Shopify: Unveiling the Undisputed Leader in Independent E-commerce

In-Depth Analysis of Strategy, Finance, and Future Prospects in the Global Market.

Have you ever wondered what the invisible force is behind millions of online successes? That silent giant enabling small dreamers and big brands alike to thrive in the digital world, challenging giants and rewriting the rules of the game? We're talking about Shopify. It's not just a platform; it's the beating heart of independent e-commerce, a continuously expanding ecosystem that democratizes global trade. But what makes this company so phenomenal and resilient to market turbulence? And, more importantly, where is it headed in an increasingly uncertain and competitive future?

Prepare to uncover the secrets of one of modern technology's most fascinating success stories. In this in-depth journey, you will discover:

Shopify's History: From a Snowboard Garage to a Digital Empire – A Trajectory of Vision and Adaptation

Profile and Business Model: The Engine Behind Every Click and Cart – Strategic Leadership for Integrated Growth

Market Profile: Strategic Positioning and Competitive Advantages in the Vast E-commerce Landscape

Financial Analysis: Shopify, Growth Aimed at Solid Foundations

Final Valuations: How Much Is Shopify Worth Today?

1) Shopify's History: From a Snowboard Garage to a Digital Empire – A Trajectory of Vision and Adaptation

Shopify's story isn't just a sequence of dates; it's a fascinating tale of how personal frustration can transform into a multi-billion dollar market opportunity. It all began in 2004, in Canada, when Tobias Lütke, a German programmer transplanted to Ottawa, decided to open an online store to sell snowboards with some friends. The project was called "Snowdevil," but Lütke soon encountered a harsh reality: the available e-commerce platforms were rigid, expensive, and unsuitable for the needs of a small business owner seeking flexibility and control. Instead of adapting to the system, Lütke decided to build one from scratch – a move that would fundamentally change the digital commerce landscape.

That artisanal software, built with the robust Ruby on Rails framework, didn't just work; it was simple, elegant, and, crucially, replicable. This is how the idea of a scalable and universally useful product was born. In 2006, along with co-founders Daniel Weinand and Scott Lake, Lütke officially founded Shopify Inc., with the clear ambition to democratize e-commerce: to offer anyone, from individual artisans to medium-sized businesses, powerful and accessible tools to sell online independently, without the need for complex technical knowledge.

The chosen model, Software-as-a-Service (SaaS), proved to be a winning strategy: customers pay a monthly subscription to access a modular platform that's highly customizable and continuously evolving. In the following years, Shopify didn't just offer a storefront; it built a complete ecosystem for commerce: from inventory management to order processing, from the integration of payment gateways like Shopify Payments (launched in 2013) to advanced marketing tools, a rich App Store with thousands of third-party plugins, and a Shopify Theme Store for aesthetic customization. This horizontal expansion has made Shopify a benchmark for creating professional and easily manageable online stores.

Explosive Growth: IPO and Strategic Acquisitions

2015 marked a pivotal turning point: Shopify went public on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the ticker SHOP. The IPO was a resounding success, raising $131 million and confirming the massive market interest in a modern, independent alternative to Amazon for merchants.

This capital injection allowed Shopify to accelerate its already robust growth, both organically and through a series of strategic acquisitions aimed at strengthening key areas of its value proposition and expanding its reach in digital commerce:

Oberlo (2017): This acquisition was a masterstroke, positioning Shopify at the heart of the dropshipping phenomenon. The Oberlo app enabled users to import products from external suppliers (particularly from AliExpress), simplifying inventory management without the need for physical warehousing. It quickly became the favored tool for newcomers and digital entrepreneurs looking to start an e-commerce business with minimal upfront capital.

6 River Systems (2019): Acquired for $450 million, this move brought Shopify directly into the field of logistics robotics. The goal was audacious: to build the Shopify Fulfillment Network (SFN), a system of automated warehouses designed to offer merchants efficient fulfillment services, from picking to packing and shipping, with the intention of directly competing with the logistical efficiency of giants like Amazon Prime.

Shop App (2020): The evolution of the order management app transformed into a genuine consumer marketplace. With features like expedited checkout via Shop Pay, the app allowed Shopify to take a significant step towards the front-end of the user experience, enhancing product and store discovery and fostering customer loyalty.

Deliverr (2022): With a massive investment of $2.1 billion, Shopify further strengthened its logistics network and fulfillment capabilities. However, in one of the most significant and debated decisions, 2023 saw a strategic shift: the divestiture of most of the SFN and Deliverr assets to Flexport, in exchange for a minority stake in the logistics company. This seemingly defensive or downsizing move actually represented a bold choice to return to a more "asset-light" and profitable model, focusing on its core strengths: software and digital selling services, while leaving the complex and capital-intensive physical management of shipments to specialized partners.

Smaller but Significant Acquisitions (e.g., Dovetail and Remix in 2021): Shopify continued to invest in the core of its technology, acquiring startups like Dovetail (specializing in video collaboration) and Remix (a framework for web app development). These integrations strengthened the platform's development capabilities and underlying technological infrastructure, ensuring Shopify remained at the forefront of offering innovative tools and features for merchants.

The Pandemic as a Catalyst and the Post-Pandemic Backlash

2020 was a pivotal year for e-commerce, and consequently for Shopify. The global pandemic forced millions of physical stores to close their doors and prompted an unprecedented number of entrepreneurs to bring their businesses online. Shopify found itself on the front lines, offering an accessible, powerful, and ready solution for the digital transition. Global e-commerce exploded, and Shopify with it.

In 2020 alone, revenues grew by an impressive 86%, while Gross Merchandise Volume (GMV) exceeded $119 billion. Shopify's market capitalization soared past $200 billion, positioning the company as the largest Canadian tech company and solidifying its place among the global e-commerce giants. Driven by this success, the company hired rapidly, expanded services, and ambitiously plunged into building the Shopify Fulfillment Network, pursuing the dream of challenging Amazon in logistics.

But the winds shift quickly in the tech sector. 2022 brought with it the post-pandemic backlash: a slowdown in online consumption and the need for merchants to reduce spending forced Shopify to contend with an operational structure that had become too heavy. Tobias Lütke himself publicly admitted to overestimating the duration of the post-Covid e-commerce boom. In July 2022, the company announced the painful layoff of 10% of its workforce, a clear signal of strategic realignment.

This deep internal reflection led to a drastic decision in 2023: Shopify sold Deliverr and most of its logistics operations to Flexport. This move, seemingly defensive during a slowdown, actually represents a fundamental strategic shift: focusing on what it does best – software and digital services that enable sales – rather than dispersing resources into the complex and costly physical management of logistics.

Shopify Today: An Infrastructure for the Future of Global Commerce

In 2024, Shopify is much more than just an e-commerce website builder. It's a robust and scalable platform-infrastructure that powers over 2.06 million merchants in 175 countries. It's the preferred choice for independent startups and globally recognized brands alike, including Heinz, Nestlé, Heineken, The Economist, Kylie Cosmetics, and even Tesla.

Tobias Lütke's leadership, still firmly at the helm as CEO, has been crucial in maintaining an approach that balances long-term vision with strategic pragmatism. The management's ability to quickly adapt to the macroeconomic context, as demonstrated by the revised logistics strategy, is one of the key signals investors should observe carefully. Shopify has shown flexibility, self-criticism, and – when necessary – the courage to backtrack on significant investments for the sake of overall financial health.

Shopify's story is thus a continuous lesson: on product, exponential growth, long-term vision... but above all, on the art of changing strategic direction without losing the fundamental objective of enabling independent commerce to thrive. This is the DNA that makes it such a relevant player in today's investment landscape.

2) Profile and Business Model: The Engine Behind Every Click and Cart – Strategic Leadership for Integrated Growth

In the previous chapter, we explored Shopify's origins and how Tobias Lütke's vision transformed a personal need into a global platform. His figure, still firmly at the helm as CEO, is emblematic of leadership that combines deep technological understanding with innate strategic ability. Lütke isn't just a brilliant programmer; he's an entrepreneur who has anticipated digital commerce trends and, crucially, demonstrated extraordinary strategic flexibility. The decision to divest the ambitious yet capital-intensive logistics operations to Flexport in 2023, while a difficult step, is a clear example of this agility. It was a courageous pivot that prioritized profitability and focus on the core business, demonstrating management's ability to backtrack on large investments for the company's greater good. This type of leadership, capable of self-criticism and bold decisions, is a key factor that investors closely monitor.

But what exactly does Shopify do today? In a constantly evolving digital landscape, Shopify is not merely a website where products are bought; it's the technological backbone that enables millions of businesses, from small entrepreneurs to large global brands, to create, manage, and scale their commercial activities online and, increasingly, offline as well. The company positions itself as a complete ecosystem for commerce, providing an integrated suite of tools and services that cover every aspect of modern retail.

What the Company Does: Empowering Independent Commerce

Shopify's core business revolves around providing an intuitive and powerful Software-as-a-Service (SaaS) platform that enables merchants to manage every aspect of their digital business. This includes the ability to build and customize their online store with a wide range of themes and drag-and-drop design tools, eliminating the need for programming knowledge. Merchants can also rely on advanced tools for product and inventory management (both physical and digital), seamless integrations with hundreds of global shipping services for order processing and tracking, and the proprietary Shopify Payments solution to simplify accepting online and offline payments. The offering also extends to marketing and promotion, with a suite of tools for SEO optimization, email marketing, and advertising campaigns. Crucially, it provides the ability to monitor business performance through intuitive analytics and reporting dashboards. Finally, Shopify extends its capabilities beyond online, allowing for multi-channel sales through physical points of sale (with Shopify POS Pro), social media, third-party marketplaces, and dedicated B2B channels.

In essence, Shopify provides the complete digital infrastructure for e-commerce, freeing merchants from technological complexity and allowing them to focus on growing their business and customer relationships.

Main Revenue Streams: An Integrated but Monosegment Model

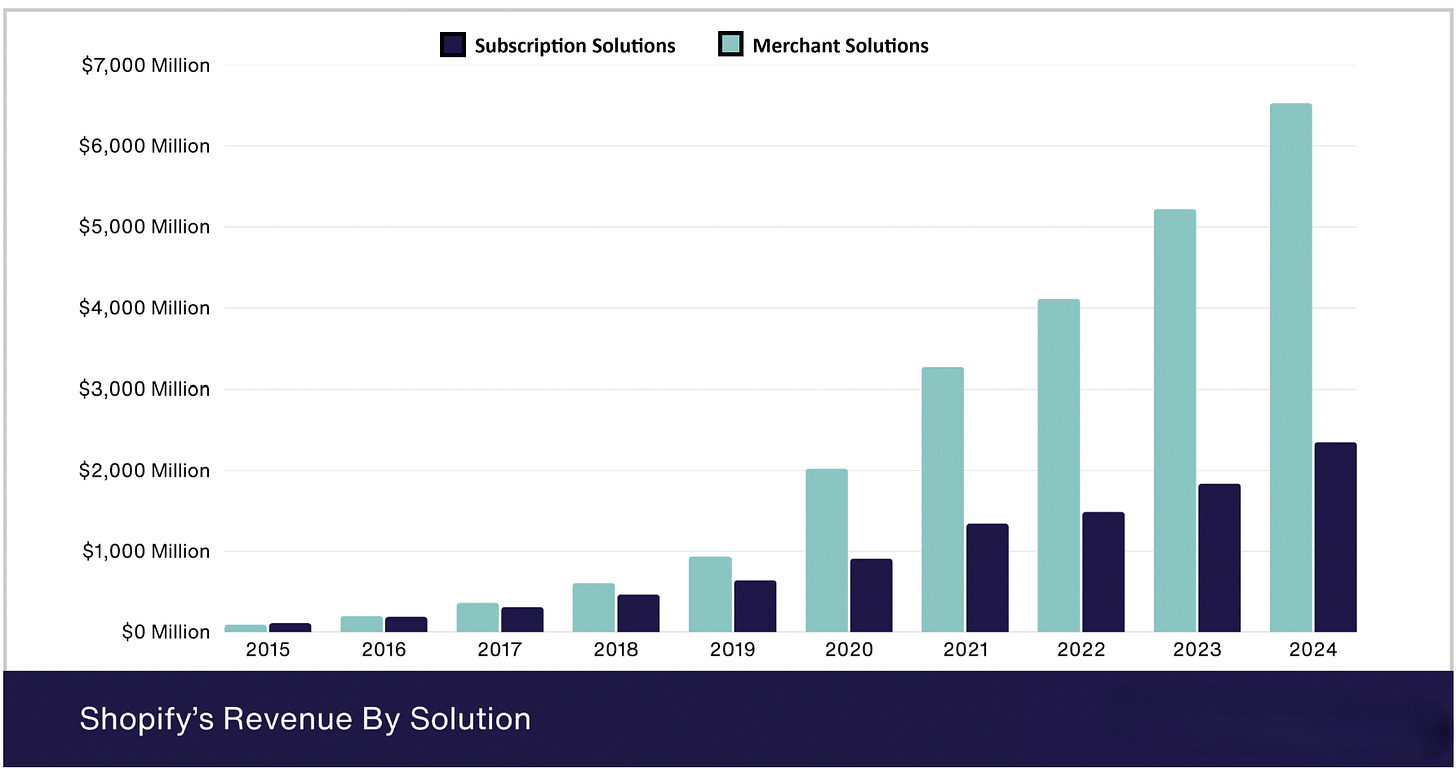

Shopify's business model is twofold, based on two main pillars that, while distinct for accounting purposes, are deeply interconnected and dependent on one another.

A. Subscription Solutions:

This component represents the recurring and predictable base of Shopify's business, contributing 26% of total revenue in 2024. Revenue primarily comes from platform subscriptions, where merchants pay a monthly (or annual/multi-year) fee to access the service. Shopify offers a range of plans, from "Basic Shopify" for small businesses up to Shopify Plus, the enterprise offering designed for high sales volumes and complex businesses, which includes advanced features like custom automations, extended APIs, and dedicated support. This is supplemented by revenue from POS Pro subscriptions for physical stores, and revenue generated from the sale of Apps and Themes via the Shopify App Store and the Shopify Theme Store, as well as domain name registrations.

For investors, Monthly Recurring Revenue (MRR) is the key metric for this category and holds strategic importance. MRR represents the monthly revenue stream that the company can predict with high certainty from its subscriptions. This predictability of earnings is highly valued by investors because it reduces risk and allows for more stable and reliable financial projections compared to models based on one-time transactions. Growing MRR indicates not only the acquisition of new customers but also their retention and the ability to further monetize the existing base (e.g., through upgrades to higher plans or the adoption of more paid services). MRR reached $178 million at the end of 2024, a 24% increase from the previous year, signaling a solid subscriber base and increasing monetization per active merchant. On an annualized basis, this MRR translates to an Annual Recurring Revenue (ARR) of approximately $2.136 billion ($178 million * 12 months). Comparing this ARR to the total Subscription Solutions revenue of $2.350 billion for 2024, it's clear that ARR constitutes approximately 90.89% ($2.136 billion / $2.350 billion) of this revenue category, confirming the predominantly recurring and predictable nature of this business line.

B. Merchant Solutions:

This is the most significant and dynamic revenue component, representing a substantial 74% of total revenue in 2024. These revenues are directly correlated with the success and transaction volume of merchants on the platform. The primary source is Shopify Payments, through which Shopify earns a percentage on every transaction processed, including currency conversion fees. This solution simplifies payment acceptance and leverages economies of scale. Other sources include referral fees from partners, revenue from Shopify Capital (cash advances and loans to merchants), transaction fees on transactions processed outside of Shopify Payments (on some plans), revenue from Shopify Shipping (label sales), sales of POS hardware, and advertising within the Shopify App Store and via Shop Campaigns.

The synergy between these two categories is the true heart of Shopify's business model. Although Merchant Solutions generates the larger share of revenue, its existence and growth are intrinsically dependent on attracting and retaining merchants on the platform, managed by Subscription Solutions. In other words, the more merchants subscribe to the platform (Subscription Solutions), the more transactions they process (Merchant Solutions), thus generating more revenue for Shopify. This creates a virtuous cycle: the SaaS platform (subscription) brings in merchants, who then use the value-added services (merchant solutions), increasing Gross Merchandise Volume (GMV) and, consequently, transactional revenue.

A "Monosegment" but Deeply Vertical Model

Despite the diversification of revenue sources between subscriptions and transactional services, it's crucial for investors to understand that Shopify's business model, while integrated, is highly monosegmental: it is entirely focused on e-commerce for merchants. All its offerings, from store development to payment and shipping management, are aimed at serving a single type of customer (the merchant) and a single purpose (enabling online and multichannel sales).

This deep verticalization is both a strength and, potentially, a risk. It's a strength because it allows Shopify to concentrate its resources and expertise on creating the best possible solution in this area, distinguishing itself from generalist competitors. However, it also means that Shopify's financial health is closely tied to the performance of the e-commerce sector and the general economic health of its merchants. Significant fluctuations in online retail, changes in consumer preferences, or economic strains affecting small and medium-sized businesses can have a direct and amplified impact on Shopify's revenue and profitability. This is a key element to consider in analyzing its risk and opportunity profile.

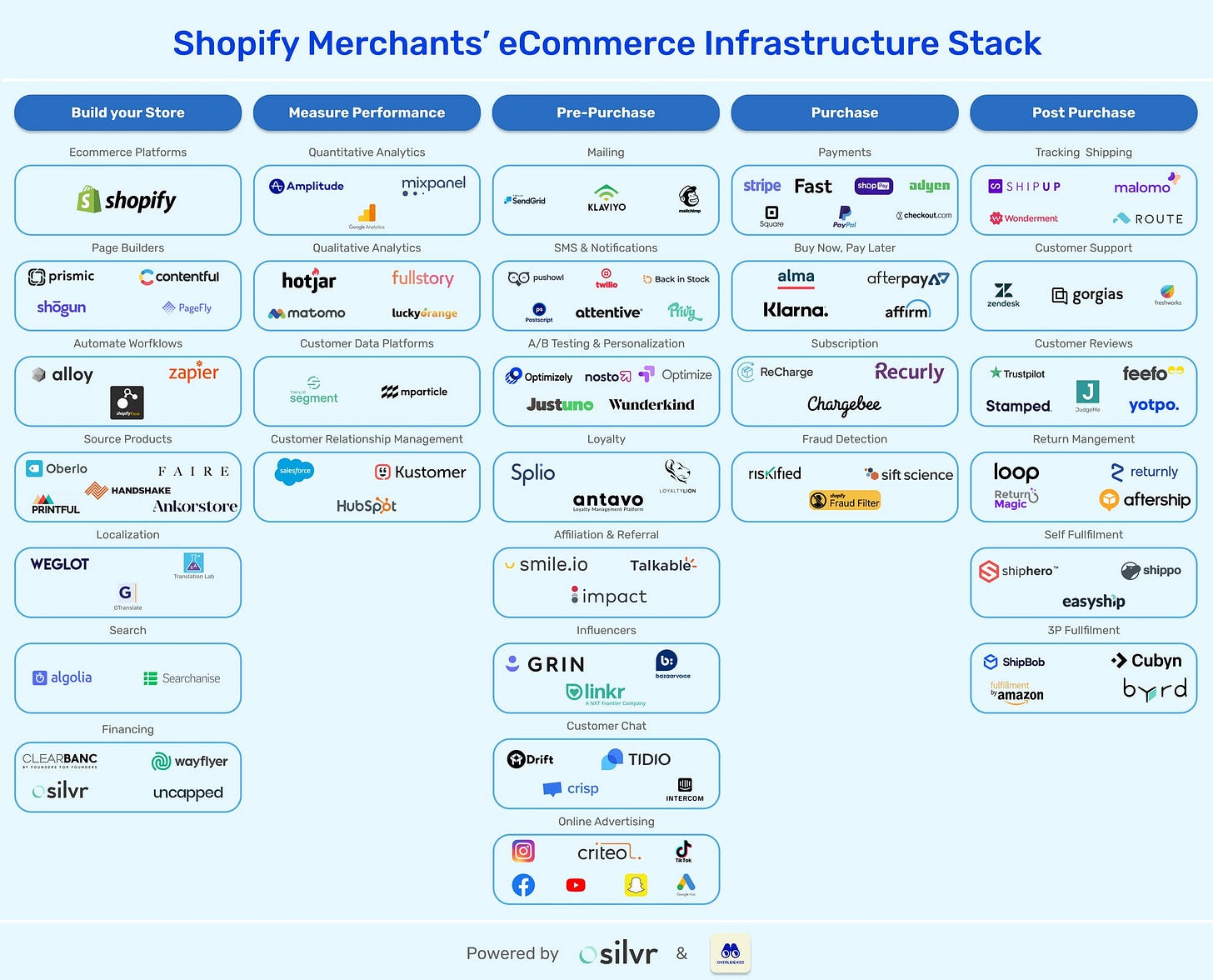

Strategic Collaborations and Management of Third-Party Dependencies: Shopify's Open Architecture

The success and scalability of Shopify's business model, while founded on a robust proprietary software platform, are intrinsically linked to a complex and extensive network of strategic collaborations and integrations with third-party providers. This open architecture is not a weakness; rather, it is a deliberate choice and a pillar of Shopify's "asset-light" strategy. It allows the company to focus its resources on continuously innovating its core technology and monetizing value-added services, delegating the management of complex and capital-intensive operations to specialized players, or enriching its offering through third-party developed extensions.

The most important collaborations, which an investor should carefully analyze, manifest at several fundamental levels:

The App Store and Theme Store Ecosystem: The Power of Multiplication. The Shopify App Store and the Shopify Theme Store are true marketplaces hosting thousands of applications and themes developed by third parties. This isn't just a simple collection of add-ons; it's the beating heart of the platform's customization and flexibility. External developers and designers create solutions that extend Shopify's functionalities in every area, from marketing automation to accounting management, CRM to advanced analytics, customer services to store customization, and much more. This ecosystem generates revenue for Shopify through commissions on the sales of these apps and themes, but the most significant value lies in Shopify's ability to offer merchants an almost unlimited range of options to adapt their store to specific needs, niche sectors, or complex growth strategies. The vitality and growth of this ecosystem are a direct indicator of the "health" and attractiveness of the Shopify platform, contributing significantly to merchant loyalty (stickiness). A merchant who has integrated numerous tools into their Shopify environment is unlikely to migrate elsewhere.

Logistics and Shipping: The "Asset-Light" Strategy in Action. As highlighted in the history chapter, Shopify's decision in 2023 to divest its ambitious but costly internal logistics operations (such as the Shopify Fulfillment Network and the Deliverr acquisition) to focus on software was a watershed moment. Now, Shopify relies entirely on an extensive and diversified network of logistics and shipping partners. This network includes third-party providers for fulfillment (warehouse management, picking, packing, order fulfillment) and for global shipping services. This approach allows Shopify merchants to access high-quality, scalable logistics services, often at competitive rates negotiated by Shopify, without the company itself having to bear the significant costs and operational complexities associated with direct ownership and management of large-scale physical infrastructure (warehouses, vehicles, logistics personnel). This strategy significantly reduces capital expenditure and exposure to operational risk related to fluctuations in logistics demand.

Payment Services: The Complementary Role of Industry Giants. Although Shopify Payments is the proprietary payment solution and the main driver of Merchant Solutions revenue, Shopify maintains an open approach to integration with numerous other third-party payment gateways. Historically, the company has had deep and strategically important relationships with industry giants like Stripe and PayPal. It's known that Shopify Payments, in many regions and for various functionalities, uses Stripe's infrastructure as an underlying payment processor. Similarly, PayPal remains one of the most widespread and globally preferred checkout options for consumers, making it an essential integration for many Shopify merchants. The direct dependence on a single player for payment processing outside of Shopify Payments is mitigated by the multiplicity of available options and the competitive nature of the payment processor market. However, Shopify's success in maximizing its Merchant Solutions revenue (which have higher margins when processed through Shopify Payments) depends on its ability to incentivize the adoption of its own solution over alternatives. Any restrictions or additional costs imposed by partners like Visa or Mastercard (the card networks, which hold significant power) or by essential third-party processors, could impact the profitability of Shopify's transactions.

Managing Risk in Third-Party Dependencies:

While the strategy of relying on third-party providers is a pillar of agility and efficiency, it naturally comes with risks. Any disruption to critical services provided by these partners, unilateral cost increases, or unfavorable changes in their commercial policies could impact not only Shopify's operations but also its profitability and merchant satisfaction. To mitigate these risks, Shopify's management is tasked with:

Diversifying Partnerships: Avoiding over-reliance on a single critical provider when possible.

Negotiating Favorable Contracts: Securing solid agreements that protect Shopify from sudden cost increases or unfavorable changes in terms.

Maintaining Quality Control: Ensuring that third-party services meet the high quality standards Shopify promises its merchants.

Developing Internal Alternatives: Where strategic and feasible, developing in-house capabilities as a "back-up" or as additional negotiation leverage.

In summary, Shopify's partnership strategy is a sophisticated balance of innovation, scalability, and capital efficiency. It's a model that has allowed it to grow rapidly and adapt, but one that requires constant and careful management of relationships with its key partners to ensure long-term resilience.

3) Market Profile: Strategic Positioning and Competitive Advantages in the Vast E-commerce Landscape

In the dynamic landscape of digital commerce, understanding Shopify's positioning means analyzing not only its market share but also the nature of the market itself and the forces shaping its future. Shopify operates in an e-commerce sector that is simultaneously vast and highly fragmented, a context that presents both immense opportunities and structural challenges.

Company Positioning in the Fragmented Market

Shopify has established itself as a dominant force in a specific segment of e-commerce: independent merchant platforms. While giants like Amazon and Alibaba control much of online commerce through centralized marketplaces, Shopify positions itself as a technological enabler of the Direct-to-Consumer (DTC) model, offering entrepreneurs the ability to build and manage their digital presence autonomously.

Although market share can vary depending on the metrics used (number of active stores, Gross Merchandise Volume – GMV, revenue), Shopify is widely recognized as a global leader among SaaS platforms for creating and managing online stores, especially for SMEs and growing brands. The platform stands out for its ease of use, scalability, and an extensible, modular ecosystem that allows merchants to adapt it to their needs.

The market is extremely fragmented and populated by various types of players, ranging from open-source platforms (like WooCommerce or Magento Community Edition) to vertical or local SaaS solutions (such as BigCommerce, Wix, PrestaShop) and enterprise solutions (Salesforce Commerce Cloud, Adobe Commerce). This fragmentation leads to significant competitive pressures on price and innovation, with new players potentially emerging quickly, and customer loyalty requiring high added value.

However, Shopify has successfully turned this fragmentation into a distinct strategic advantage. By positioning itself as an "optimal balance" between the flexibility and control of open source (which requires high technical skills and resources for management) and the robustness and completeness of enterprise solutions (often prohibitive in cost and complexity for SMEs), Shopify has built an extremely powerful and hard-to-replicate Value Proposition. This value proposition is based on its ability to offer a user-friendly and immediate experience for getting started, combined with a depth of functionality and scalability to support a merchant's growth from a small startup to a large global brand, all with a unified technological consistency. This approach has allowed Shopify to occupy a unique space in the market, creating an unstoppable network effect thanks to its vast merchant community and the constant expansion of its partner and developer ecosystem. This advantage translates into a high switching cost for customers and a significant barrier to entry for new competitors.

Shopify's Distinct Competitive Advantages

Shopify currently enjoys a very strong competitive position, thanks to inherent advantages that are difficult to replicate and effectively distinguish it in the fragmented e-commerce landscape:

Deep Ecosystem Integration: Shopify's ability to offer a complete end-to-end solution – from store creation to payments (Shopify Payments), from advanced marketing (Shopify Audiences) to logistics management through qualified partners (the Shopify Fulfillment Network and its network) – creates operational synergy that few competitors can match. This native integration reduces complexity for merchants and minimizes the need to rely on multiple external providers, acting as a powerful retention lever (stickiness).

Democratization of E-commerce and Technical Accessibility: Shopify's promise lies in its exceptional user-friendliness and the availability of themes and apps that enable even those without deep technical skills to launch and manage a professional e-commerce store quickly. This low barrier to entry is a huge attractor, allowing it to capitalize on the vast audience of aspiring entrepreneurs and small businesses.

Unmatched Scalability and Consistent Growth Path: From basic needs with Shopify Basic to the complex volumes of Shopify Plus for global brands, the platform is inherently designed to grow with the business. This scalability eliminates the need for merchants to migrate to different platforms as their business expands, reinforcing their permanence within the Shopify ecosystem.

Vast Modular Ecosystem and Network Effect: The Shopify App Store and its extensive global network of developers, agencies, and technology partners are not just simple add-ons; they're critical components that add exponential value to the platform. This ecosystem creates a significant lock-in effect, as each added integration makes it more costly and less convenient for customers to switch to competing solutions. The prosperity of this third-party community directly testifies to the platform's attractiveness.

Brand Power and Community Strength: Shopify has built an extremely recognizable and reliable brand in the independent e-commerce sector. Its vast and active community of merchants and developers creates a powerful network effect, fostering positive word-of-mouth, facilitating problem-solving, and providing mutual support that few competitors can match, serving as an additional barrier to entry.

Vast Modular Ecosystem and Network Effect: The Shopify App Store and its extensive global network of developers, agencies, and technology partners are not just simple add-ons; they're critical components that add exponential value to the platform. This ecosystem creates a significant lock-in effect, as each added integration makes it more costly and less convenient for customers to switch to competing solutions. The prosperity of this third-party community directly testifies to the platform's attractiveness.

Brand Power and Community Strength: Shopify has built an extremely recognizable and reliable brand in the independent e-commerce sector. Its vast and active community of merchants and developers creates a powerful network effect, fostering positive word-of-mouth, facilitating problem-solving, and providing mutual support that few competitors can match, serving as an additional barrier to entry.

Market Growth and Future Prospects

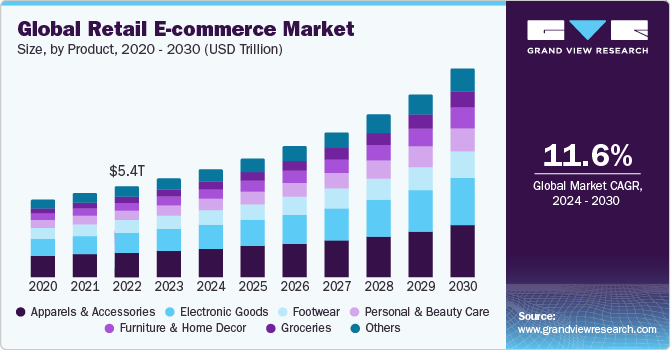

The global e-commerce market, although currently undergoing a phase of consolidation after the pandemic-driven surge, remains on a path of structural growth, driven by digitalization, increasing digital penetration in emerging markets, and growing consumer sophistication.

According to estimates from authoritative institutions like Statista and eMarketer, the compound annual growth rate (CAGR) for the global e-commerce sector is projected to be between 9% and 12% in the 2024-2030 period. A significant portion of this growth is expected to occur outside North America, areas where Shopify is actively investing in localization, alternative payment channels, and logistics infrastructure.

Furthermore, the trend of marketplace disintermediation sees a growing number of brands wanting to directly manage the relationship with the end customer, thereby favoring the DTC approach for which Shopify is the primary technological enabler.

Impact of Tariffs Imposed by Trump in 2025

With Donald Trump's return to the presidency in 2025, the administration has announced and implemented a new series of punitive tariffs on imports from China. In particular, technological products, consumer electronics, apparel, and industrial components are affected by tariffs reaching up to 60%. Although Shopify is not directly a manufacturing company, the impact of these tariffs on its ecosystem and on merchant behavior is far from negligible. The analysis of this impact unfolds on several main levels.

Effect on Shopify's Customer Base (Indirect Impact)

A significant portion of Shopify merchants sell products imported from China or manufactured using Asian supply chains. The introduction of tariffs on electronics, apparel, home goods, and OEM components has led to a generalized increase in costs for these merchants. Added to this, effective May 2nd, the revocation of the de minimis exemption for shipments under $800 USD originating from China has particularly affected small operators. According to industry estimates, these measures have resulted in an 8% to 15% cost increase for many merchants. Many are already evaluating or implementing a reallocation of their supply chain, shifting towards countries like Vietnam, India, or Mexico. However, this process requires time and resources, and in the meantime, it can generate an increase in churn. By "increase in churn," we refer to a higher percentage of customers (in this case, merchants) who stop using Shopify's services (by canceling their subscription or closing their store on the platform). This phenomenon particularly affects less structured operators, who struggle to bear the additional costs and reorganize their business.

Risks for Dropshipping and Print-on-Demand Segments

A significant portion of Shopify stores, particularly those in the entry-level and micro-entrepreneur segments, utilize business models like dropshipping or print-on-demand. Dropshipping, in particular, is a retail fulfillment method where the seller accepts customer orders but does not keep goods in stock. Instead, when an order is received, it forwards it to a third-party supplier (often located in China, such as AliExpress or CJ Dropshipping), who then ships the product directly to the end customer. Similarly, print-on-demand relies on suppliers who print and ship customized products only after an order is placed.

The introduction of significant tariffs and the revocation of the de minimis exemption are seriously undermining the competitiveness of these models. They typically operate on already extremely thin profit margins and are highly sensitive to changes in unit product costs. The combination of increased tariff barriers, longer shipping times, and greater regulatory uncertainty is leading to several negative consequences. A decrease in new store openings in these segments and a potential increase in the abandonment rate (churn) among existing operators are already being observed. For many of these merchants, the rise in operational costs makes the model no longer sustainable, forcing them to close or seek complex and not always accessible alternatives. This represents a direct risk to Shopify's broader and growing user base, negatively impacting the Gross Merchandise Volume (GMV) generated by these segments.

Shopify's Strategic Position as a Neutral and Responsive Platform

Shopify has reacted to this context with a proactive approach, enhancing tools like Shopify Markets and Shopify Markets Pro, which help merchants diversify sales markets (e.g., selling in Europe or Asia without incurring the repercussions of internal tariffs). The company is also actively collaborating with logistics partners (like Flexport) to build more resilient and distributed supply chains within the United States. To complement these initiatives, Shopify has introduced new AI-powered features for calculating duties and taxes, optimizing logistics, and forecasting demand, offering merchants more advanced tools to navigate complexity.

While the SHOP stock showed some volatility in the months following the announcements (e.g., a -20% on April 3rd, followed by a +17.5% on April 9th due to the temporary suspension of certain measures), analysts believe that in the medium term, Shopify could emerge stronger. This is particularly possible if the tariffs accelerate the transition from unstructured business models towards direct, more resilient brands, which find an ideal growth partner in Shopify.

Summary of Tariff Impact

The impact of tariffs imposed by Trump in 2025 represents an indirect but significant threat to Shopify, especially in the segment of small merchants operating in dropshipping or selling imported goods. However, for more structured merchants and brands using Shopify Plus, the impact is minor or manageable. Furthermore, Shopify possesses the infrastructural and strategic flexibility to adapt quickly, strengthening its value-added services in logistics, procurement, and internationalization. In the medium term, the pressure on merchants could favor consolidation towards more robust operators and direct brands, paradoxically strengthening Shopify's position as a platform for next-generation independent e-commerce.

4) Financial Analysis: Shopify, Growth Aiming for Solidity

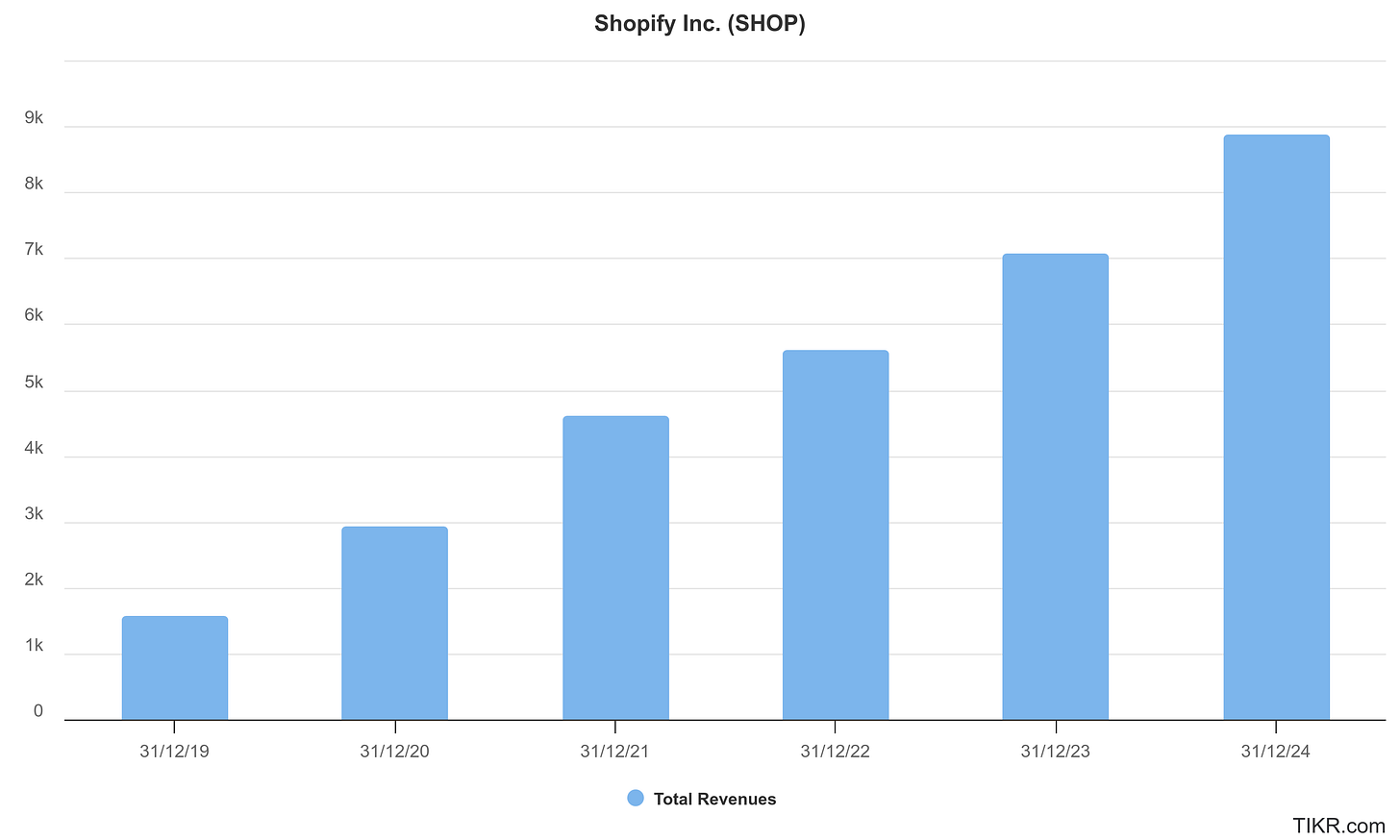

An analysis of Shopify's financial data between 2019 and 2024 reveals the transformation of a tech company from a pure "growth story" to a more mature entity, aiming not only for growth but also for sustainable and profitable expansion.

Let's look in detail at the evolution of the main financial statement items and key ratios.

Revenue Growth: Consistent, but More Disciplined

Revenues have shown robust and consistent growth:

After the post-Covid surge of 2020-2021, Shopify has maintained a solid, albeit more rational, pace of expansion. The 2022–2024 CAGR is approximately 25%, which is still very high for an already well-capitalized company. This demonstrates that Shopify no longer relies exclusively on new merchants but successfully extracts added value from its existing ecosystem: payment solutions, premium subscriptions, Shop Pay, paid apps, and themes. The revenue growth confirms the scalability of the SaaS model, which benefits from economies of scale without requiring corresponding increases in fixed costs.

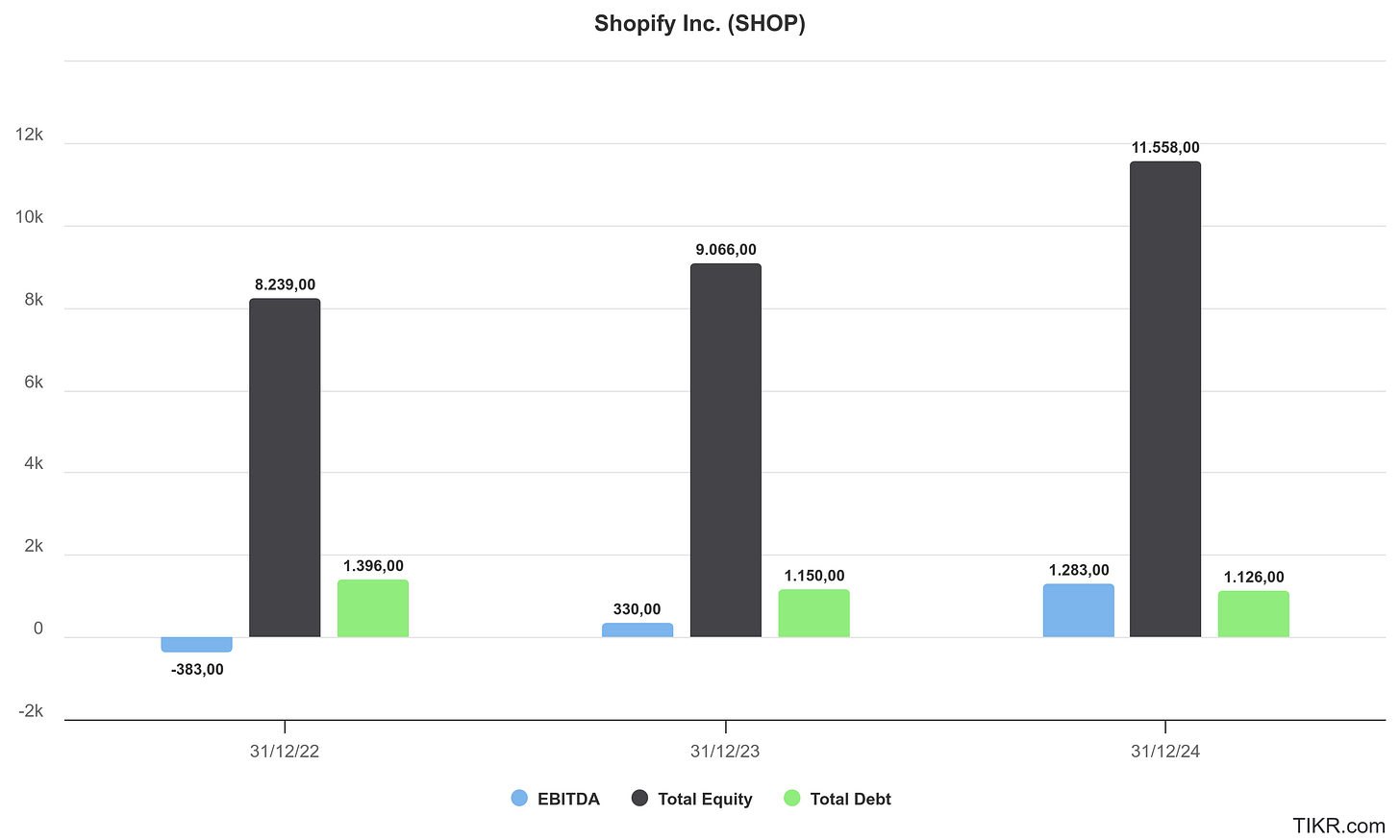

Debt Coverage and Balance Sheet Equilibrium: Exemplary Financial Strength

Further confirming Shopify's extraordinary financial strength, it is essential to analyze the relationship between its operating profitability and its liability structure, as well as the balance between equity and overall indebtedness. This aspect, often overlooked for companies perceived as "growth stocks," reveals an extremely low-risk profile and prudent asset management.

Analyzing the data clearly reveals:

Debt Coverage via EBITDA: Shopify's EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) has shown a strong recovery and growth. After a negative value in 2022 (-$383.00 million), there was a remarkable turnaround with robust values in 2023 ($330.00 million), reaching an impressive $1.283 billion in 2024. Comparing this operational cash generation with the Total Debt (which was $1.396 billion in 2022, $1.150 billion in 2023, and $1.126 billion in 2024), an exceptional ability to cover all obligations in less than one year is evident. It's crucial to remember that most of these liabilities consist of convertible bonds, not traditional bank debt. These bonds do not generate periodic financial charges in the form of interest expenses but rather potential future dilution if converted into shares. This context highlights minimal pressure on financial charges and extreme solvency, given that the generated EBITDA comfortably covers these strategic liabilities.

Total Equity vs. Total Debt Ratio: Shopify's balance sheet demonstrates an exceptional ratio between Total Equity (shareholders' equity) and Total Debt (total non-equity liabilities), attesting to an extremely solid capital structure. Equity has grown from $8.239 billion in 2022 to $9.066 billion in 2023, reaching $11.558 billion in 2024. Meanwhile, Total Debt has remained extremely contained and strategically managed (with values of $1.396 billion in 2022, $1.150 billion in 2023, and $1.126 billion in 2024). This clear predominance of equity is evident in the Equity/Debt ratio, which stood at approximately 5.90 times in 2022, 7.88 times in 2023, and exceeded 10 times in 2024 (10.26x). This indicates that the vast majority of Shopify's operations and growth financing comes from shareholders' equity and internal cash flows, not from burdensome debt in the traditional sense. Such a capital structure, with a very high proportion of equity compared to liabilities, gives Shopify superior financial resilience, the ability to self-finance growth, and ample strategic flexibility, making it almost immune to interest rate shocks or credit restrictions. It is an irrefutable pillar of its valuation as a "quality asset."

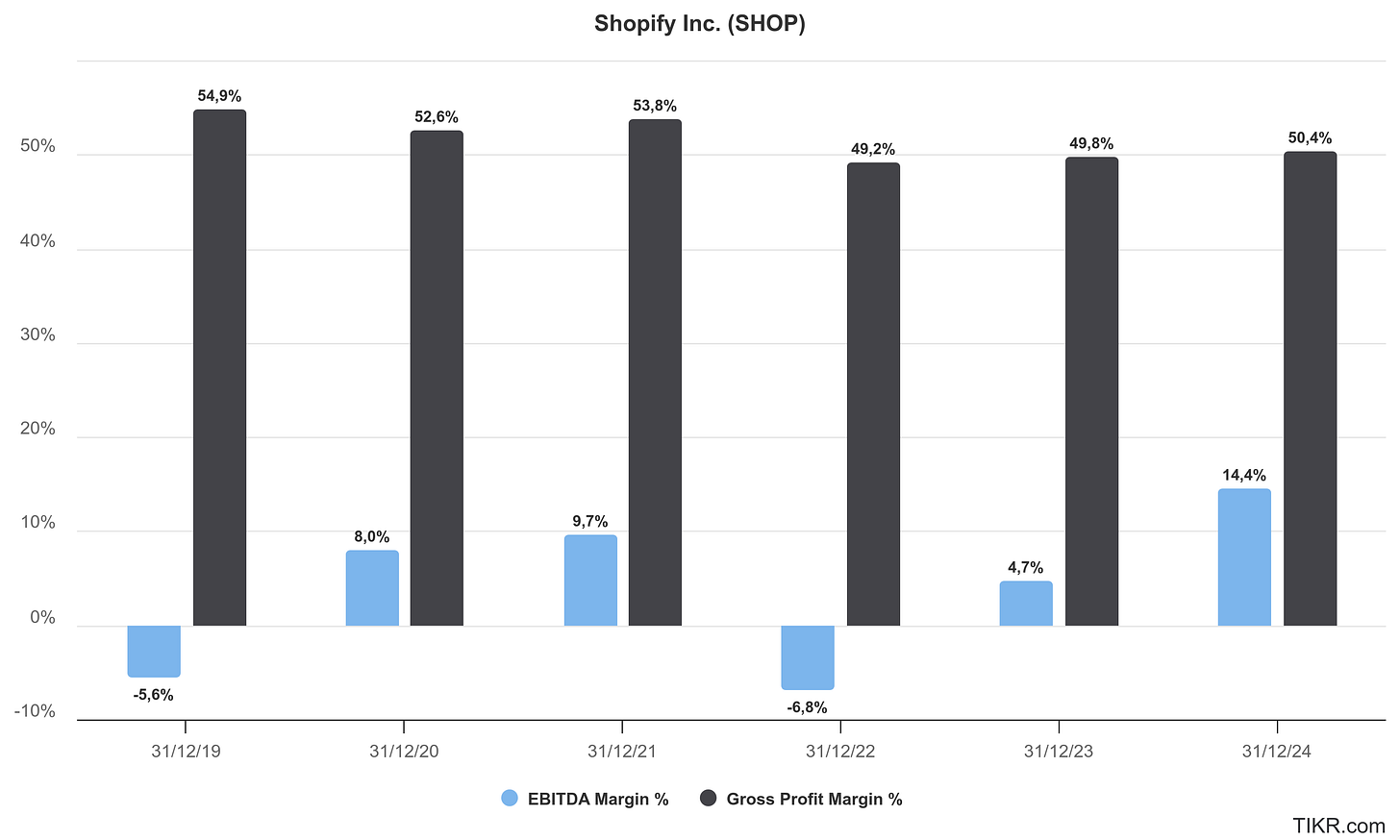

Operating Margins: From Crisis to Transformation

The EBITDA margin, which measures operating profitability before depreciation and amortization, has transitioned from negative values to a decidedly healthy performance.

This recovery highlights two key elements:

Cost cutting and internal restructuring after the excesses of the pandemic period.

Strategic focus on the core business, abandoning low-margin areas like logistics (e.g., the sale of Deliverr and SFN to Flexport in 2023).

In other words, Shopify has learned to do more with less: it no longer chases growth at any cost but aims for sustainable profitability, an essential transition from a "growth" company to a "quality growth" company. The gross margin has also remained stable around 50%, a sign of pricing power and a low variable cost structure.

The trend of Shopify's operating margins and gross margin are visible in the following chart:

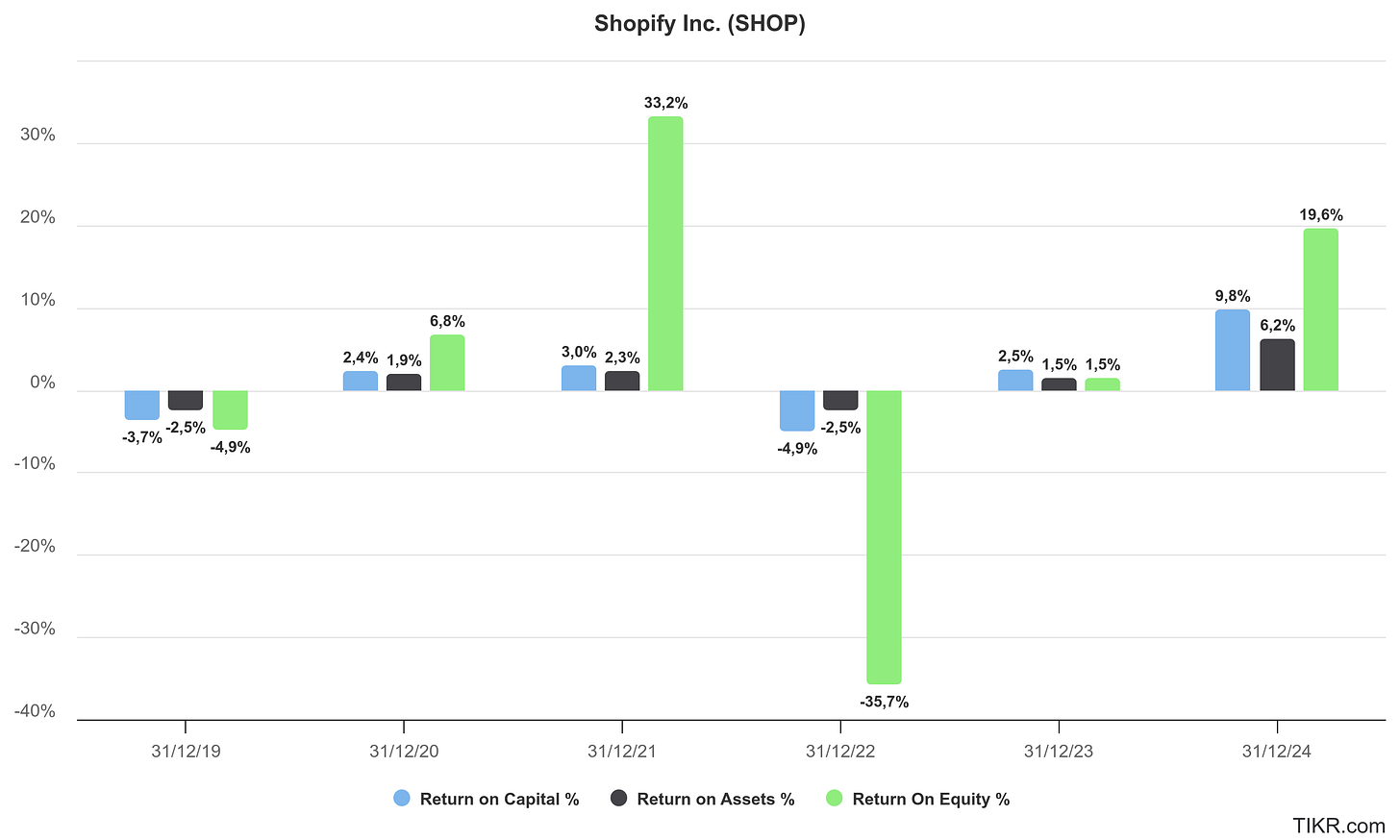

Return on Capital: Clear Trend Reversal

Shopify's key indicators for return on capital employed show a clear turning point, as highlighted in the chart:

Return on Capital: Clear Trend Reversal

Shopify's key indicators for return on capital employed show a clear turning point, as highlighted in the chart:

In 2022, the company was still contending with the aftermath of massive hiring and logistics investments. The negative ROE (-35.7%) signaled a temporary destruction of shareholder value. But in the following two years, Shopify successfully repositioned itself:

ROIC (9.8% in 2024) returned above the weighted average cost of capital, implying that every dollar reinvested in the business now generates value.

ROE at 19.6% is particularly interesting for a company without financial leverage: it demonstrates that profitability stems from operational management, not from artificial leverage effects.

Net Financial Position: A Liquid Strongbox

One of Shopify's most distinctive strengths is its extremely solid financial position, characterized by an absence of traditional financial debt and a strong net cash position. The Net Financial Position (NFP) has shown a growing trend, highlighting a progressive and robust accumulation of liquidity: in 2022, it stood at -$3.69 billion, improving to -$3.89 billion in 2023, and reaching a remarkable -$4.39 billion in 2024. These values, although negative in the NFP format (which indicates net debt), in Shopify's specific context, indicate a company that is more liquid than indebted. The fact that financial charges are zero is far from coincidental.

Shopify, in fact, does not finance itself through traditional bank debt, but through:

Equity raised in its IPO and subsequent capital increases.

Convertible bonds, which represent a hybrid form of financing and do not generate significant interest expenses, but do involve potential future dilution if converted into shares.

This "asset-light" capital structure allows Shopify to:

Maintain operational flexibility.

Better withstand unfavorable macroeconomic conditions.

Avoid debt pressures in high interest rate environments.

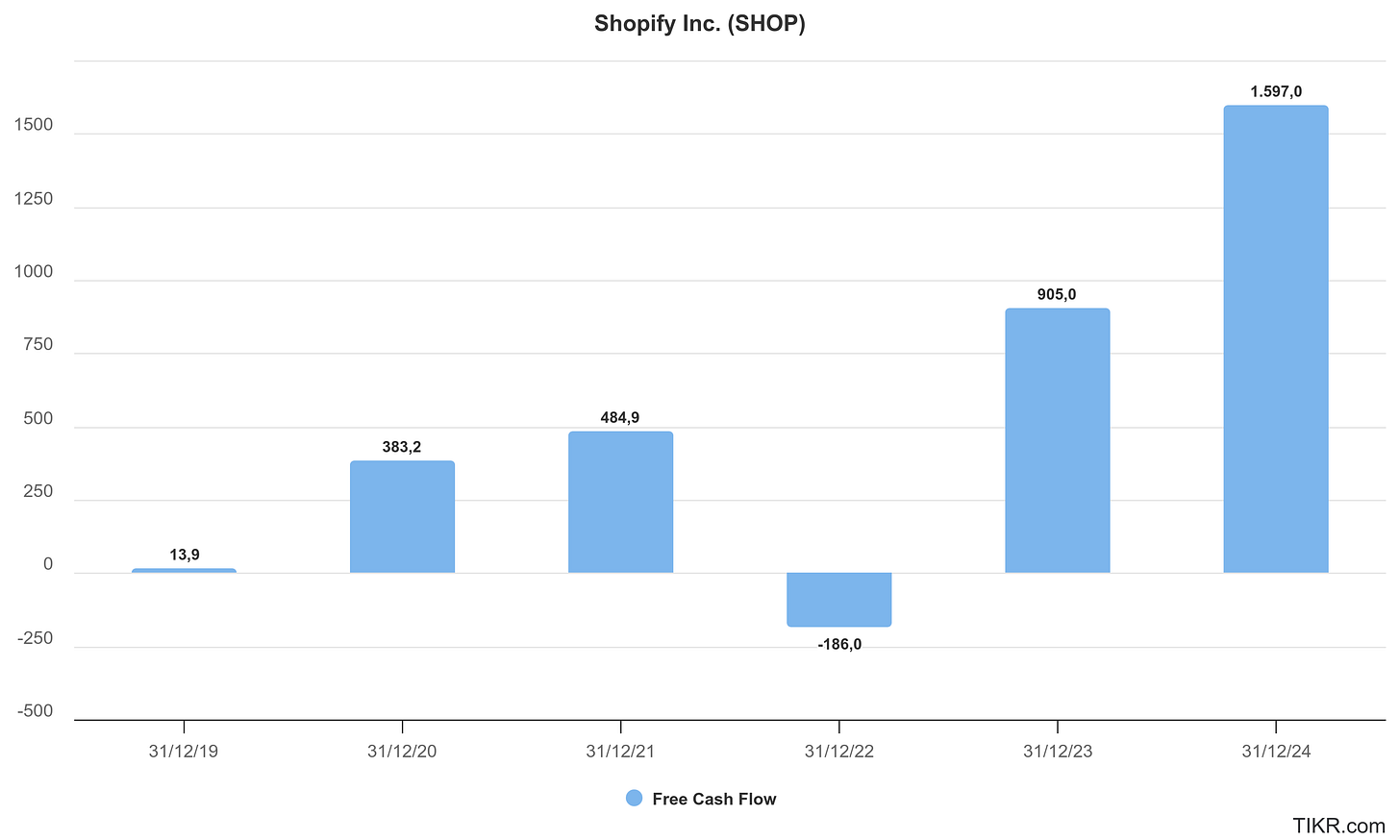

Free Cash Flow: An Increasingly Efficient Cash Machine

Shopify's Free Cash Flow (FCF) generation has shown a decisive and structural improvement in the 2022–2024 period, moving from negative values to a solid capacity for self-financing.

In 2022, the company still reported a negative FCF of -$186 million, symptomatic of an operational structure not yet optimized and intensive investments. However, 2023 saw a clear reversal, with a positive FCF of $905 million, further strengthened in 2024 to $1.597 billion. This represents an increase of over 8 times in two years, reflecting growing efficiency in converting operating profits into real cash.

The Free Cash Flow Leverage, an indicator of debt sustainability relative to cash generated, has also improved significantly: from +5.0% in 2022 (an anomalous value due to negative FCF) to -36.4% in 2024, passing through a solid -23.3% in 2023. Negative values in this context are positive, as they indicate that FCF largely exceeds net financial needs.

In parallel, the Net Financial Position (NFP) has consistently remained positive (i.e., in surplus), improving further from -$3.7 billion in 2022 to -$4.4 billion in 2024, confirming a balance sheet structure free from liquidity risks and highly defensive.

The NFP/Net Invested Capital (NIC) ratio also improved, moving from -81.2% in 2022 to -61.2% in 2024, with a three-year average of -72.5%. This figure reflects strong financial autonomy, a crucial element in turbulent market contexts like the current one.

In summary, Shopify has not only regained profitability but has also transformed its structure into an efficient cash-generating machine, capable of self-financing growth and consistently strengthening its net cash position.

Concluding Remarks: A Solid and Evolving Financial Structure

The data clearly shows that Shopify is a solid, well-capitalized company undergoing a progressive normalization of its operational structure. After the excesses of 2020-21 and the corrections of 2022, the 2023-24 biennium marked a phase of maturation.

For an investor, the signals are strong and consistent:

Sustained and profitable revenue growth.

An ultra-healthy balance sheet structure.

No burdensome debt.

Increasing cash generation.

Return to value creation for shareholders (positive ROIC and ROE).

Shopify today is not just a promising tech company but a solid asset on which to build long-term exposure in the global e-commerce world.

5) Final Valuations: What Is Shopify Worth Today?

After a deep dive into Shopify's economic and financial fundamentals, operational model, and market position, we arrive at the valuation summary. We applied two complementary approaches: Peer Analysis and Discounted Cash Flow (DCF).

The outcome of these valuations suggests an average fair price of $124 per share, approximately 8.8% higher than the current price of $114 USD. This indicates that the stock is not overvalued and presents a moderate potential for medium-term appreciation, aligning with improving profitability and growing cash flows.

But Is Now the Time to Invest? The Strategic Knot of US–China Tariffs

Complicating the valuation picture, as extensively discussed in Chapter 3, is the trade war launched by the new Trump administration in 2025. The tariffs have had a significant indirect impact on the Shopify ecosystem, increasing costs for many merchants. The revocation of the de minimis exemption has made dropshipping and print-on-demand models less sustainable.

These dynamics have caused sharp stock fluctuations in the early months of the year, with a decline of between –20% and –27% from February to April, followed by a significant rebound to date.

The YTD performance is currently positive (+8%), despite the volatility, thanks to the recovery between May and July.

Although Shopify is responding with proactive measures—diversifying logistics routes, enhancing AI tools, and pushing into international markets—the outlook remains conditioned by macroeconomic and political uncertainties, specifically tied to the evolution of the trade war.

Outlook in Case of a Trade Agreement: Operational Rebound and Potential Stock Rally

Should the United States and China reach a new trade agreement leading to the reduction or elimination of tariffs, the repercussions for Shopify would be extremely positive. Operationally, removing tariff barriers would lower procurement costs for merchants, translating into improved margins and a rebound in sales volume.

From a stock market perspective, the market could interpret an agreement as a powerful catalyst for Shopify stock (NYSE: SHOP). A de-escalation of the trade war would reduce uncertainty and strengthen growth prospects, potentially triggering a stock rally driven by analyst upgrades and renewed institutional interest.

Conclusion: A Quality Stock, But Requires Timing and Patience

Shopify solidifies its position as a high-quality asset: a solid net financial position, growing margins, accelerating free cash flow, a scalable business model, and technological adaptability. However, the current geopolitical context introduces an exogenous element of volatility.

In light of this, we believe Shopify:

Deserves attention from medium-to-long-term investors;

Can be selectively acquired, especially in the event of further pullbacks;

Must be carefully monitored to assess the structural effects of tariffs.

Prudence is necessary, but so is vision: Shopify remains one of the best bets on a more distributed and independent e-commerce future.

Technical Analysis:

Analyzing Shopify's chart, we can observe how the upward trend still remains solid.

Currently, the stock is in a consolidation phase, a normal behavior considering how this company is influenced by tariff policies, particularly those related to Trump's decisions. For this reason, the market shows indecision, and consequently, no decisive directional movements are observed.

At the moment, the stock remains above the POC (Point of Control), indicating that buyers continue to exert pressure.

A first significant resistance to overcome is at the 129.32 level, followed by another important one in the 145 area.

It will be crucial to carefully monitor the trade decisions between the United States and China, as they will have a decisive impact on the stock's future direction.

Should new and negative news regarding Trump's tariffs towards China "knock down" the stock, we could witness a strong reversal. This scenario could lead to a break of both moving averages, with the stock potentially even touching the April 7th period lows, in the $70 area.

All opinions and viewpoints mentioned in this report constitute our judgment as of the date of writing and are subject to change at any time. The information contained in this material is not intended to be used as a primary basis for investment decisions and should not be construed as advice that meets the particular investment needs of any individual investor. Please remember that investing involves risks, including the loss of principal, and that past performance may not be indicative of future results. Equity Analysis, its members, officers, directors, and employees expressly disclaim any liability for actions taken based on all or part of the information contained herein.