The Illusion of Solidity: An Analysis and Perspective on the Colossus Called PepsiCo

The Evolution of a Giant's Business Model

Every time you pop open a can of Pepsi or tear into a bag of Doritos, you're taking part in a nearly $100 billion financial operation. We've always thought of this flavour empire as unshakeable, but what happens when even a titan like PepsiCo has to contend with a rapidly changing landscape? Will its legendary resilience be enough to withstand the pressure?

Join us on a journey that starts in the 19th century and explores the strategies and key figures that make PepsiCo a pillar of the global food and beverage industry. Our goal is to provide a complete picture, balancing the uncertainties of the present with the undeniable strength of its business model.

In this article you will find:

The History of Pepsi: From a Visionary Pharmacist's Shop to a Global Flavour Empire

Company Profile and Business Model: The PepsiCo Secret Formula

1) The History of Pepsi: From a Visionary Pharmacist to a Global Flavour Empire

In the world of investing, success stories that stand the test of time are rare. But one of them began in an unexpected place: a pharmacy in North Carolina. It was 1893 when a pharmacist named Caleb Bradham created a sugary, fizzy drink he called "Brad's Drink." His goal wasn't just to sell a refreshing beverage but also to offer a remedy for indigestion. By combining cola syrup, vanilla, spices, and pepsin (a digestive enzyme), Bradham gave life to a formula that, five years later, he renamed with a name destined to make history: Pepsi-Cola.

The story of Pepsi is an epic of ascent, failure, and rebirth. After facing no fewer than three financial bankruptcies, the company found its salvation in 1931 thanks to Charles Guth, the president of Loft, Inc., a confectionery chain. Guth acquired Pepsi and relaunched it with an ingenious and aggressive move that would mark the beginning of the legendary "Cola Wars." The slogan, "Twice as much for a nickel," was a hymn to affordability that spoke directly to consumers exhausted by the Great Depression: it sold a 12-ounce bottle for the same price as a 6-ounce bottle from its rival, Coca-Cola. It was a direct hit to the heart of its main competitor, kicking off a rivalry that would define the history of marketing.

The Era of the "Cola Wars": Aggressive Marketing that Made a Difference

The war between Pepsi and Coca-Cola intensified in the 1970s and 80s, evolving from a price battle into one of perception and brand identity. While Coca-Cola positioned itself as a timeless brand tied to tradition, Pepsi presented itself as the "choice of a new generation," a dynamic and daring brand.

The turning point was the famous "Pepsi Challenge." In a series of blind taste tests conducted in shopping centres, consumers were asked to taste both beverages and choose their favourite. The results often favoured Pepsi. The company broadcast these tests in national television commercials, a bold move that undermined the belief that Coca-Cola had the superior taste. Pepsi hired the hottest celebrities of the time, from Michael Jackson to Michael J. Fox, to make the brand appear young and modern, solidifying its position as a leader in pop culture.

The Acquisition That Changed the Game: The Birth of PepsiCo

The true stroke of genius, which transformed Pepsi from a simple drinks company into a global powerhouse, was diversification. Starting in the 1960s, the company embarked on a series of strategic acquisitions that led it to dominate not just the beverage market, but also the snack market.

The cornerstone of this transformation was the 1965 acquisition of Frito-Lay. This merger wasn't just a simple portfolio expansion; it was a visionary move that created unprecedented synergy: Frito-Lay's savoury snacks (Lay's, Doritos, and Cheetos) were the perfect complement to Pepsi's beverages. This partnership not only doubled the company's size but also laid the foundation for a resilient business model, capable of capitalising on both hunger and thirst simultaneously. It was with this merger that the company changed its name to PepsiCo Inc., a name that reflected its new, combined identity.

From Restaurants to a Healthier Portfolio

The acquisition of Frito-Lay was just the beginning. In the following years, PepsiCo continued to expand its empire with a series of targeted moves that demonstrated its long-term vision and its ability to adapt to new consumer trends.

The Foray into Restaurants: In the 1970s and '80s, PepsiCo acquired successful restaurant chains like Pizza Hut, Taco Bell, and KFC. This strategy, although the chains were later spun off into Yum! Brands, allowed PepsiCo to secure massive distribution for its beverages in millions of sales points—an area that Coca-Cola had always dominated.

Strengthening the Health Portfolio: With the growing interest in wellness, PepsiCo acquired Quaker Oats in 2001 for $13.4 billion. This acquisition not only brought in a historic cereal and oats brand (Quaker), but, most importantly, the sports drink Gatorade, the undisputed leader in its sector. This move allowed PepsiCo to dominate both the sugary drinks market and the market for functional and healthy beverages.

Recent Acquisitions: Focus on Innovation and Niche Markets

In recent years, PepsiCo's acquisition strategy has pivoted towards innovation and niche markets, demonstrating its agility in capturing emerging consumer preferences.

SodaStream (2018): This acquisition strategically positioned PepsiCo in the growing do-it-yourself beverage market, which caters to the modern consumer's needs for convenience and sustainability.

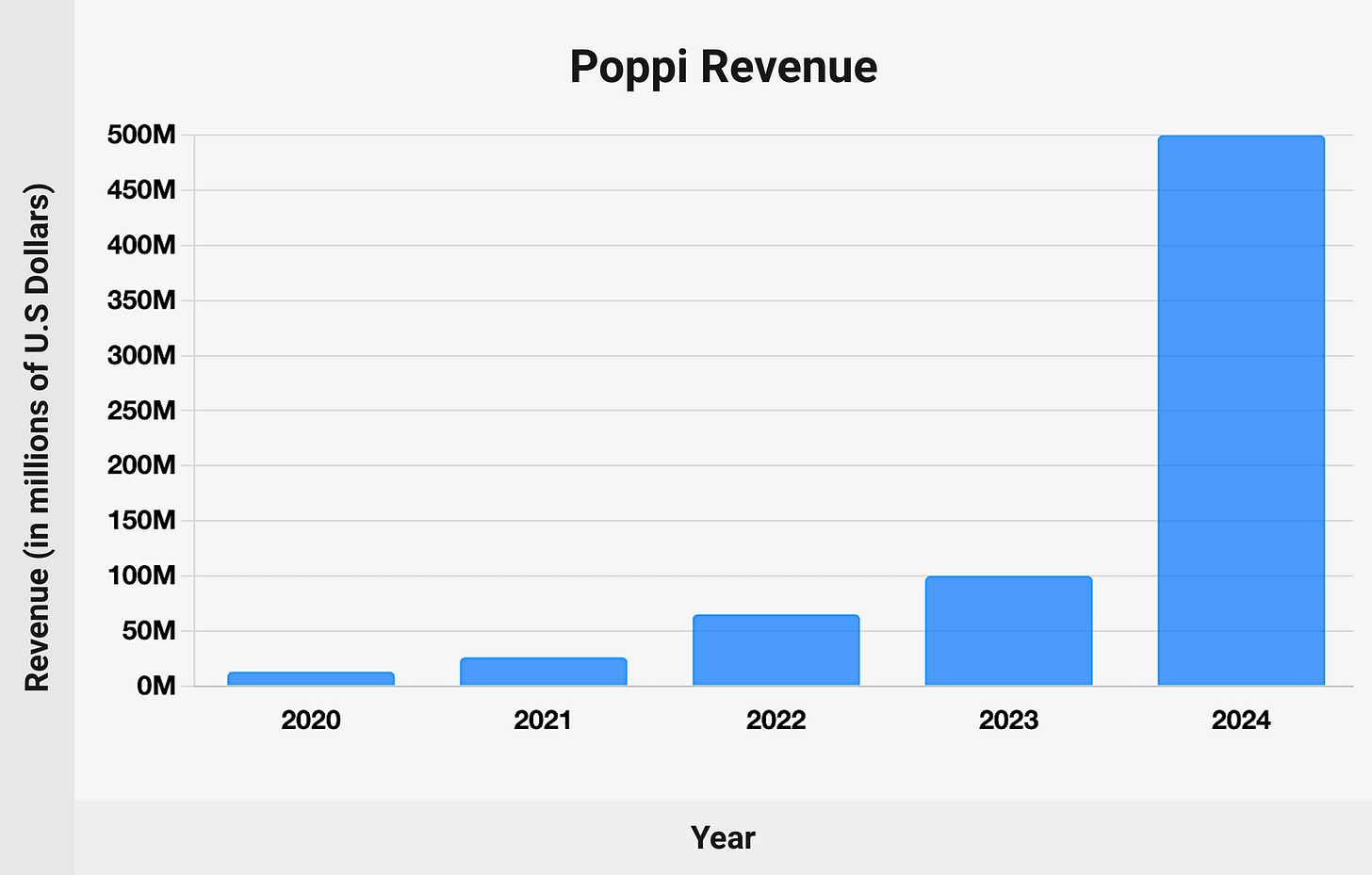

Growth in Niche Markets: More recently, PepsiCo has acquired a minority interest in emerging brands like Poppi, the popular prebiotic soda, and CELSIUS Holdings, a fast-growing energy drink. While not full acquisitions, these strategic moves indicate that PepsiCo is investing in innovative brands with a strong appeal to a younger audience, leveraging its vast distribution network to help them grow.

Today, the name "PepsiCo" evokes much more than just a soft drink. It represents a diverse portfolio of over 22 brands (as of 2025) that each generate more than $1 billion in retail sales. This includes well-known names like Lay's, Cheetos, Doritos, and Gatorade, as well as joint ventures like Lipton (a 50/50 partnership with Unilever for iced teas) and Starbucks (for ready-to-drink beverages distributed globally by PepsiCo). This diversification has not only protected the company from the volatility of a single market but has also created a resilient and continuously evolving business model, which we will analyse in detail in the next chapters.

2) Company Profile and Business Model: The PepsiCo Secret Formula

If the first chapter revealed how a pharmacist’s intuition gave birth to an empire, this section delves into the heart of the system that makes this empire so robust and profitable. Unlike a single-product company, PepsiCo's business model is a complex and expertly diversified machine. It navigates market turbulence better than many competitors, turning the dichotomy between snacks and beverages into its main competitive advantage. It’s a model that doesn’t just sell products; it creates experiences, strengthens iconic brands, and anticipates consumer trends.

Corporate Structure and Operating Divisions

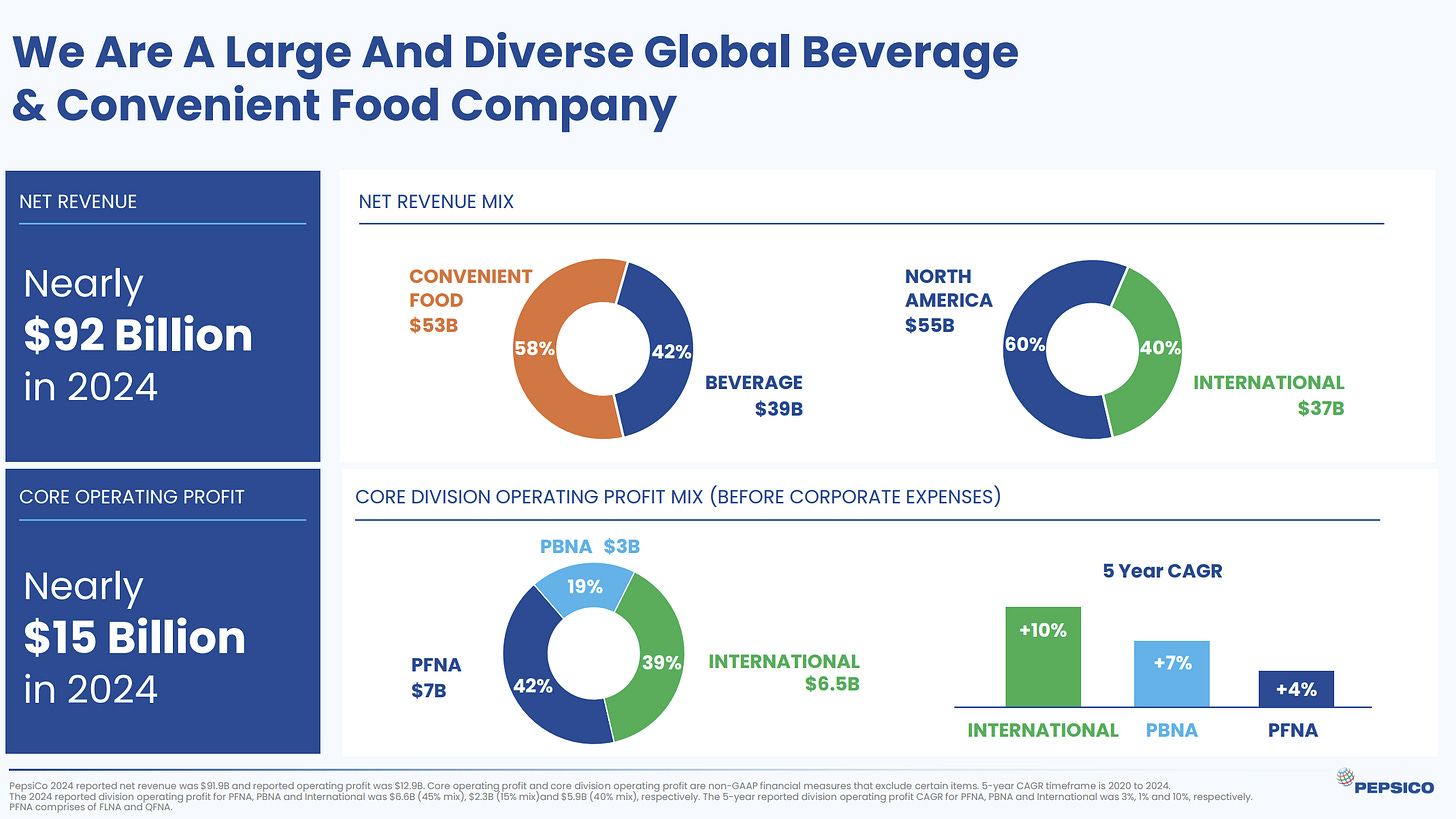

PepsiCo's strength lies in its organisational structure, which combines a centralised administration with decentralised operational management capable of adapting to the specifics of each local market. The company operates through seven main divisions, which represent its global growth engines. The three North American divisions (FLNA, PBNA, QFNA) are the business's heartbeat, generating roughly 60% of total revenue.

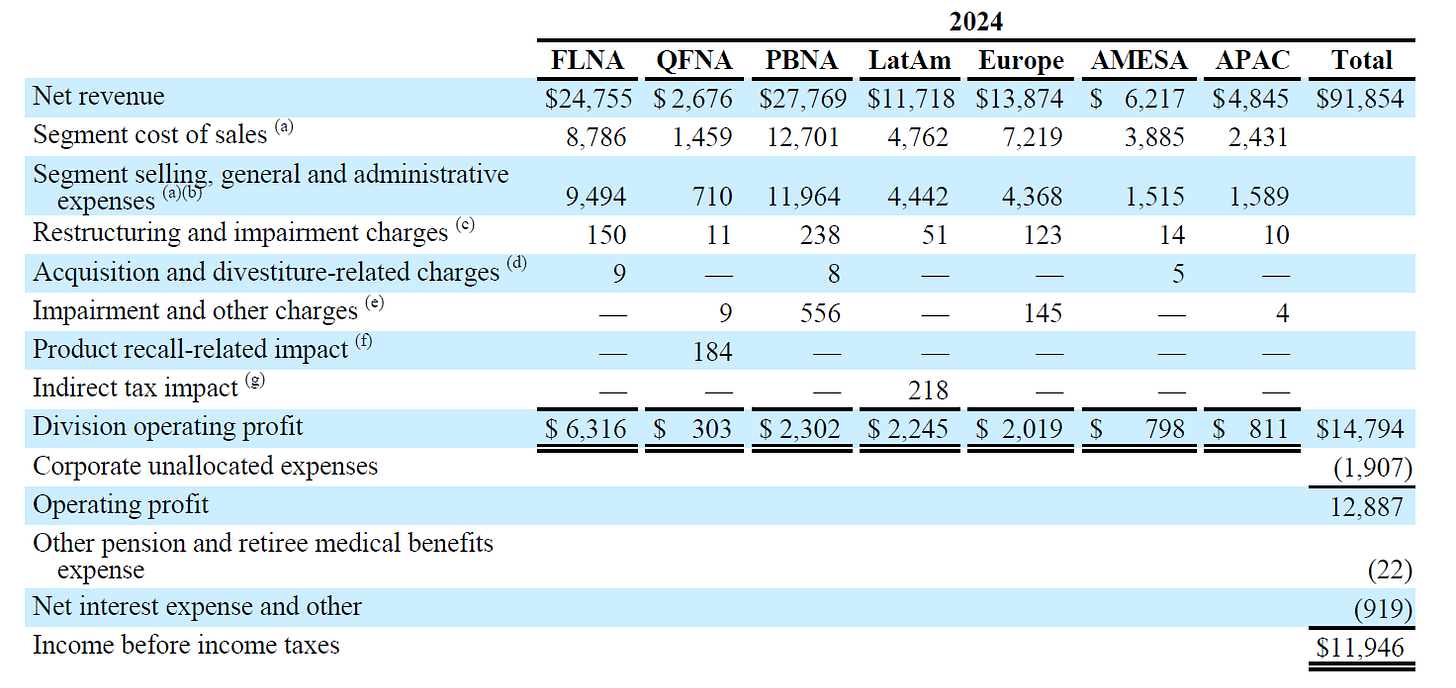

Frito-Lay North America (FLNA): The undisputed profit engine. This division manages the entire portfolio of savoury snacks in the United States and Canada, with iconic brands like Lay's, Doritos, Cheetos, Tostitos, and Ruffles. FLNA operates with a direct-store-delivery (DSD) model, which ensures total control over the value chain, from production to the shelf. In 2024, this division accounted for about 27% of total revenue but contributed disproportionately to operating profits, generating a remarkable 42% of divisional operating profit.

The direct-store-delivery (DSD) model is not just a logistical advantage; it's a true competitive pillar. Thousands of delivery vans visit sales points daily, ensuring fresh products, fully stocked shelves, and maximum brand visibility. This level of direct control is rare in the industry and gives PepsiCo a hard-to-replicate advantage, which we will explore further in the section on PepsiCo's competitive advantages.

PepsiCo Beverages North America (PBNA): Manages the beverage business in North America, including Pepsi, Mountain Dew, Gatorade, and Aquafina. Unlike Coca-Cola, which primarily uses franchised bottlers, PepsiCo owns a significant portion of its bottling chain. In 2024, PBNA accounted for roughly 30% of total revenue. Although margins are lower than FLNA, the combination of massive volume, brand awareness, and customer loyalty makes this division a stable source of income.

Quaker Foods North America (QFNA): Specialising in cereals, rice, pasta, and healthy snacks (brands: Quaker Oats, Cap'n Crunch, Life), QFNA contributes only 3% of total revenue but is strategic for diversifying the portfolio and aligning with health-conscious trends. In 2024, a product recall caused a 38% drop in operating profit, highlighting how even the smallest divisions can have significant impacts on results.

The remaining divisions cover international markets: Latin America (~13%), Europe (~15%), APAC (~5%), and AMESA (~7%). These divisions represent long-term growth opportunities, but margins can be more volatile due to currency fluctuations, local competitive dynamics, and macroeconomic factors like tariffs or food regulations.

Revenue Streams and Product Portfolio: Diversification as a Cornerstone

The defining feature of the PepsiCo model is its near-perfect diversification between snacks and beverages. In 2024, the revenue mix was 58% from "convenient foods" and 42% from beverages. This balanced distribution has guaranteed stability even during recessions when consumers tend to favour snacks and small treats.

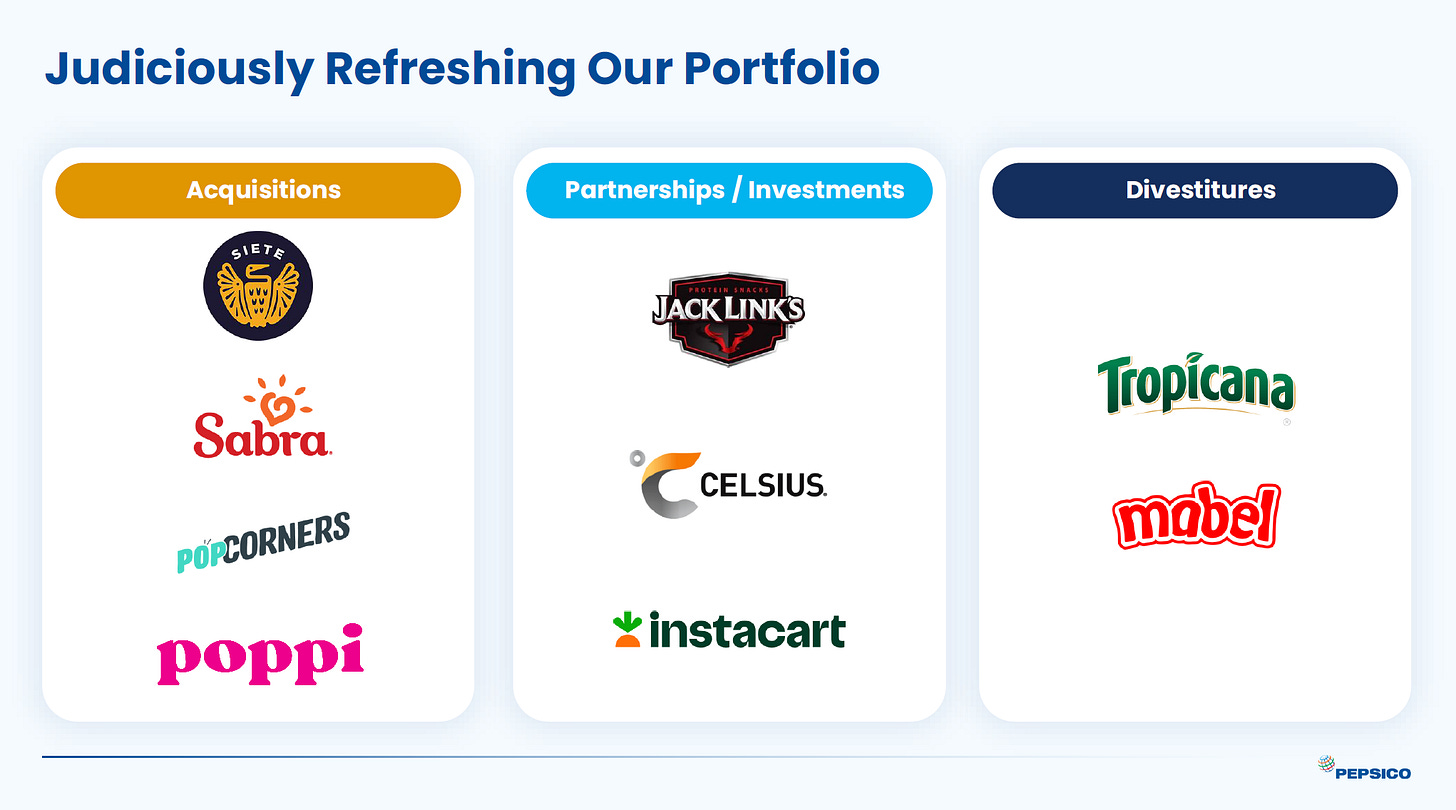

The portfolio of iconic brands includes 22 brands (as of 2025), and its scope is constantly evolving thanks to targeted divestitures, partnerships, and acquisitions:

Asset Divestiture: In 2021, the Tropicana and Naked juice brands were sold to a joint venture with PAI Partners, while PepsiCo retained a 39% stake. This move allowed the company to exit a low-growth segment and focus on more profitable areas.

Partnerships and Distribution Agreements: As mentioned in the first chapter, PepsiCo has formed several key partnerships. It manages ready-to-drink Lipton iced tea through a joint venture with Unilever and has a solid partnership with Starbucks for ready-to-drink beverages. It has also acquired stakes and distribution rights with emerging brands like CELSIUS Holdings, in which it has held a minority stake since 2024, extending the agreement to include distribution in Canada.

Niche Acquisitions: The 2025 acquisition of Poppi confirms the strategy of incorporating innovative, emerging brands. Monetisation is focused on premiumisation, multi-packs, and "Better for You" products, such as plant-based snacks and low-sugar beverages, to capture consumers willing to pay more for ingredients perceived as healthier.

Value Chain and Competitive Advantages

PepsiCo's value chain is an example of operational excellence and integrated management. A central element is its Direct-Store-Delivery (DSD) model, a distribution approach where products are delivered straight from PepsiCo vehicles to retail locations, bypassing intermediate warehouses. This method guarantees product freshness, fully stocked shelves, and constant brand visibility.

The DSD system also enables the company to:

Respond quickly to changes in local demand, adjusting deliveries based on sales peaks or promotions.

Tailor product assortments to the specific preferences of consumers in each individual store.

Achieve superior control over the value chain, reducing waste and inefficiencies while enhancing the customer's perceived quality.

The integration between the snack and beverage divisions allows for logistical synergies, optimising store replenishment and maximising brand visibility. This level of control and flexibility is difficult for competitors to replicate when they rely on traditional distribution systems that use central warehouses.

Distribution Channels: PepsiCo covers all major channels, from traditional retail to the rapidly growing e-commerce sector and the HORECA channel (Hotels, Restaurants, Cafés). Strategic partnerships with fast-food chains and cinemas strengthen brand presence in high-visibility contexts and provide integrated experiences for consumers.

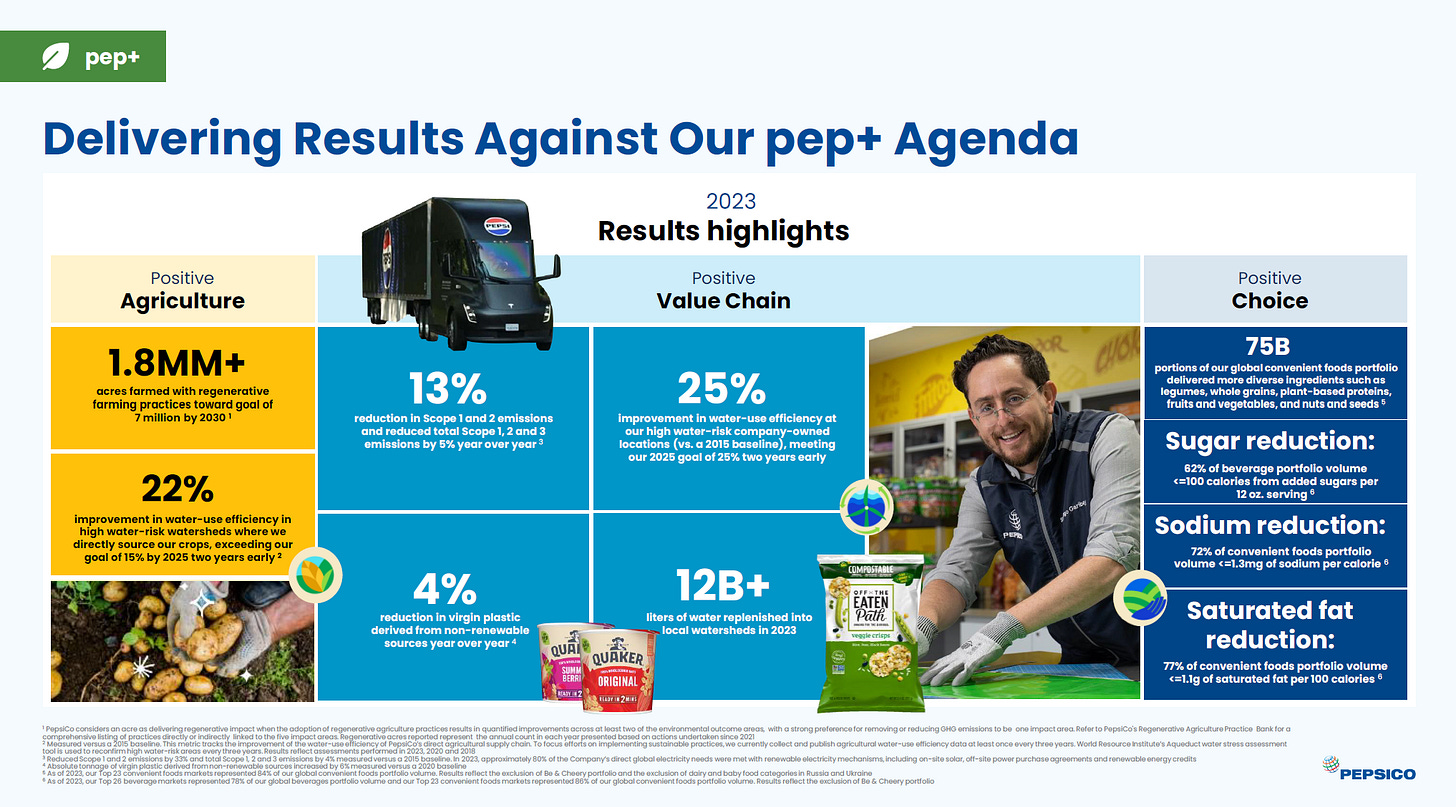

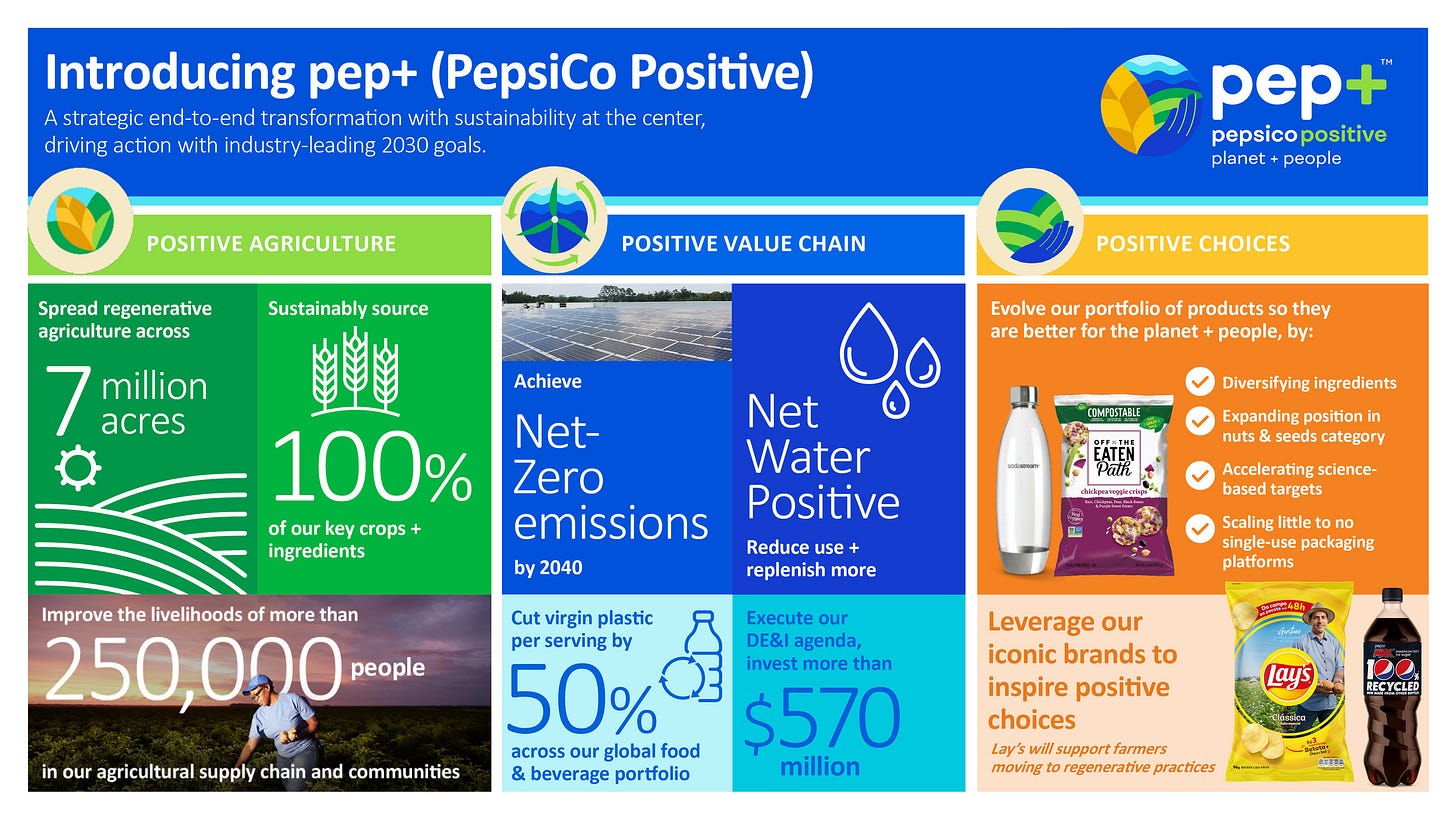

Operational Efficiency and Sustainability: To mitigate risks related to raw materials, packaging, currency fluctuations, recalls, and macro factors (like tariffs and regulations), PepsiCo focuses on operational excellence. The pep+ (PepsiCo Positive) programme is an integrated operational strategy that:

Optimises water usage and reduces energy consumption in production processes.

Increases the use of recyclable packaging and reduces virgin plastic.

Promotes regenerative farming practices to lower environmental impact and improve supply resilience.

Develops "Better for You" products, reducing sugars and fats to align with consumer health and wellness trends.

These initiatives not only improve sustainability but also help reduce operational costs, increase supply chain efficiency, and strengthen the company's resilience against price fluctuations and regulatory changes.

The ability of PepsiCo to pass on cost increases to consumers, a strategy known as pricing power, demonstrates the strength of its brands. In 2024, organic revenue growth was 2%, with price increases successfully offsetting volume declines in some areas.

By combining the DSD model, inter-divisional integration, diversified channels, and sustainability strategies, PepsiCo builds a competitive fortress that goes far beyond a single product. It creates an integrated, diversified business model, ready to withstand market challenges and seize future growth opportunities.

3) Financial Analysis: PepsiCo's Performance and Stability

An analysis of PepsiCo's financial data reveals a solid company capable of generating consistent revenue and stable margins, with capital management that supports sustainable growth and shareholder returns.

Revenue and Growth: Business Resilience

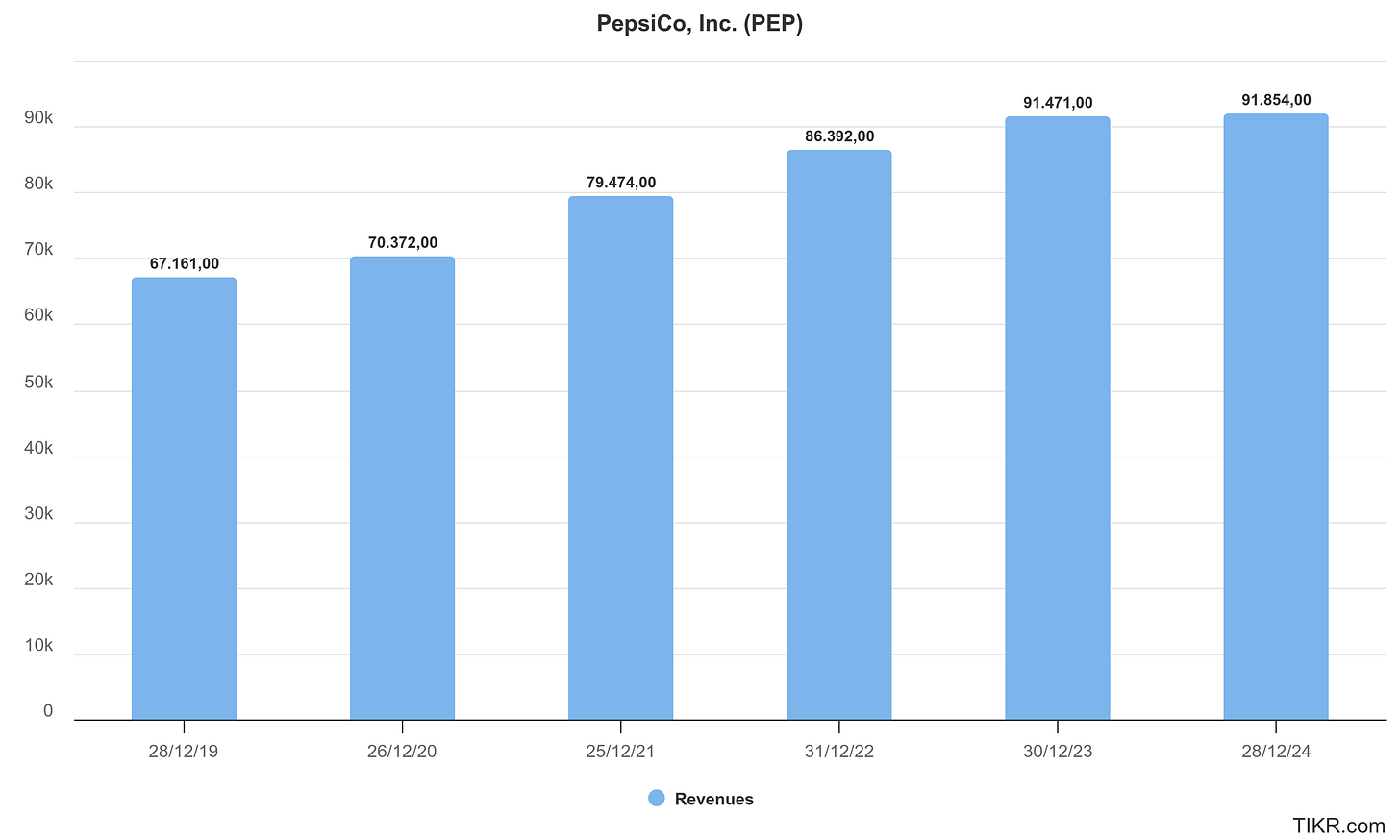

In 2024, PepsiCo reported revenue of $91.9 billion, an increase from $91.5 billion in 2023. This steady, albeit moderate, growth confirms the resilience of its business model and the effectiveness of its diversification strategies across snacks and beverages. The company's ability to maintain a positive revenue trajectory, particularly amid inflationary pressures and regulations, is a sign of strength that is difficult to find in other sectors.

EBITDA Margin

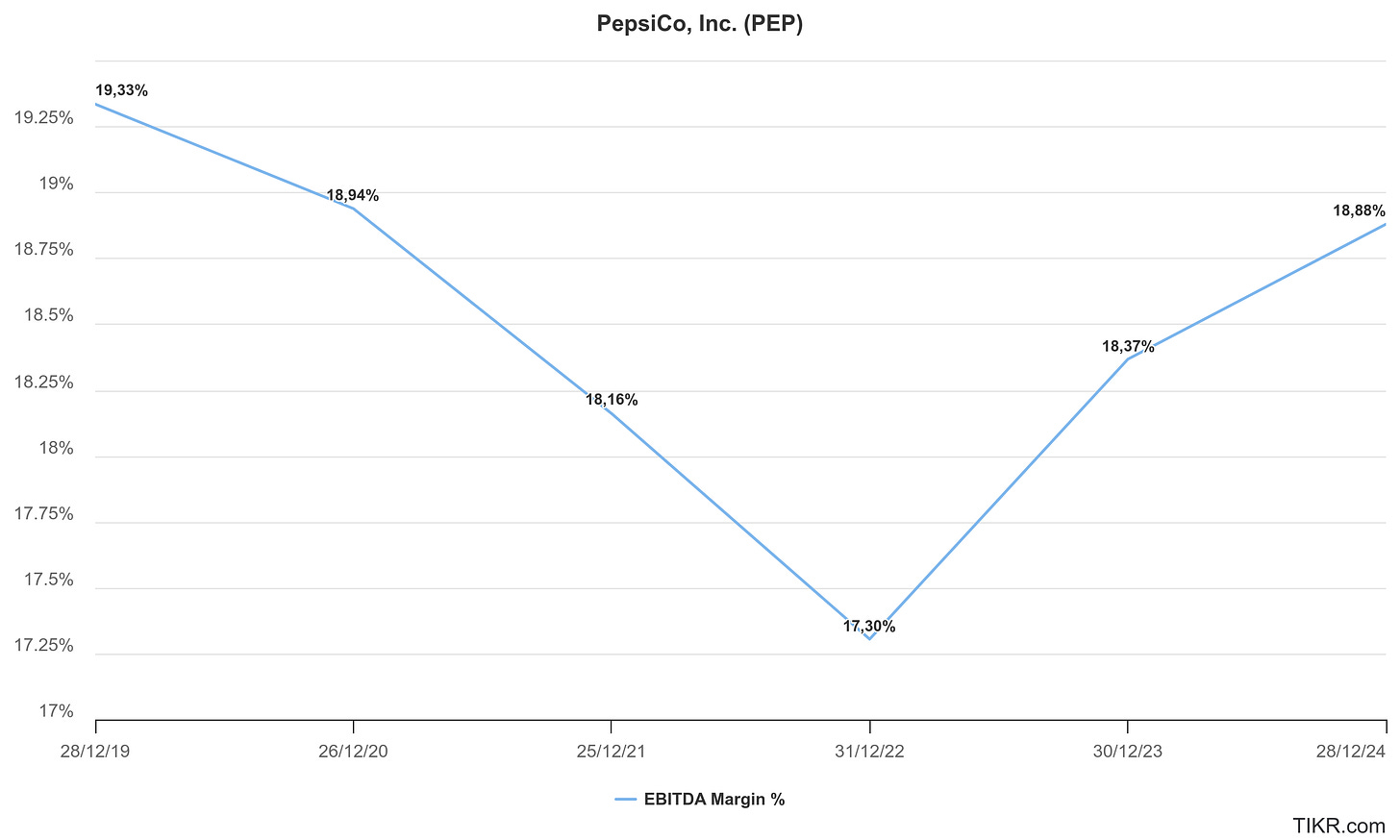

PepsiCo's EBITDA margin has shown consistent improvement, rising from 17.3% in 2022 to 18.9% in 2024. This trend reflects the strength of PepsiCo's brands, which gives it the ability to pass price increases on to consumers (known as pricing power) without significantly impacting sales volumes. However, it's crucial to note that these margins haven't yet reached pre-pandemic levels (19%–20%), indicating there's still a path to achieving maximum operational efficiency.

Efficiency Indicators (ROA and ICR)

The average ROA (Return on Assets), which measures how efficiently a company generates profit from its assets, remains high and stable between 16.6% and 16.9%. Similarly, the Interest Coverage Ratio (ICR), which measures the company's ability to cover its financial obligations, is solidly high at 19.2x to 19.8x. These figures confirm efficient and prudent management that maximises profitability without taking on excessive risk.

Capital Structure and Cash Flow: The Strength to Innovate

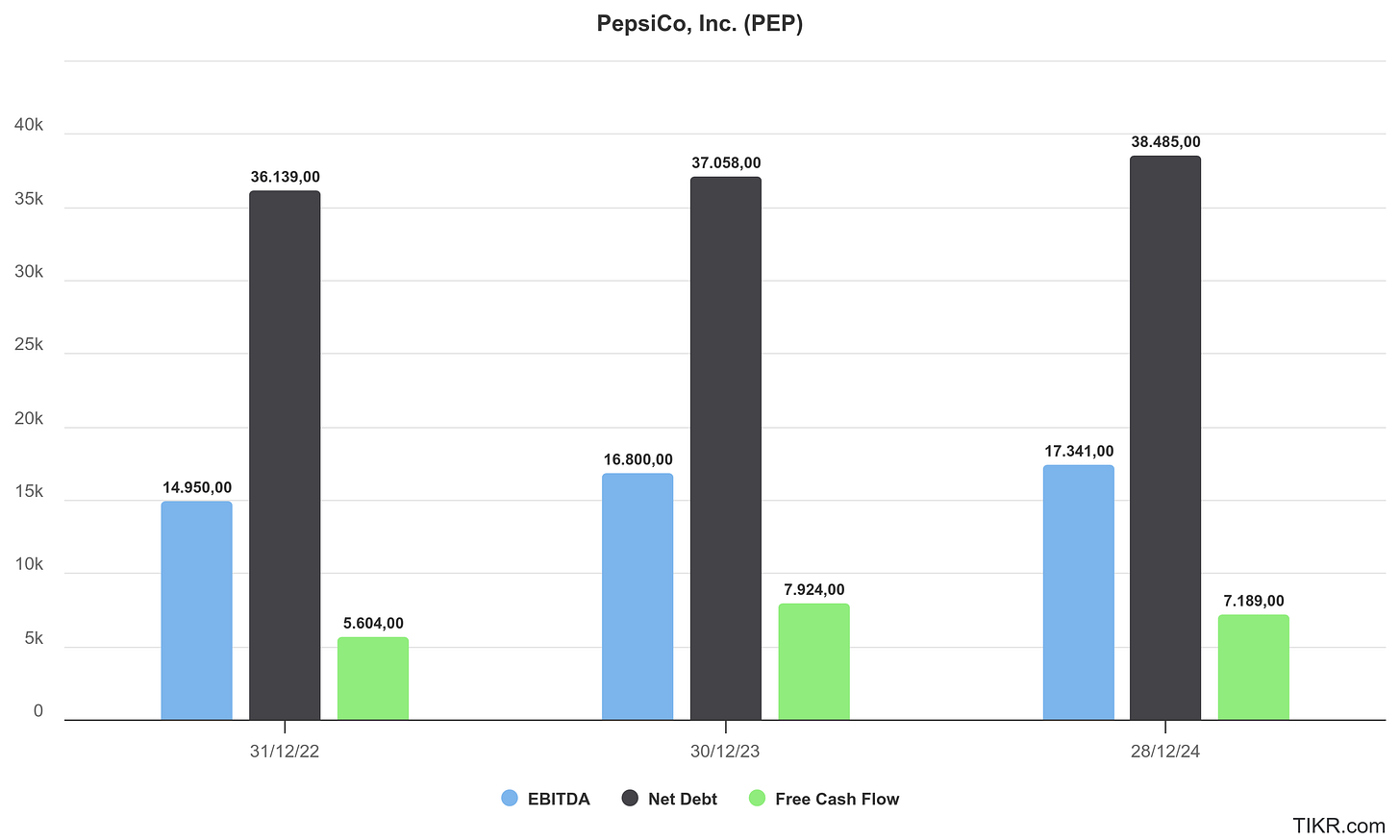

PepsiCo’s financial structure appears solid and well-balanced. With stable leverage in the 2.2x–2.4x range, the company maintains moderate debt, which mitigates financial risk while still supporting growth. As of 2024, net debt stood at approximately $38.5 billion, while EBITDA remained robust at over $18 billion—a combination that confirms the group's ability to manage its financial commitments prudently.

Free Cash Flow reached $7.2 billion in 2024, consistent with previous years ($5.6 billion in 2022 and $7.9 billion in 2023), highlighting a constant and resilient generation of cash even in complex market environments. When comparing net debt to FCF, a theoretical repayment period of approximately 5 years emerges, a level that is particularly competitive within the food and beverage sector and a sign of strong self-financing capacity.

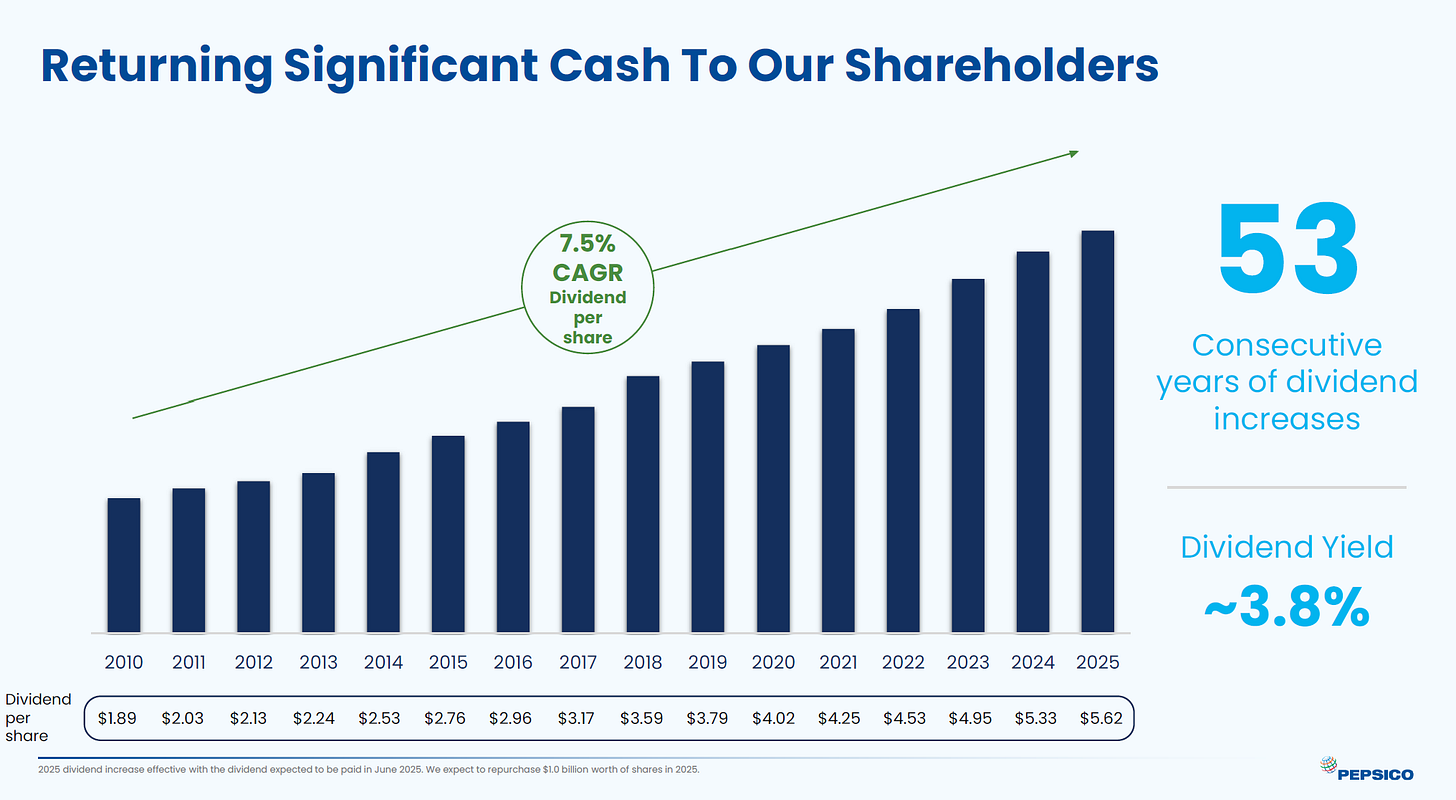

This financial solidity is not an end in itself but represents the lifeblood that fuels innovation and value creation. PepsiCo uses its cash flow to finance strategic transformation programmes like pep+, support the development of new products, and, at the same time, ensure a constant and growing return for shareholders through dividends and share buybacks. The balance between prudence and return on capital makes PepsiCo’s financial policy a key strength for the stock's appeal to long-term investors.

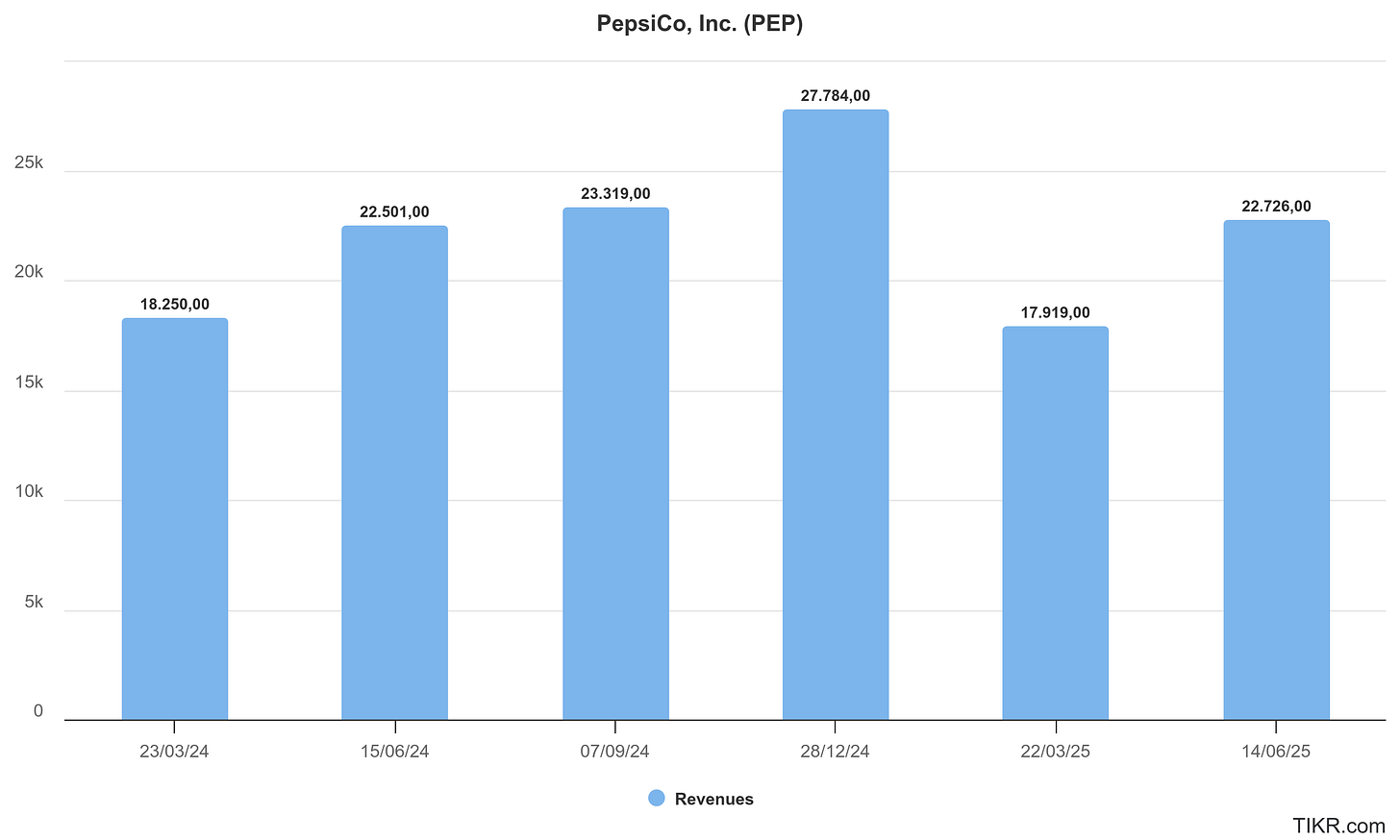

2025 Financial Update: Setbacks and Signs of Recovery

Despite the stability shown in its year-end 2024 financials, the first quarter of 2025 marked a setback that raised market concerns. The company recorded its first earnings miss in years and cut its full-year growth forecast. First-quarter net revenue fell 1.8% year-on-year to $17.9 billion, while net income dropped 10% to $1.83 billion. Adjusted earnings per share (EPS) were $1.48, just below analysts' expectations of $1.51. Consequently, the company revised its full-year 2025 growth forecast downwards, which is now expected to be flat. This slowdown was attributed to a "weak macroeconomic framework" and new tariffs.

However, the second quarter was characterised by a recovery, with net revenue increasing by 1% year-on-year and adjusted EPS of $2.12, which beat analysts' forecasts of $2.0

Valuation and Market Sentiment

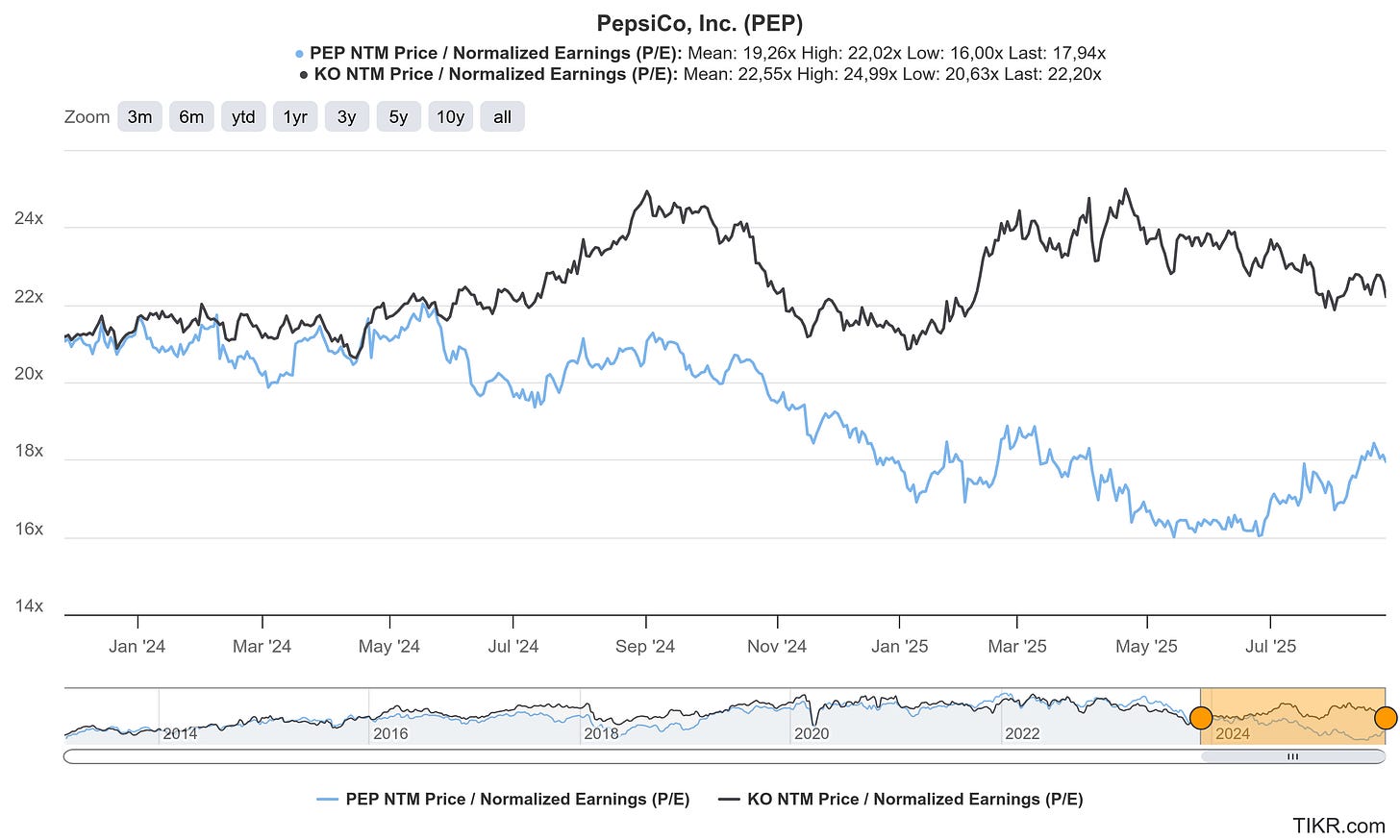

The uncertainty, especially reflected in the first quarter's data, has heavily impacted the stock's valuation. The P/E ratio, which previously stood at 20-21, plummeted to 16-17, offering a significant discount compared to its main competitor, Coca-Cola (which has a P/E of 23-24). The slightly better second-quarter results led to a partial improvement in the valuation, with the stock rebounding to a P/E ratio of 18. While this figure still reflects a substantial gap with Coca-Cola, it suggests the market has revised its growth expectations downwards rather than valuing the company based on its historical performance.

4) Market Profile: Mapping PepsiCo’s Competitive Territory

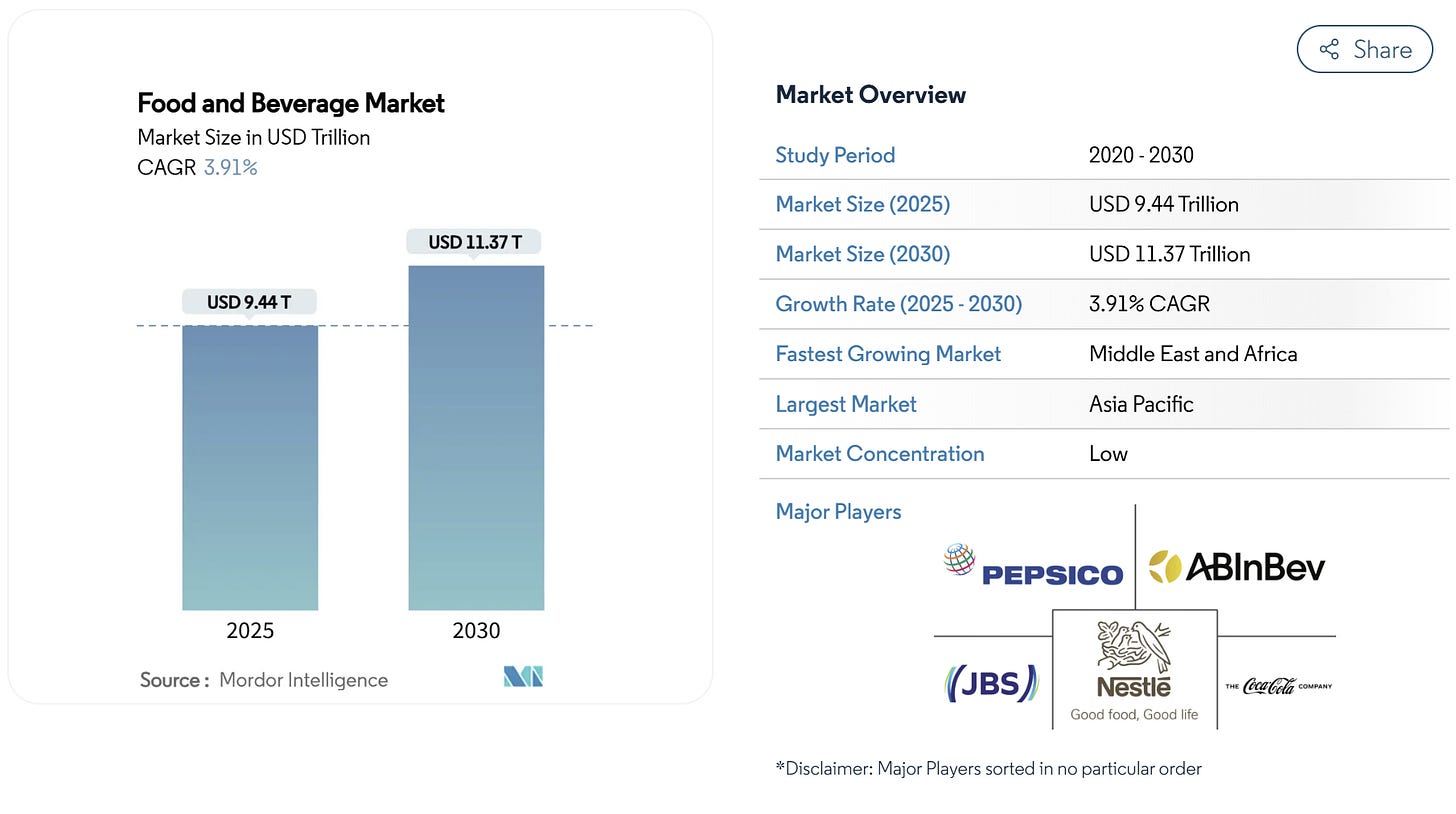

Understanding the market PepsiCo operates in means placing the company within a scenario that is never static, but one of growth, conflicting pressures, and unrelenting competition. The global food and beverage sector is one of the world's largest industries: its estimated value in 2025 is approximately $9.4 trillion, with growth projections up to over $11 trillion by 2030. We're not talking about exponential growth, but a steady CAGR of around 4%, which in a mature sector like this is still a solid pace.

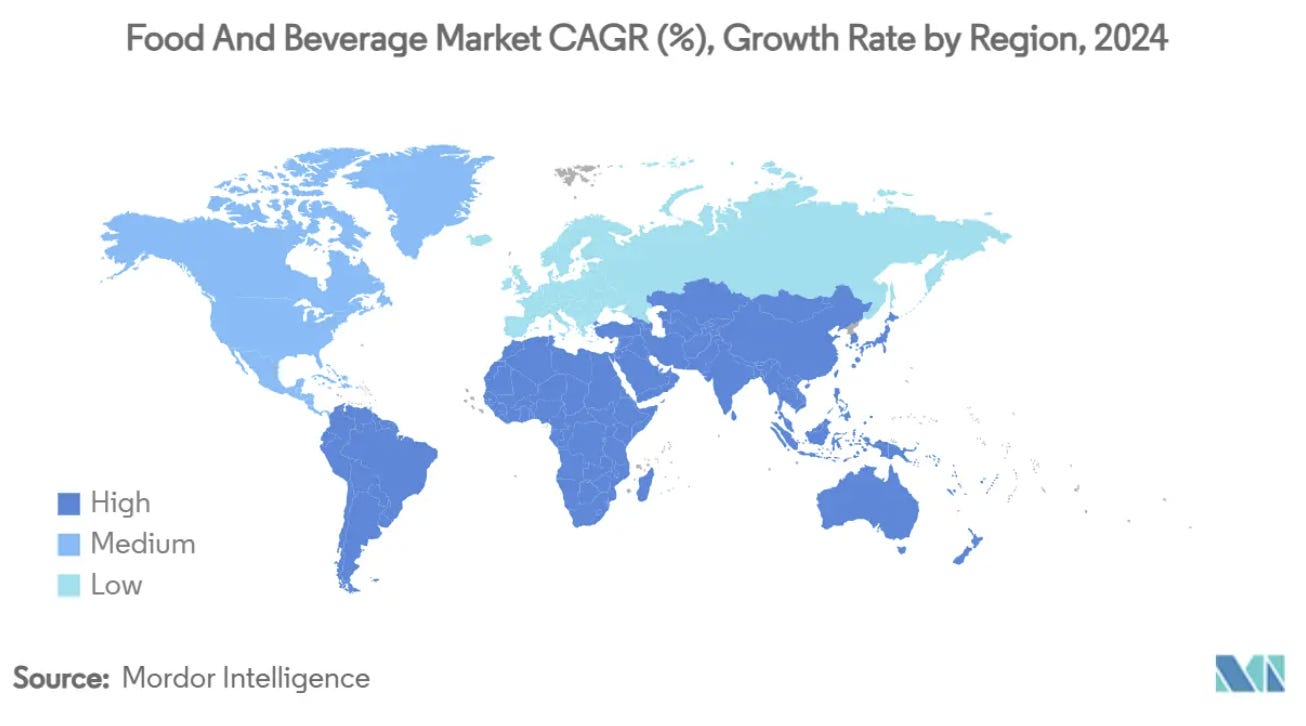

The geography of the market reveals interesting differences. Asia-Pacific is already the main engine, with a share that exceeds 40% of the total, driven by demographic growth and an expanding middle class. But the region that is most surprising for its dynamism is the Middle East and Africa, where expected growth exceeds 5% per year. North America, on the other hand, remains the "historical" market: less dynamic in terms of volume, but still the most profitable, thanks to consumers willing to pay a premium for health-conscious and premium products.

In this scenario, PepsiCo is playing a very particular game. Unlike most competitors, who operate either in the snack or beverage sector, PepsiCo dominates both. The Frito-Lay division, with an estimated share of almost 40% of the US snack market, is a cash-flow machine that provides the stability to offset the greater volatility of beverages. This is a key strategic advantage: when fizzy drinks struggle (due to declining demand or the rise of competitors like Dr Pepper, which has now surpassed Pepsi as the second most-consumed cola in the US), snacks keep revenue high.

The competitive landscape is, in fact, more complex than it seems. Coca-Cola remains the non-alcoholic beverage giant, with superior brand equity. However, PepsiCo balances this gap with its dominance in savoury snacks and strong assets like Gatorade, the undisputed leader in the sports drink market. Its joint ventures with Unilever (Lipton) and Starbucks for ready-to-drink beverages also make it a key player in the iced tea and ready-to-drink coffee segments, respectively. Other competitors like Nestlé, Mondelez, and Kellanova (formerly Kellogg's) command specific areas, but none have PepsiCo's vertical integration and diversification.

Trends Reshaping the Market and Risk Factors

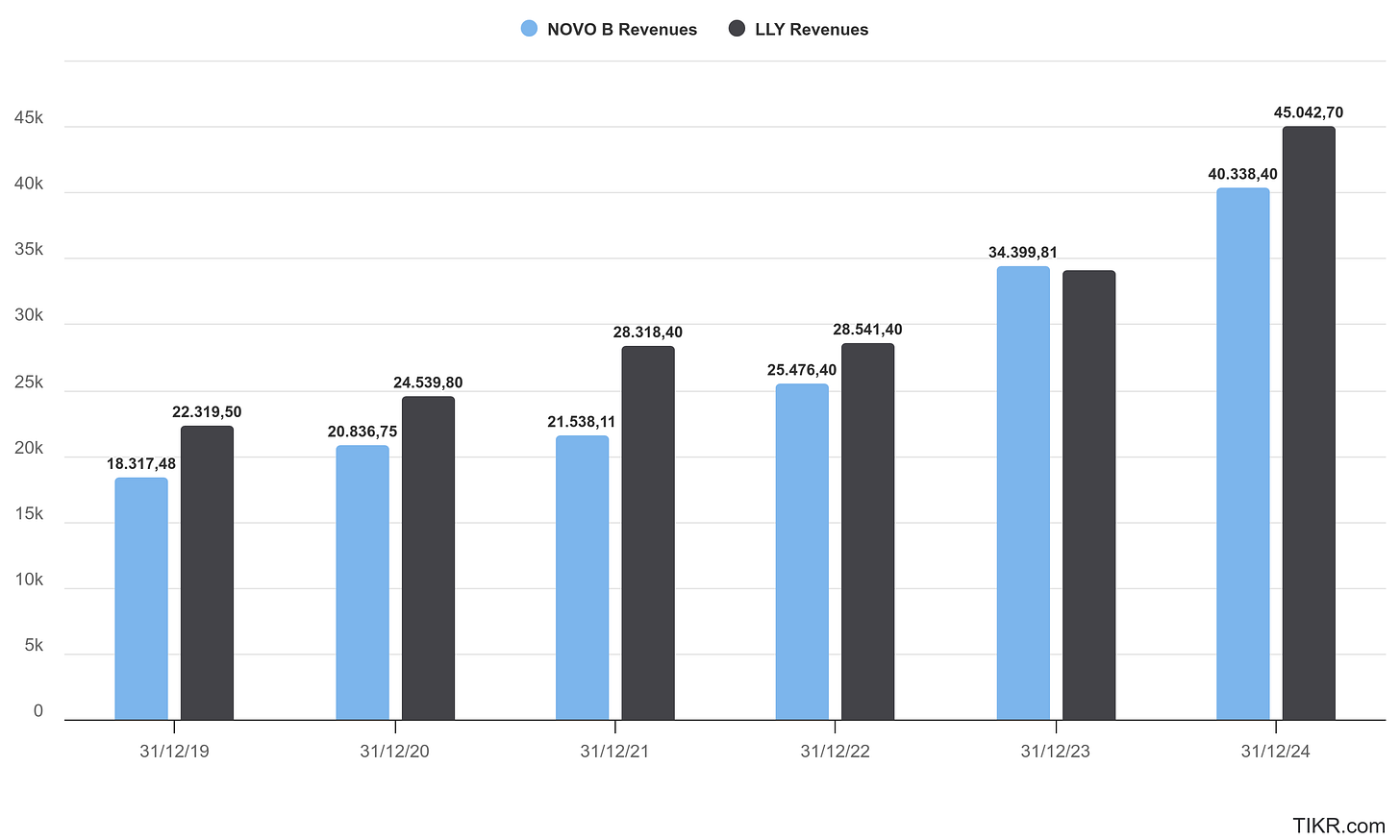

However, the ground is not free of mines. On one hand, consumer demand is rapidly shifting towards low-sugar products, protein-rich or functional snacks, and "better for you" solutions, which requires continuous innovation. One signal of this profound change in consumer habits emerges from a completely different sector: the rise of weight-loss medications from companies like Novo Nordisk and Eli Lilly. The explosive growth in sales of these drugs indicates not just a medical trend, but a clear consumer push towards a healthier lifestyle and greater weight control.

In response to these dynamics, PepsiCo is accelerating its strategic evolution through an approach that integrates innovation and sustainability. The pep+ (PepsiCo Positive) programme is the core of this transformation: a 360-degree initiative that embraces the entire value chain, from sourcing and production to the final consumer.

pep+ focuses on three key pillars:

Positive Agriculture: To reduce environmental impact and improve supply resilience.

Positive Value Chain: Which promotes sustainable packaging and production efficiency.

Positive Choices: Which translates into products that promote health and wellness.

A clear direction is confirmed by recent acquisitions. The expansion of SodaStream has positioned the company in the DIY beverage segment, which addresses modern consumers' needs for sustainability and personalisation. Similarly, the acquisition of Poppi and strategic partnerships with growing brands like CELSIUS demonstrate PepsiCo's commitment to expanding its portfolio with functional and healthier perceived beverage alternatives. This focus not only responds to new consumer tastes but also strengthens the business's long-term resilience.

On the other hand, the macroeconomic context is not helpful: inflation on raw material costs (sugar, maize, potatoes), currency fluctuations, and especially new tariffs imposed by the Trump administration in 2025 risk compressing margins and putting pressure on the global supply chain.

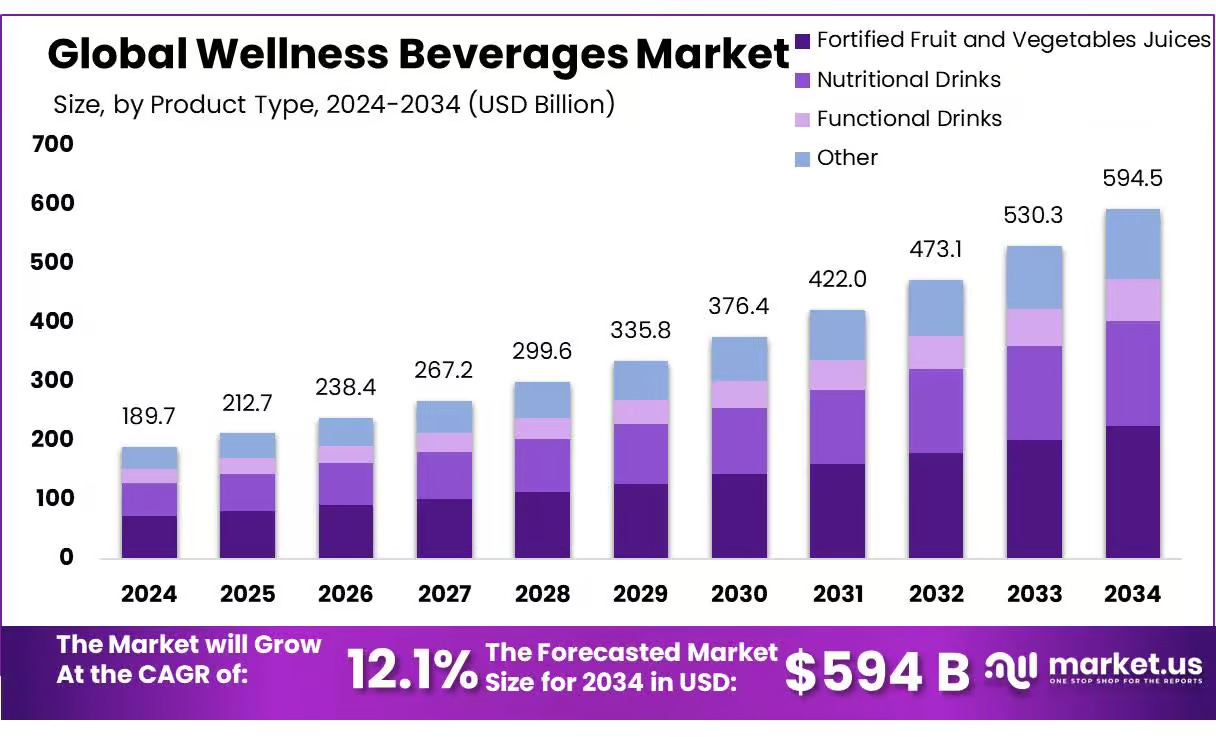

Better for You: A Double-Digit Growth Market

To fully understand PepsiCo's strategy, it's essential to analyse the context in which it operates. The functional and healthy beverage sector is undergoing extraordinary expansion. The global wellness beverage market is expected to grow at a CAGR of 12.1% between 2024 and 2034. This figure is not just a number but a clear signal that consumer demand is shifting decisively towards products that offer additional benefits beyond simple taste. In a landscape where the core business of traditional beverages is growing at a single-digit rate, this segment represents the true frontier for future growth.

How Much Do Healthy Brands Weigh? The Portfolio Strategy

One of the most relevant questions for an investor, and of great interest to the market, concerns the actual weight of healthy beverages on PepsiCo’s total business. Although the company does not provide specific data that completely isolates this segment in its financial reports, it is possible to get a clear picture by analysing the available information. It is observed that internal lines like the functional waters Lifewtr and Propel recorded combined sales of $312 million in 2023, growing 18.3% year-on-year. Plant-based products are also expanding, having generated approximately $449 million in the same year, despite representing only a small fraction of the total beverage portfolio.

In this context, the real key is not so much their current modest size but PepsiCo's strategy to acquire a leadership position in emerging, exponentially growing markets. The acquisition of brands like Poppi and the partnership with Celsius are the perfect examples of this move.

Poppi, acquired in 2025 for a precise net value of $1.65 billion, saw its annual revenue skyrocket past $500 million, growing at an impressive rate of +163% year-on-year. A crucial detail for the investor is the multiple that PepsiCo paid for this brand: a significant 3x its sales, an unequivocal sign of the strategic value the company places on its position in the emerging market for functional beverages.

Still more significant is the story of Celsius, in which PepsiCo holds an 8.5% stake. It's important to note that PepsiCo does not consolidate Celsius's revenue on its balance sheet but benefits indirectly from its growth through distribution and its shareholding. In Q2 2025, the brand recorded revenue of $739 million (+84% year-on-year), with rapidly expanding operating margins, and now accounts for about 20% of the value growth of the entire US energy drink market.

If we combine the available estimates, we can get an idea of the segment's total weight on the business. Considering that the beverage business is worth roughly $41 billion (45% of PepsiCo's total revenue in 2024) and adding the estimated sales of brands like Poppi ($0.5 billion), the total "healthy beverages" segment amounts to approximately $1.2–1.5 billion. Ultimately, the "better-for-you" brands currently represent a numerically limited part of PepsiCo's revenue. However, their growth potential is notable, and their value lies in the strategic positioning they offer the company. While the core business is growing at a single-digit rate, these brands—although representing only 3-4% of total revenue—are in some cases growing at triple-digit rates. By acquiring these brands, PepsiCo not only enters high-growth segments but also leverages its vast distribution network to make them explode onto the market. If the consumer trend towards healthier products continues, it's reasonable to expect the weight of this line on overall revenue to become much more significant in the next 3–5 years, further strengthening the company's resilience and competitiveness.

The Impact of 2025 Tariffs and the Competitive Comparison

The tariff measures introduced by the Trump administration in 2025 have particularly affected intra-Atlantic flows of food and beverages, creating significant pressure on PepsiCo's production costs. A relevant portion of its beverage concentrates is produced in Ireland and imported into the US; the new tariffs increase the unit cost of every bottle or can sold in the American market, compressing margins that are already under pressure from raw material inflation. Additionally, tariffs on aluminium directly impact the cost of cans, a crucial element for the beverage business, especially for low-margin formats. Certain categories of agricultural ingredients are also affected by the tariffs, making supply chain management and cost planning more complex.

In comparison, key competitors show different exposure: Coca-Cola, for example, produces most of its beverages for the US market directly in local plants, drastically reducing the impact of tariffs. Similarly, Nestlé and Mondelez, while also active in similar segments like snacks and packaged goods, can rely on a diversified global supply chain that allows them to quickly shift suppliers or production plants to countries not subject to tariffs. This difference creates a temporary competitive advantage for PepsiCo’s rivals, which management will have to address with targeted strategies.

Strategies for Responding to Tariffs

PepsiCo has already begun to outline countermeasures. First, the company is considering increasing domestic production to reduce its dependence on Ireland, although this requires substantial investment and time. In parallel, management has indicated it will continue to leverage its pricing power: gradual increases in consumer prices, supported by the strength of its brands, to absorb at least part of the impact of the tariffs. On the strategic front, PepsiCo is accelerating its supply chain localisation projects and plans to push for product innovation: more premium and value-added formats (e.g., functional beverages, protein snacks) that allow for higher margins.

Opportunities and Risks in a Strained Balance

The key point for investors is that PepsiCo, more than others, can manage this volatility thanks to its integrated resilience: the combination of snacks and beverages, brand strength, and geographic diversification. However, trade and regulatory tensions add a variable risk that was marginal just a few years ago. The market profile, therefore, gives us the image of a giant that isn't resting on its laurels: PepsiCo holds a privileged position in a sector that is growing slowly but with resilience. However, it will have to continue to move on two fronts simultaneously: defending its share in traditional beverages, which is increasingly being eroded by competitors and new consumer trends, and riding the global expansion of snacks and healthier products. It is a balancing act, and investors must ask themselves whether the company can maintain this equilibrium in a rapidly changing economic and regulatory environment.

5) Final Conclusions and Stock Perspectives

An analysis of PepsiCo reveals an intriguing duality: on one hand, a company with enviable assets and brands; on the other, a giant navigating a turbulent phase, as evidenced by negative market sentiment and a financial performance below expectations.

Three Years of Underperformance and New Challenges

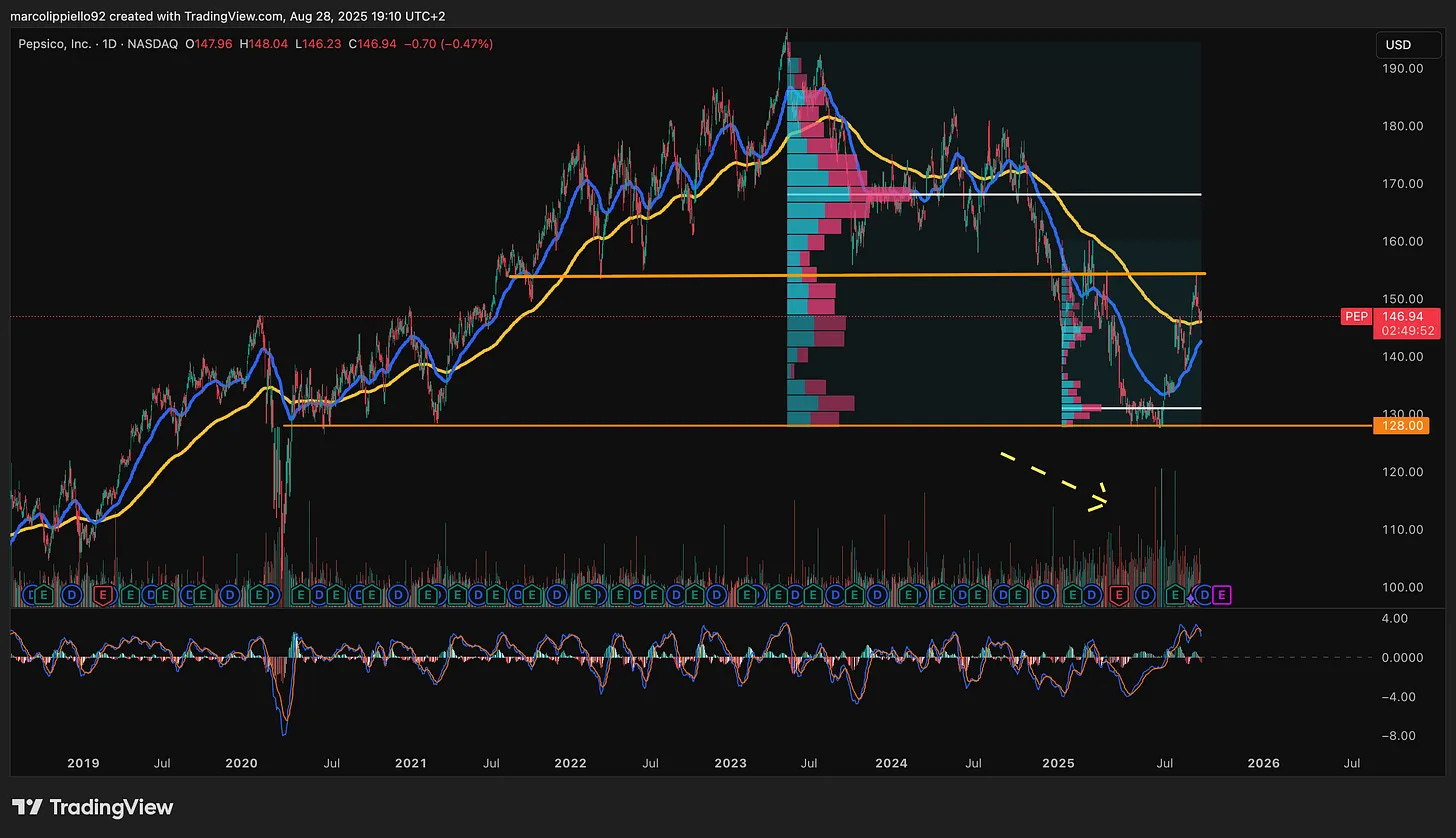

As recent data shows, PepsiCo has, for the time being, missed the guidance communicated by management in 2023 and 2024, which indicated a mid-to-long-term revenue increase of between 4% and 6%. The reality has been far more restrained: 2024 closed with an increase of just +0.4% compared to 2023, while initial 2025 projections suggest modest growth of between 1% and 1.5%. This gap between expectations and results has contributed to negative investor sentiment, fuelled by the fact that the company repeatedly fell short of analyst estimates in the 2022–2024 period. The market has reacted decisively: from a record high of $195 in May 2023, the stock progressively fell, hitting a low of $129 in May 2025.

Looking at operating profits, the picture is similar: on both an EBITDA and EBIT level, PepsiCo has often missed, albeit slightly, the targets set by analysts. In 2024, for example, EBITDA was $17.34 billion against an estimate of $17.85 billion, while EBIT stood at $14.38 billion against forecasts of $14.69 billion.

Financial Strategy and Competitive Pressures

A key factor that has negatively influenced investor perception has been the shift in capital strategy, particularly the reduction in share buybacks. Historically, before COVID, PepsiCo allocated 30–40% of its Net Income to buybacks, a fundamental lever for supporting EPS. After the pandemic, this percentage plummeted, stabilising today at around 12% of net income.

This choice is not accidental: it is dictated by the need to increase operational investments (capex, marketing, supply chain) to cope with rising costs and new competitive challenges, in addition to prudently managing debt. In essence, the company has prioritised financial stability and dividend protection over the artificial support of EPS. The dividend, which has continued to grow for over 50 years, also appears to have reached its growth limit, as its payout ratio (the ratio of dividends to earnings) absorbs approximately 73% of net income.

To further complicate the picture, there is the strong exposure to new protectionist policies and increasing competitive pressure: as early as 2023, PepsiCo lost its second-place position in the US carbonated soft drink market, being overtaken by Keurig Dr Pepper. This shift marks a turning point in the sector's historical rankings and reflects both increasingly aggressive competition and the evolution of consumer preferences towards alternatives perceived as healthier.

Despite these difficulties, it should not be forgotten that PepsiCo remains one of the most solid and resilient companies in the sector. Its diversification between beverages and snacks, global leadership, and ability to adapt allow it to maintain a defensive profile that the market continues to price at a premium compared to its peers.

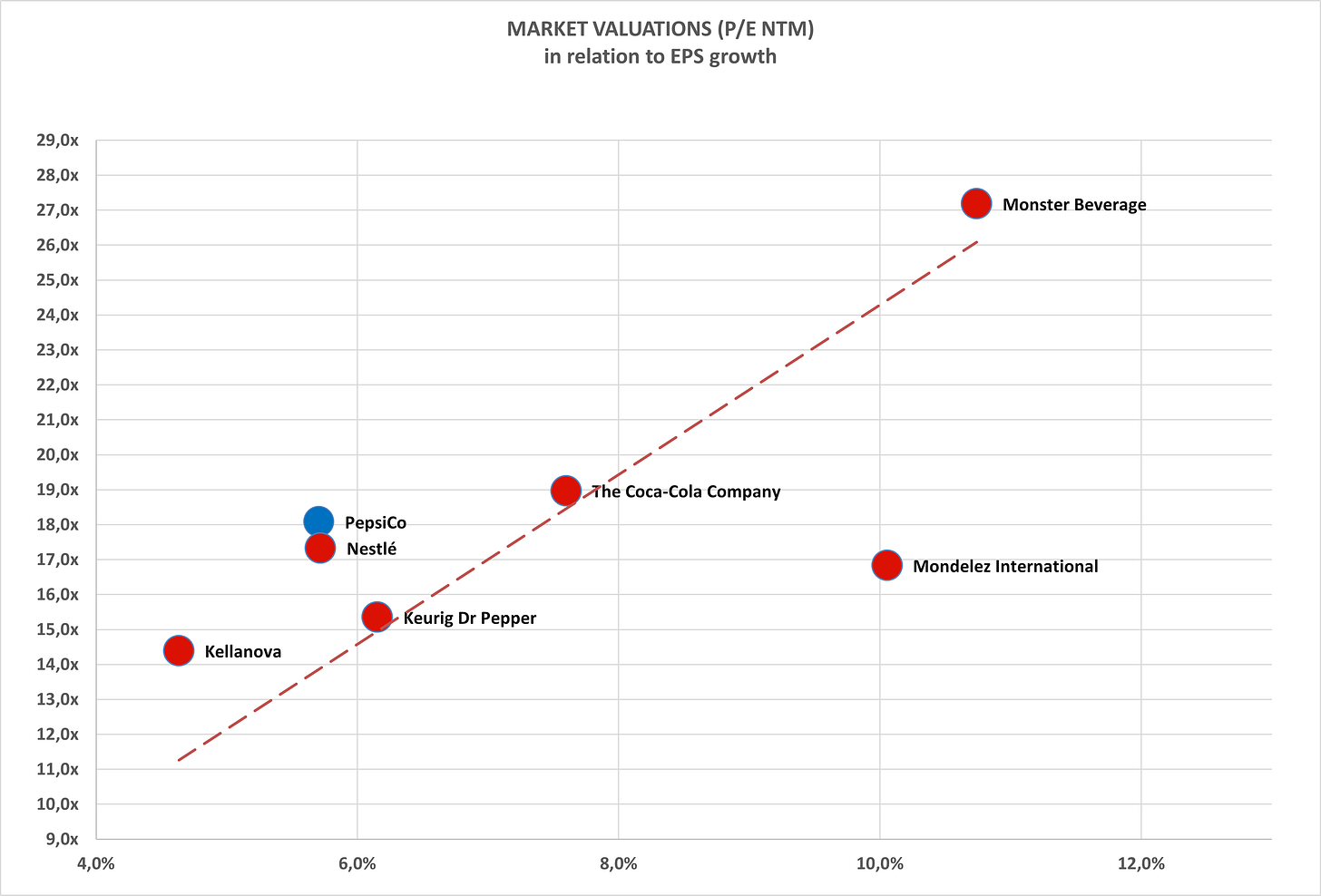

As a regression analysis between EPS CAGR and NTM P/E multiples shows, PepsiCo is in the area of companies with contained growth (5-6%) but a high multiple (around 18x), which is higher than that of competitors with similar profiles, such as Nestlé, Kellanova, and Keurig Dr Pepper. This confirms that the stock is being paid for more than just its growth, thanks to a perception of stability and quality.

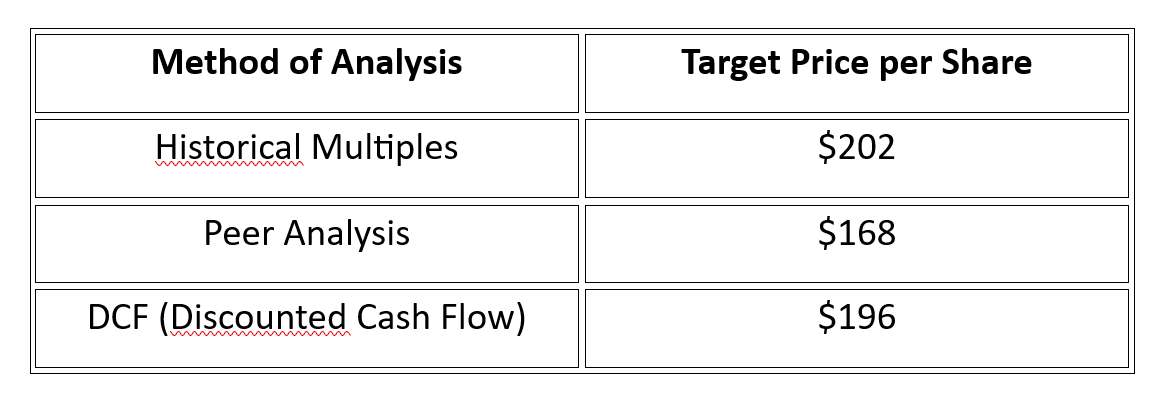

In light of these valuations, our integrated analysis based on three different approaches yields an average price target of $189 per share, representing a potential upside of +26% compared to the current $150.

Final Opinion

In conclusion, PepsiCo is undergoing a phase of strategic recalibration and slowdown that has clearly weighed on its stock performance and investor sentiment. The gap between the ambitious guidance communicated by management and the actual results has generated a degree of caution in the market, causing the stock to pull back from its highs.

The mid-to-long-term prospects remain interesting, but our valuation, which sets a price target of around $189 per share, suggests that the all-time high of $195 from 2023 seems difficult to re-attain for the time being. This forecast reflects a more prudent market outlook, which is discounting current uncertainties related to organic growth and cost pressures.

Despite these challenges, the stock maintains its unique defensive characteristics. Its extraordinary diversification between the snack business (Frito-Lay) and beverages, combined with exceptional pricing power derived from the strength of its iconic brands, creates a solid barrier against economic volatility. PepsiCo therefore remains a strong bet for those seeking stability, dividends, and resilience in a defensive portfolio.

For the stock to fully express its potential and, in the long term, return to its highs, the company must demonstrate that it can regain investor confidence with growth more in line with expectations. Strengthening competitiveness in the beverage business, where it has lost ground, and fully capitalising on emerging consumer trends will be the key catalysts for the future. If the company succeeds in these challenges, the stock will once again attract market interest, reaffirming itself as a timeless classic in the consumer staples sector.

Technical Analysis

After the collapse in late June, the Pepsi stock price hit the $127 area, a level not seen since March 2021. This area had already acted as support in May/June 2020. Following the June 2025 low, the stock bounced by 19%, but was then rejected by a significant resistance area at $153. The most recent strong rebound, which occurred after the quarterly earnings report, left an open gap in the $135 area, which could still be filled.

Analysing the volume profile, a large portion of the trading volume (as confirmed by daily volumes) is concentrated in the zone ranging from $128 to $145. We believe this area is considered an excellent buying zone by the market, representing a technical "fair value". The Point of Control (POC) is located in the $131 area, and the rebound from that point has occurred with ascending lows.

Looking at the 50-period and 200-period moving averages, a bounce off the 50-period average (the blue one) could be a signal of buying strength. This is particularly relevant because the two averages are attempting to cross, in a potential bid to form a Golden Cross, which has not yet materialised. To resume an upward trend, the stock needs to break through the $155 area, which currently remains a very difficult resistance to overcome.

All opinions and views mentioned in this report constitute our judgment as of the date of writing and are subject to change at any time. The information contained in this material is not intended to be the primary basis for investment decisions and should not be construed as advice that meets the particular investment needs of any single investor. Please remember that investing involves risks, including the loss of principal, and that past performance may not be indicative of future results. Equity Analysis, its members, officers, directors, and employees expressly disclaim any liability for actions taken based on all or part of the information contained herein.