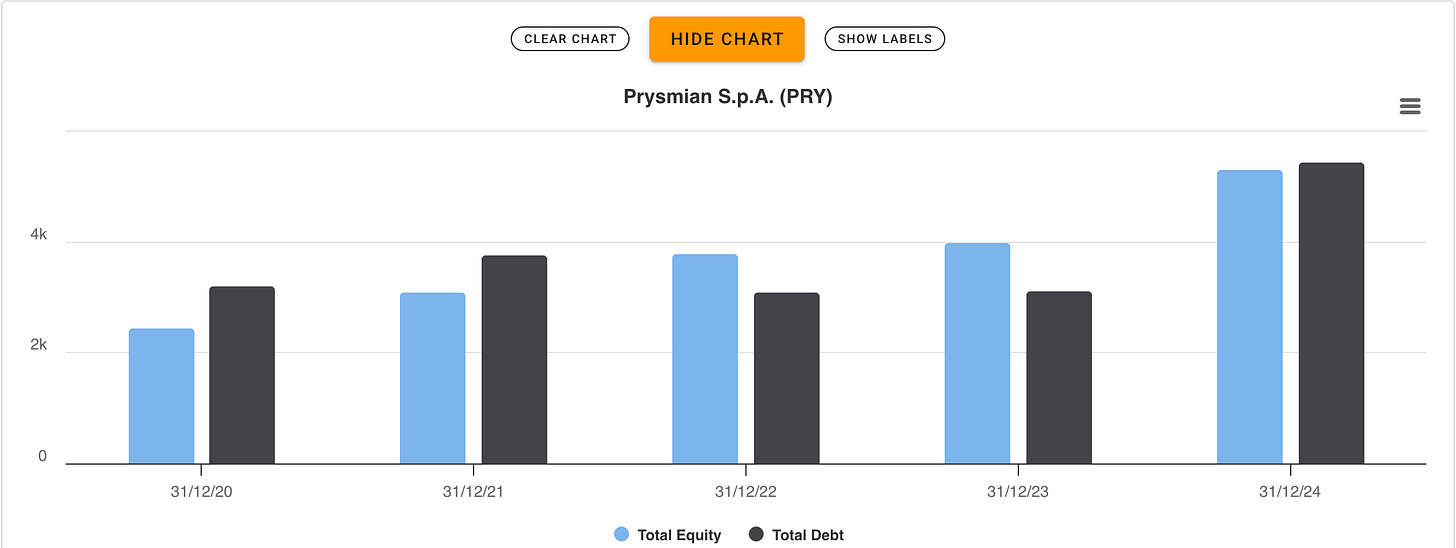

Financial Risk

The ratio between total debt and total equity indicates a very moderate financial risk. Indeed, from the chart below, we can see a Total Debt of €5.425 billion and a Total Equity of €5.297 billion.

A healthy balance between debt and equity gives Prysmian significant financial flexibility. This allows them to tap into both credit and equity issuance to fund future investments and acquisitions. It's important to remember that Prysmian's growth strategy will continue to be built on both organic expansion and M&A operations, which are key tools for consolidating their competitive advantage, acquiring strategic know-how, and generating ever-increasing synergies.

5.Final Valuations

Still during the Capital Markets Day, the company's CFO continued to provide a series of metrics for the next target to be reached by 2028. Let's start with EPS!

Earnings Per Share (EPS)

Prysmian is aiming for solid growth in diluted Earnings Per Share (EPS), with a projected compound annual growth rate (CAGR) between 15% and 19% for the 2024-2028 period, in line with its EBITDA objectives. Management also provided an estimate for diluted EPS in 2028 between €4.6 and €5.2 per share, excluding the amortization of intangible assets from prior acquisitions, with a midpoint of approximately €5 per share.

Return on Capital Employed

Despite a significant increase in net invested capital, which grew by approximately €5 billion following the recent acquisitions of Encore Wire and Channell, Prysmian has set an ambitious target for improving Return on Capital Employed (ROCE). An increase is expected from the 16% recorded in 2024 to a midpoint of 21% in 2028.

Capital Allocation and Cash Generation

Prysmian anticipates robust cumulative cash generation of approximately €5 billion over the 2025-2028 period, a significant increase compared to the €3.2 billion projected for a 5-year period in the previous Capital Markets Day. This strong cash generation will enable the company to pursue a balanced capital allocation strategy, focused on both growth (organic and inorganic) and strengthening its financial structure.

Dividend, Debt, and M&A

As part of capital allocation, Prysmian intends to consistently increase the dividend per share with an estimated CAGR of +12% over the 2024-2028 period, allocating approximately €1.1 billion for this purpose. Another priority is the reduction of net debt by approximately €1.3 billion, with the goal of achieving a net debt/EBITDA ratio between 1 and 1.5 by 2028, further improving its credit rating and financial strength. Finally, the improved financial situation will offer Prysmian greater flexibility to evaluate future Mergers & Acquisitions (M&A) opportunities.

In light of the reassuring declarations from management, who have historically and consistently exceeded expectations – just consider the brilliant early achievement of Prysmian's 2027 targets in 2024 – we can reasonably assume that the midpoint for 2028 EPS will hover around €5 per share.

Considering a current NTM P/E of approximately 13.94, a more appropriate valuation for Prysmian can confidently be projected around €69.70 per share (a potential upside of 28% from current values).

However, if we were to undertake a more in-depth valuation analysis using the DCF (Discounted Cash Flow) methodology, we could assert that...

Assuming a growth rate in line with the sector's CAGR and that Prysmian's average annual growth can be maintained at 6%, net of any expansion or contraction cycles in demand due to macroeconomic events, we have estimated that:

In the medium to long term, given the strong impetus from market demand and the increased profitability Prysmian has demonstrated, leading to growing cash flows, we have hypothesized an average target value of approximately €78.00 per share.

However, considering that Central Banks will still need to reduce interest rates to stimulate capital-intensive activities, a sector where Prysmian is a leader, we expect a decisive recovery in the stock price. This forecast is based on the previously listed growth factors and a likely more accommodative stance in monetary policies.

The previous target price, according to management data, was around €69.70 per share, while our DCF (Discounted Cash Flow) model indicates a value of €78.00 per share.

Our average target price is positioned around €73.00 per share, which is (almost) the price reached at its historical highs in January 2025.

TECHNICAL ANALYSIS

Graphically, Prysmian is still feeling the effects of the sharp market decline caused by the repercussions in America following Trump's "liberation day."

Even though Prysmian is well-positioned, should Trump threaten other countries with increased tariffs again (as happened in 2018 when trade tensions reignited), markets could experience further downturns due to increased volatility.

Currently, after the meeting between the USA and China in Switzerland last weekend, it seems a de-escalation process has begun: the USA has reduced tariff percentages from 145% to 30%, while China has reduced theirs from 125% to 10%. The situation currently appears quite calm.

In any case, we believe that Prysmian, even with a tariff increase of a few percentage points, remains in a solid position, given that a significant portion of its revenue comes from the USA.

Graphically, the stock has not yet surpassed the POC (Point of Control) zone, which could represent strong resistance. Until the price action breaks above the POC level and then tests it (as indicated by the yellow arrows), no bullish trend will begin.

Our views expressed here are current as of this report's date and may change without notice. This information isn't meant to be your primary guide for investment choices, nor should it be taken as personalized financial advice. Remember, all investments carry risk, including the potential loss of your principal, and past performance doesn't guarantee future returns. Equity Analysis, along with its team members, leaders, and staff, explicitly disclaims responsibility for any actions you take based on this content.

This analysis is very impressive, well done to the author!